Sensors are at the heart of robotic mobility disruption

“Disruption is coming to our streets and cities” said Pierre Cambou, Principal analyst, Imaging, at Yole. “Mobility has defined the way humans have organised their society for ages and our world is currently being reimagined around a new generation of robotic vehicles. They appeared insignificant two years ago when we published our first report on the matter, today they are on the brink of changing the world as we know it."

In this context, the market research & strategy consulting company, Yole intensively analyses the robotic mobility market and technologies and offers a comprehensive understanding of the industry in the 'Sensors for Robotic Mobility 2020 report'. Aiming to provide a scenario for sensors within the dynamics of the robotic vehicle market, this report includes market and revenue forecasts, key technical insights and gives an in-depth understanding of the ecosystem and players.

Current means of mobility are hitting five major limitations. The first concerns the most vulnerable modality, namely that pedestrian safety is deteriorating. Second, in the major cities where people tend to live nowadays, public transportation is facing challenges in terms of efficiency and cost. Third, cars are no longer the grand solution to mobility they used to be.

Congestion and cost of ownership is undermining this option. Four, air mobility is currently enjoying rapid expansion, but travel remains difficult as city to airport connections remain poor. Fifth, CO2 emissions due to all current means of mobility make urgent change vital. Regulators and customers are willing to change in both top-down and bottom-up manners.

According to Cambou: “The mobility industry will have to adapt, and for some this will be a massive opportunity. In this respect robotic mobility clearly checks all the right boxes. Whether it is robotic cars, shuttles or electric VTOL aircraft, the combination of all these new modalities will provide 'MaaS' from inner cities, from cities to suburbs and cities to cities. Previous means of mobility will not disappear, just as cinema still existed while TV was massively deployed. Regardless of the naysayers, robotic vehicle technology will provide the Netflix of mobility before 2032.”

Carmakers developing ADAS technology have now mainly chosen a camera-and-radar approach. As Mr E. Musk, the CEO of Tesla, said: “LiDAR is a fool's errand […] in the automotive context”.

Robotic vehicles do not focus on the cost and long term reliability issues that are the main concern for other automobiles.

All that matters is the immediate availability, performance, and supportability of their sensor suite. The robotic sensor data flow is utterly limited by downstream computing power. While previous generations were in the range of several hundred Tops, the latest robotic vehicles are in the range of a thousand Tops.

This gives limited increases in terms of sensor data flow, which relates to what Yole calls 'More than Moore’s law'. The computing power needed increases with the square of data flow input. The number of sensing cameras, radars and LiDARs will grow far slower than the performance of robotic vehicle computers.

The way around data sparsity is for roboticists to use 'better' data, meaning sensors which bring other types of information. The quality of information is increased, not the quantity. On top of industrial grade cameras and radars, they are massively using 3D sensing Lidars, navigation grade GNSS devices and IMUs and more recently Thermal IR cameras.

