Are sensing technologies impacting our future?

Consumer applications, especially smartphones and tablets, have been the main driver of the MEMS and sensors industry for some time now. Today, a general slowdown has been clearly identified by the players and confirmed by the Yole Développement (Yole) report, Status of the MEMS Industry (Yole Développement, May 2016).

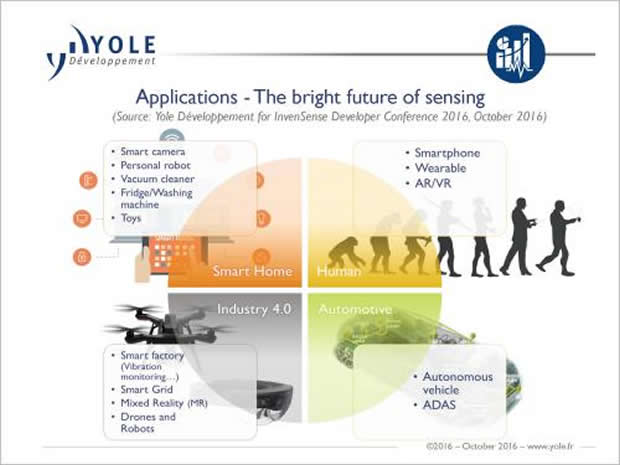

The future of MEMS and sensors is still bright. Some applications including IoT, drones, autonomous driving and AR/VR, are showing promising business opportunities and could be part of our future. How will the sensor industry evolve? To respond to such opportunities, what technical choices will MEMS and sensors companies make and what marketing strategies will they establish? Technology & Market Analyst, Guillaume Girardin, explores the future with you and suggests Yole’s vision, with its presentation entitled ‘What does the MEMS Industry have in Store for the Future?’ at the InvenSense Developers Conference (IDC 2016), taking place on 20-21st October at the Santa Clara Convention Centre.

Even if, within the smartphone market, the golden era seems to be over, our forecast is rather optimistic where sensors are concerned. Driven by the expansion of the smartphone category over other phones and new applications, the sensor industry for mobiles and tablets is expected to increase at a 9.5% Compound Annual Growth Rate (CAGR) from 2015-2021.

The market was worth $12bn in 2015 and will reach $21bn by 2021. The woes of Samsung with the Galaxy Note 7 and the lukewarm reception of the new iPhone 7 paint a good picture of the current status of the smartphone market; catching its breath and waiting for a true innovation.

In a previous announcement, Guillaume Girardin, Yole Technology & Market Analyst, commented: “Apple is under pressure. Its sales are showing a drastic decrease, from 108.7 million units in the first half of 2015 to 91.6 million units one year after. There has never been a situation like this since the launch of the first iPhone.” See (Apple is facing cathartic moment for innovation). We are at this cathartic moment when we should see the full innovation potential of those so-called technology companies.

And the ‘More than Moore’ market research and strategy consulting company moves the analysis further: among the three main hubs that best characterise the evolution of the MEMS & sensors industry today, the optical hub is probably the most promising and could become a means for success. Indeed, the optical hub represented a $9.5bn market value in 2015. In 2020, it will reach $17.6bn with an impressive 10.9% CAGR. Therefore, many innovations, new products, company’s creation, mergers and acquisitions have occurred in recent years.

“At Yole, we believe 3D cameras will be a game-changer in the smartphone industry in coming months and years,” explained Guillaume Girardin from Yole. “3D cameras are low-cost sensors that can enable the growth of a long list of applications…”

However, the consumer industry is not the only market that benefits from the optical hub. Accordingly, the ADAS is also a promising application. MEMS & Sensors technologies have a powerful impact on making fully autonomous vehicles a reality. Ultrasonic sensors, radars and multiple camera systems are already embedded in high-end vehicles. Within ten years, maybe less, sensor technologies could also include long-range cameras, LIDAR, micro-bolometers and accurate dead reckoning. Yole expects $2.6bn market value in 2015 for sensors in autonomous cars, reaching $36bn by 2030, at a 19% CAGR for this period.

Today, the most advanced car with ADAS functions has about 17 embedded sensors. Yole’s analysts anticipate more than 29 sensors by 2030. This is clearly a huge growth and is especially supported by imaging technologies. In its latest report focused on the automotive sector, Imaging Technologies for Automotive 2016 (Yole Développement, October 2016), the market research company Yole is highlighting numerous innovative technologies coming from the imaging world: “Imaging technology, which is currently mainly cameras, is exploding into the automotive space, and is set to grow at 20% CAGR to reach US$7.3 billion in 2021,” asserted Pierre Cambou, Activity Leader at Yole and author of this new analysis.

“The Industry has been targeting the Internet of Things (IoT). At InvenSense, we believe that the IoT is primarily about sensing, so it is really the Internet of Sensors. We believe that every device out there is going to have a multitude of sensors,” said Eitan Medina, Vice President of Product Management and Marketing at InvenSense. “We’re excited to have Yole come and speak about the future of sensing to our developers, ecosystem partners and customers at our 5th annual InvenSense Developer Conference.”