Sensor technology set to make waves

At a recent event in London, Texas Instruments (TI) unveiled a new sensor portfolio aimed at automotive radar, industrial and infrastructure applications, bringing what the company claims is a new level of precision sensing to the industry. Electronic Specifier attended the launch event where Greg Delagi, Senior Vice President, Embedded Processing and Sameer Wasson, General Manager, Processors, at Texas Instruments discussed the new offering.

Automakers are designing new vehicles with a range of diverse technologies to keep up with ever-growing consumer demand for increased safety, comfort, convenience and energy efficiency. For example, with around 94% of global road accidents attributed to human error, several countries are now mandating that all vehicles must be equipped with Advanced Driver Assistance Systems (ADAS) by 2020. As a consequence shipments of ADAS components are expected to increase from 218 million units in 2016 to 1.2 billion units in 2025.

To meet this demand and a range of applications spanning the automotive, factory and building automation and medical markets, TI’s new millimetre wave (mmWave) single-chip Metal-Oxide Semiconductor (CMOS) portfolio includes five solutions across two families of 76-81GHz sensors with a complete end-to-end development platform. TI claim that the portfolio delivers up to three times more accurate sensing than current mmWave solutions on the market.

Speaking at the launch event Delagi commented: “Texas Instruments invests very heavily in innovation and we are very excited about this announcement as we believe it will be a real pioneering technology. This new portfolio is a culmination of investments that began almost a decade ago and has evolved over time, so it’s very exciting to finally introduce it to the market.”

A changing market place

The pace of change in the automotive industry means that, according to TI, there could be ten million self-driving cars on the road by 2020. Regardless of whether that figure is accurate, the importance of the role that electronics is playing in the advancements of cars is undeniable, and we are on a journey towards cars becoming more autonomous in nature. A key enabling technology for this to happen is of course, semiconductors. A typical ADAS incorporates various sensing technologies along with advanced processing and communication capabilities and, as such, automakers rely heavily on suppliers to provide these automotive electronics.

The need for sensing in the automotive industry is growing rapidly as technology develops, and is aimed at applications such as range detection, object detection and arrival angle. Sensors may have to penetrate other materials such as glass or plastic, whilst still being able to maintain sensing accuracy without any disruption. The surrounding environment also has to be considered i.e. rain, fog, dust, light and darkness. All of these factors can impede the ability to sense so despite the growing demand, sensing technologies in automotive environments also face huge challenges to be robust enough to maintain performance to an optimum level.

This is where, as Delagi explained, TI’s AWR1x mmWave sensor portfolio comes in: “We believe that mmWave technology is the only sensing technology that is robust enough to meet these kinds of challenges. And, in terms of getting these products to market, we’re well placed as we have one of the broadest product portfolios in the industry and we invest in bringing out highly differentiated products on an ongoing basis.

“We invest around $1bn a year on R&D with the specific aim to extend those product portfolios. Also, one of the things we have invested in is the infrastructure to be able to manufacture those products and to support a very broad customer base. We serve markets like automotive and industrial and typically customers in those markets want to buy products that last ten to 15 years. So, the infrastructure we have in place enables us to do that. We are also in a unique position in terms of channels to market.”

The AWR1x portfolio includes three devices and supports different ADAS radar sensor configurations ranging from USRR, SRR to MRR, to LRR and imaging. Delagi added that mmWave is not a new technology and the automotive industry has been using it for some time. However, he highlighted that current mmWave sensor solutions are inadequate, stating: “In its current form a mmWave system includes a whole bunch of different chips and is large in its implementation, with a number of challenges around accuracy, size, power consumption, time to market and complex design. What we are doing is introducing the world’s smallest (10.4x10.4mm), most precise 76-81GHz mmWave sensor. So we’ve taken all those separate chips and collapsed it down into a single chip - that’s really what’s at the heart of the revolution we’ve brought to the industry.

