Quantum computing: A quantum of solace for the players?

Quantum technologies have three primary applications: computing, communication, and sensing.

Computing still attracts most of the R&D effort and investor money. However, pushed by quantum computing developments, the other two are also starting to attract more attention: quantum networking will be necessary to interconnect quantum computers, and new applications will require ultra-sensitive sensors based on quantum effects.

According to Eric Mounier, Ph.D., Director of Market Research at Yole Intelligence, part of Yole Group: “As quantum computers become readily available, they will be able to break the current integrity keys used for data exchange. This creates a direct connection to quantum cryptography, and post-quantum approaches are being developed to prevent future hacking by quantum computers (communication, bitcoins, cryptocurrency, etc., could also be compromised by quantum computers).”

Driven by emerging high-performing applications (e.g., robotics, brain-computer interface), new types of quantum sensors will be developed in the future; currently, the most common quantum sensors are gravimeters and atomic clocks.

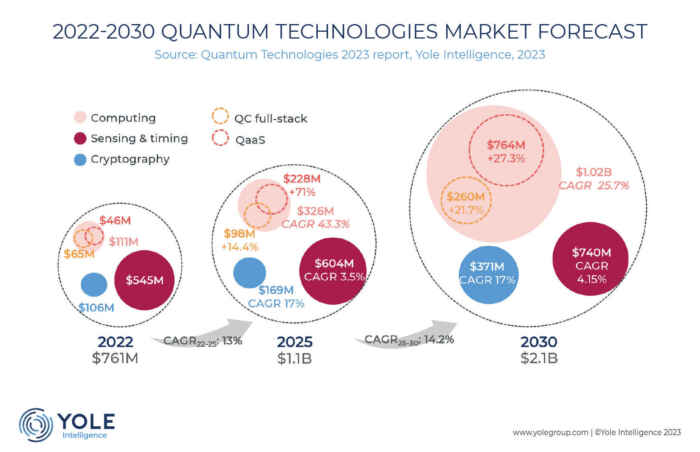

The total quantum market will be worth $2.1 billion in 2030. Quantum sensing has the largest share, with well-defined use cases. But beyond 2030, it is expected that quantum computing will dominate. In fact, the quantum computing market will total $4.09 billion in 2035 (both hardware and service). QaaS will have the major share, with most of the services running on quantum computers in the cloud.

In this context, Yole Intelligence releases its brand-new emerging technology report, Quantum Technologies 2023. With this report, the company, part of Yole Group, gives an overview of the quantum technologies for computing (hardware and software), networking, and sensing applications.

Eric Mounier: “The quantum ecosystem is maturing step-by-step and strengthening through research project collaborations, patent portfolio (China is currently dominant), creation of numerous startups (USA, Canada, and Europe are leading), and big semiconductor vendor/equipment makers entering the game, as a consequence, an industrial quantum supply chain is developing. Many companies are positioning themselves, from materials and equipment providers to chip foundries, systems, services, and associated hardware.”

The involvement of semiconductor players, including GlobalFoundries, TSMC, X-FAB, Intel, photonics with Ligentec, and equipment makers (for example, Keysight, Formfactor, Oxford Instruments, AMAT) is setting up a robust technological base for future quantum technologies: spin QD is, of course, also of interest, as it leverages Si CMOS technology.

But partnerships are still critical since only relatively few companies can pursue different R&D approaches simultaneously. Infineon Technologies is quite the exception, with R&D on three different technological qubit techniques: superconducting, trapped ions, and spin.

The trend today is to have a “full stack approach” from the quantum chips up to the computer and software/service level. However, as this approach requires significant R&D resources, people, budget, and effort, not all players can do it.