Will EVs start to take up SiC and drive prices to parity with silicon?

Wide band-gap devices have yet to break into the EV market in a meaningful way, but the stage is set for them to become the technology of choice as they drop in cost and demonstrate the performance and reliability needed.

By Anup Bhalla, VP Engineering at UnitedSiC.

Martians are puzzled

The SpaceX Falcon Heavy rocket has just put a cherry-red Tesla roadster into an orbit around the Sun which will see the sports car come close to Mars.

We don’t know how much of the car’s electronics are in place but if the electric motor drive is there, the Martians may be a bit puzzled when they look at the technology: [Translation] “Hey, they’re still using IGBTs! Cool music though - same vintage as the semis.”

If the designers had wanted the car to function on the Red Planet, they may well have opted for wide band-gap devices early on with their high temperature rating and inherent rad-hard capability, but they played safe for the more benign earthly highways and used IGBTs as a proven and quick solution. Not just one or a few but reportedly 66 in the Tesla model S. Even IGBT modules were discounted in favor of individual TO-247 packages.

It’s not just the powertrain inverter of course - there will be power switches in any on-board battery charger, any inductive charging converter and in the auxiliary converter up to 5kW or so with maybe 12V output for the legacy components such as lighting, A/C, power steering, fluid pumps, and control and entertainment systems. There’s every incentive to try to use the latest switch technology such as SiC or GaN that promises savings in overall system cost.

Smaller electronics and a golf bag

When you compare the current cost of automotive-grade TO-247 650V IGBTs with a SiC or GaN switch in the same package (if you can find any that are automotive qualified), you can see a cost differential.

For sure, the automotive drivetrain manufacturers are looking to the future, especially as battery voltages go up to the next level of 800V, with new designs that may well include SiC diodes and MOSFETs. If they push the switching frequencies up to theoretical maximums they will certainly get the benefits of smaller size and lighter weight by a factor of five or more, but significant efficiency gains may be more elusive.

And it’s efficiency that matters, translating to less wasted power, more range from a battery charge or a smaller battery for the same range. The thing is, higher frequencies give higher switching losses, everything else being equal, so you may have lost 45 pounds and gained a little extra space running at 500kHz - but when you use that space for your 45-pound golf bag, you’re no better off in overall weight and the efficiency and range is less because of that high frequency.

Add four adult passengers at 170 pounds each and the weight saving and its effect on range disappears into the road noise.

A more sensible idea might be to keep switching frequencies low, maybe 50kHz, but use SiC devices such as cascodes, which can be near drop-in replacements for IGBTs. There will be efficiency gain along with reduction in number and size of other components such as snubbers and anti-parallel diodes. Better still, little else would change in the powertrain drive, giving the safe, incremental improvement that automotive manufacturers prefer.

The best solution will always be a compromise of course, and cost is often more of a driver than a passenger. If SiC devices can get to price parity with IGBTs then the extra cost savings in the various converters, including passive components - especially if the switching frequency is pushed upward - will look attractive to the guys setting the showroom price.

Will SiC better IGBTs for cost effectiveness?

A better question might be; “will a system solution using SiC be more cost effective than one using IGBTs?” The answer is a resounding yes if the advantages of SiC are fully exploited. Increasing switching frequency and efficiency reduces size of magnetics and other passive components such as capacitors and heatsinks.

It’s realistic to say that inductors and transformers used with IGBT automotive drives at high power and say 8-12kHz would be discrete parts, probably bobbin-wound with flying wire terminations. Assembly would be complex with many manual operations, prone to errors and variability.

Compare this with the possible SiC solution running at say 50kHz; the inductor now might be a planar type around a fifth of the size with windings formed from stamped metal or PCB traces with easy assembly and perfect repeatability.

Couple this with SiC cost improvements from smaller die and increasing wafer sizes eliminating the cost premium and the way’s clear for cost effectiveness. Along with the increased efficiency of SiC in power conversion giving either better range or reduced battery cost, what’s not to like?

Further developments coming will be to move away from leaded components such as the TO-247 style to modules with multiple SiC chips giving yet more economy in construction with savings in mechanical and electrical connection costs and cooling schemes.

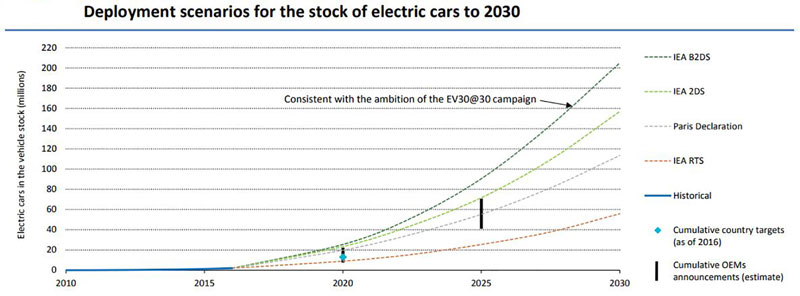

The market itself is of course expanding rapidly. Data shows varying estimates of the market growth by up to a quarter of a billion electric vehicles in use by 2040 (Figure 2), with 25% of all vehicles electrified by 2025, so with the volumes increasing, SiC should be in pole position.

Figure 2. Electric vehicle predictions (source: International Energy Agency)

Let’s hope that the next car the Martians reverse engineer shows off our latest wide band-gap technology. They’ll want to keep the Bowie soundtrack, though.

Learn more about how SiC Cascodes Outperform in Practical Applications.