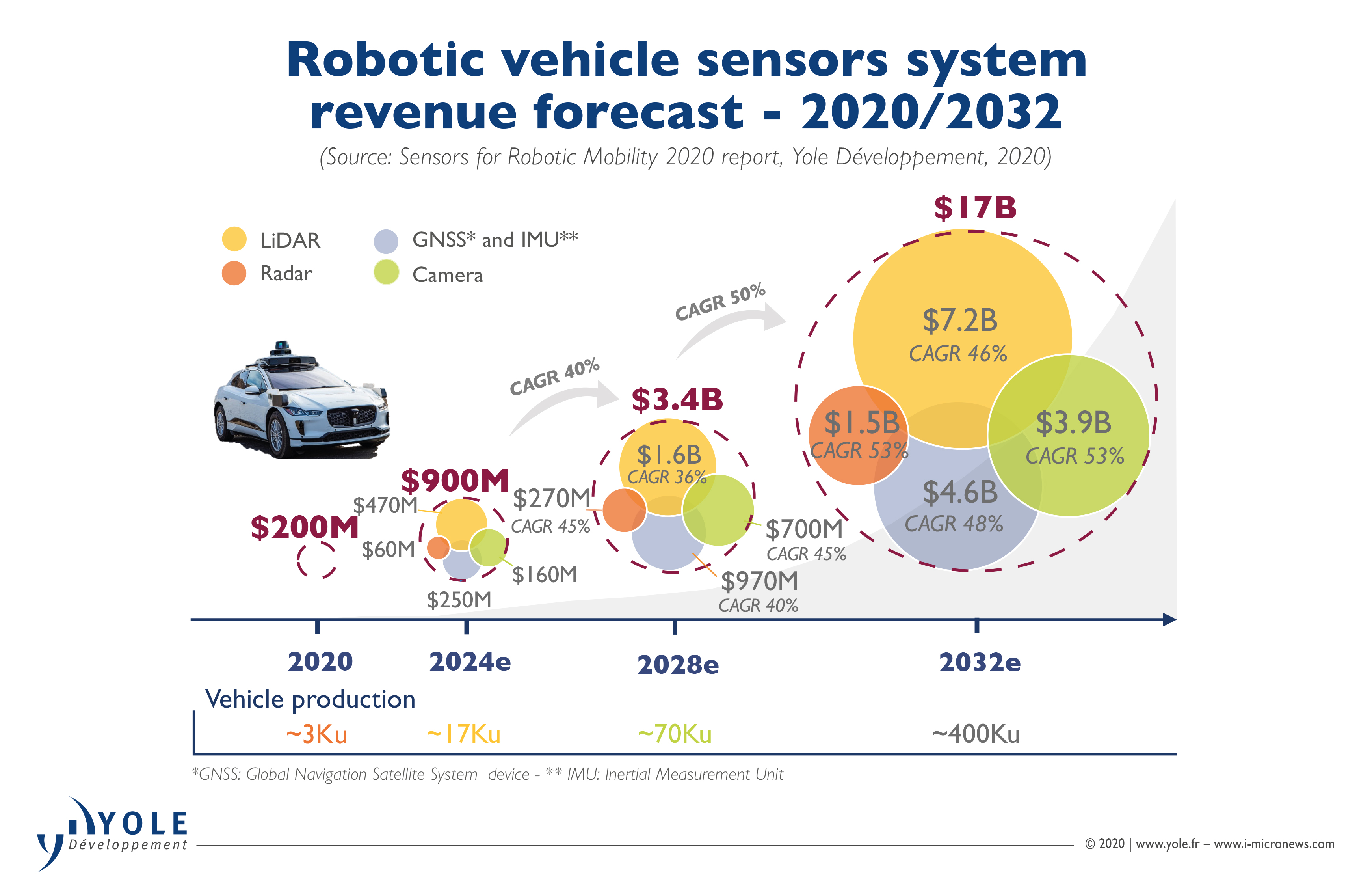

These sensors come with significant price tags, and will therefore generate $900m in revenues by 2024, $3.4bn by 2028 and reach $17bn by 2032, a time when a million robotic vehicles may be roaming our streets.

For Pierre Cambou: “Growth rates are expected to be impressive. In 2019 production of robotic vehicles was in the range of a few thousand worldwide. We expect production volumes to reach 400k units annually, with cumulative production of 1 million units, by 2032.”

This ramp up forecast is based on a 51% CAGR for the next 15 years. By then, the total revenue associated with the production of robotic vehicles will reach $60bn. 40% of that figure will originate from the vehicles themselves, 28% will come from sensing hardware, 28% from computing hardware and the remaining 4% will be from integration. This means that within 15 years complete industries will be structured around robotic vehicle technologies.

When looking closer to the present, in 2024 Yole’s analysts expect sensor revenues to reach $0.4bn for LiDAR, $60m for radar, $160m for cameras, $230m for IMUs and $20m for GNSS devices. The split between the different sensor modalities may not stay the same for the 15 years to come. Nevertheless the total envelope for sensing hardware should reach $17bn in 2032, while, for comparative purposes, computing should be in the same range.

Today’s car sales account for $2.4tn and are the natural target of internet giants like Google, Baidu, Amazon and Uber. They are mostly attracted by the MaaS market, which Yole believe should reach the same value of $2.4tn within the next decade.

With an additional $1.1tn to be generated by sales of personally-owned autonomous driving vehicles, the added value of autonomous driving will reach a total of $3.5tn by 2032.