Differentiation

So, how do TI differentiate its new offering from the rest of the market. Delagi continued: “Firstly we began with CMOS – a high volume technology that is used very broadly in the semiconductor industry. This was the basis of what we were going to integrate. There was however, tremendous complexity in terms of design, in order to get these systems to perform in CMOS, but we have years of architecture, circuit design, analogue and mixed signal design experience behind us to get the performance of these chips to where we wanted them to be.”

CMOS technology has allowed TI to take integration to the next level, integrating intelligent radar front ends with MCU and DSP capabilities into the AWR1x single-chip portfolio. Processing is co-located with the front end to reduce the size and form factor of the radar systems by 50%.

This further enables the efficient mounting of multiple radar systems.

CMOS also holds the key to greater accuracy and enabled TI to offer a sensor ten times more accurate than what is currently available, according to Delagi: “The technology can detect distance down to the width of a human hair. Think about that for a moment in terms of accuracy.

Contrast that with something like ultrasonics, which is similar to what is in today’s cars, which will beep when you are a metre away from an object for example. With the distance that can now be detected with our mmWave sensors, what could that mean for accuracy from an application standpoint?”

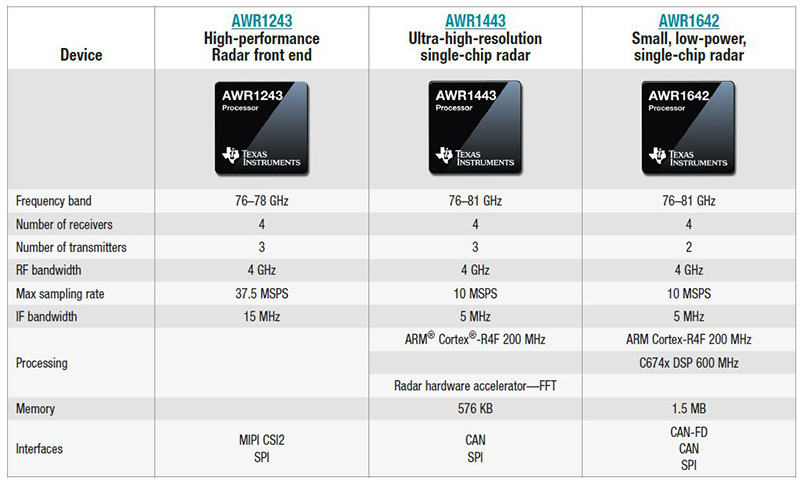

Above: summarising the key features of each sensor in the AWR1 x portfolio

Above: summarising the key features of each sensor in the AWR1 x portfolio

Given the use of multiple discrete components, current radar systems are big and bulky when they really need to be smaller, lower power and cost effective. Sensors have to be miniaturised and optimised in order to adapt to future automated driving market demands.

CMOS technology, combined with power management techniques, has enabled the AWR1x sensors to be low power, which is critical to the automotive industry’s development of energy efficient electric vehicles. The AWR1x portfolio consumes around 25% of the power of current solutions, down to 150mW depending on the system and the sensing application. Lower power also leads to a cost advantage because designers can now select more economical and lighter housings.

Delagi continued: “When you compare this to existing systems it really is a breakthrough in terms of power,” he said. “Low power of course, means things can be made smaller, are less expensive, they don’t need a big housing, you don’t have to dissipate heat etc. It’s very important that, as we are driving power we are also driving miniaturisation, and this leads to the next key feature which is its small footprint. We can drive sensors that are 25mm2. And shrinking this sort of technology down means it can start to be used in a very different way compared to how it’s being used today.”

Automotive focus

Traditionally, developers have encountered obstacles when creating Society of Automotive Engineers (SAE) International Level 2 and above functionality in vehicles, with sensor size and power a particular hindrance. The AWR1x mmWave portfolio allows developers to meet these requirements through built-in quality standards, precision within a small form factor and a low power envelope. Designers have the ability to enhance ADAS and autonomous driving safety features – including ISO 26262, which enables Automotive Safety Integrity Level (ASIL)-B – but also deliver new features such as automated parking assistance, pedestrian detection and occupancy and driver monitoring.

Sammer Wasson picks up the story: “The automotive family goes through specific automotive level testing, and we have specific ISO 26262 software, which the automotive industry needs. These devices are custom-built for the automotive market.

“By looking deeper and speaking to customers, there isn’t one standard use case across the automotive market. Each customer wants to use the technology in a slightly different way. So what we’ve come up with is a family of devices to cover a number of use cases – ranging from a high performance front end for a higher level of integrated elements, all the way to a single-chip solution with MCU, DSP and RF front end.

“An important thing to mention is that all of the devices are linked with the common mmWave SDK software, and that is fundamental to our approach to our customers, because being able to reuse their R&D across a scalable portfolio of devices is vital and it’s something we focus on.”

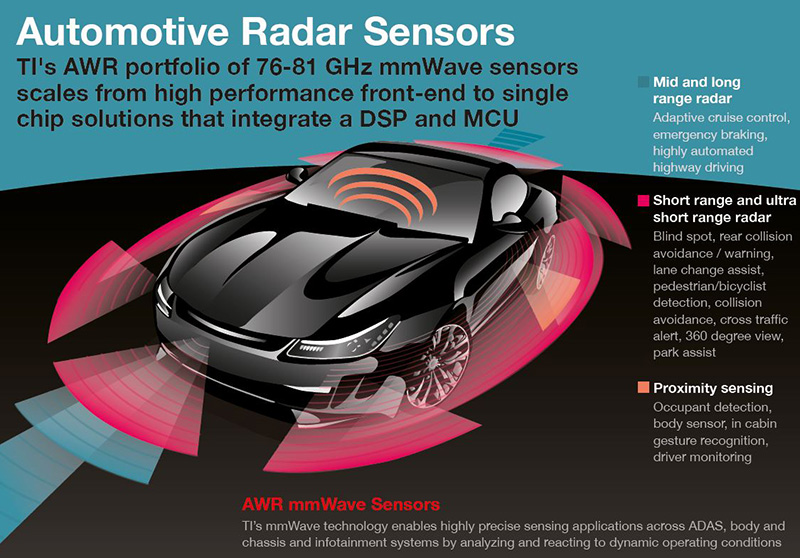

The range of automotive sensors includes radar sensors (mid- and long-range), which covers emergency braking, adaptive cruise control and automated highway driving; and proximity sensing covering occupant detection, body sensing, in-cabin gesture recognition and driver monitoring. These types of proximity sensor already exist in the market but tend to be limited to high end models. Wasson highlighted that this new portfolio will bring this type of sensor more into the mainstream as they have been made more robust.

Other sensor types in the range include ultra-short and short range radar - covering blind spots, rear collision avoidance/warning, lane change assist, pedestrian/bicyclist detection, collision avoidance, cross traffic alert, 360 degree view and park assist.

In addition, the devices cover dynamic multi-modal operation, where the sensors switch from catering for high speed driving to slow speed manoeuvring and parking scenarios.

Market position

Commenting on TI’s position within the mmWave market Delagi concluded: “We’ve been working with customers on this technology for years, so we’ve got a pretty good idea of where we stand at this point. There will be others that will build similar technology, so to differentiate, we are providing a family of products, because no matter what sort of customer you talk to, they all have a slightly different topology in terms of what they want to do with a their application.

“The applications targeted by the range of sensors are very dynamic and are changing all the time so the idea of a family of products with a common software development capability, is something that we are doing that is dramatically different to our competitors.

“The accuracy of these sensors means that there are a never ending number of applications within the car. In all honesty I have no idea which one is going to be the big one, but that’s not what we’re trying to do. We’re trying to enable the technology and the innovation on behalf of our customers and they will be the ones who determine how broadly this technology goes.

“We are working with automotive and industrial customers in a very hands-on way and as such, I’ve never seen quite the reaction to a technology quite like this.”