How laser diodes help devices to see the world

Tiny laser diodes offer 3D sensing functionality for consumer electronics like smartphones and robots like self-driving cars. In this article, the technology consulting firm IDTechEx demonstrate how advances in laser technology and decreases in laser price enable novel applications in optical sensing.

This article presents some insights from the recently published report titled ‘Laser Diodes & Direct Diode Lasers 2019-2029: Technologies, Markets & Forecasts’. In this report Dr Nilushi Wijeyasinghe, Technology Analyst at IDTechEx, provides a comprehensive review of laser diode technologies, value chains, key player activities and global markets.

Recent progress in optical sensing is highlighted using case studies, where she draws on her background in laser physics and semiconductor physics research to explain new technical concepts. Segmented ten-year market forecasts and technology roadmaps are based on the extensive analysis of primary and secondary data, combined with careful consideration of market drivers and restraints.

Evolution of laser diode price and performance

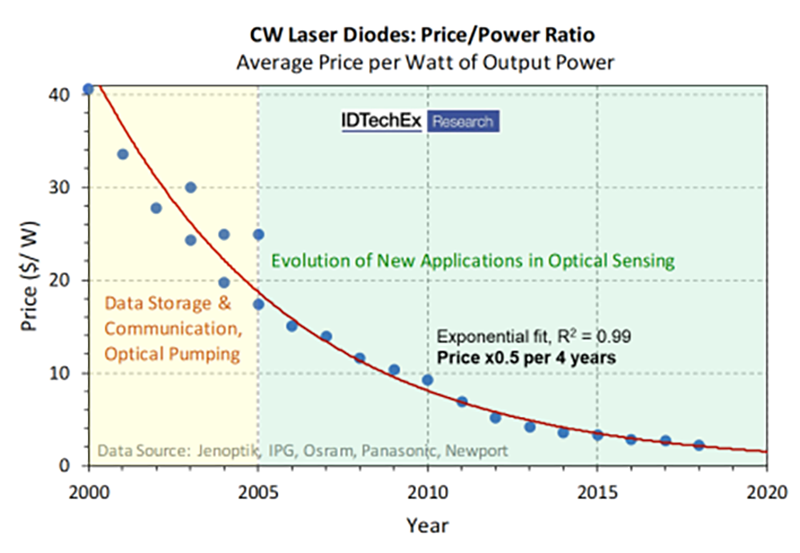

As a semiconductor technology matures and reaches mass production, a dramatic reduction in price is usually observed. Laser diodes are very compact and energy efficient semiconductor devices, which are available in many wavelengths from ultraviolet to long-wave infrared (LWIR): the wavelength is determined by the device structure and its semiconductor materials. The average price per watt of continuous wave (CW) devices designed for high-volume applications decreased exponentially during the past few decades to a value of $2/W.

In 2019, mass-produced laser diodes are available at prices below $0.10 per unit for bulk orders. Compared to light-emitting diodes (LEDs), laser diodes produce a coherent and collimated beam of monochromatic light, have a higher radiance (brightness), and are more energy efficient. These valuable properties originate from the generation of laser light via stimulated emission and the amplification of light using an optical cavity.

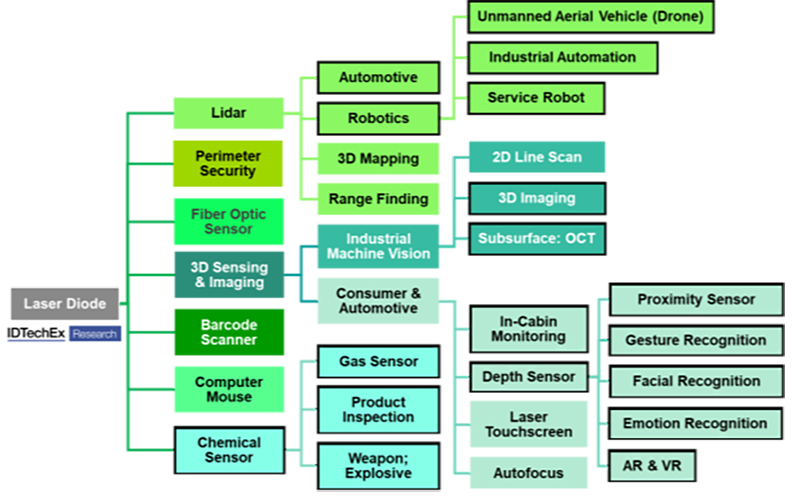

Combined with attractive product pricing, the unique properties of laser diodes enable next-generation technologies in optical sensing markets and provide fantastic business growth opportunities. IDTechEx forecast the global market for laser diodes to reach a size of $12 billion by 2029, where the optical sensing segment grows by an order of magnitude during this period.

Near infrared (NIR) wavelengths are a popular choice for optical sensing, because infrared lasers are safer for human vision than visible lasers operating at similar output power. Operating a laser at higher power can extend the object detection range for remote sensing applications. Visible laser diodes can be used for sensing if operated at low power or limited to low-risk environments; underwater sensing is an example.

LWIR wavelengths are produced by quantum cascade lasers (QCLs), which are useful for detecting numerous chemical signatures and are also an emerging 3D sensor technology. QCLs are rare and exotic lasers: their system architecture differs significantly from standard laser diodes. Consequently, QCLs are more expensive than the devices discussed above.

Depth sensors in consumer electronics

The rise of vertical-cavity surface-emitting lasers (VCSELs) for 3D sensing in consumer electronics is a particularly important technology trend. Applications of disruptive VCSEL technology include mobile devices, game consoles, augmented and virtual reality (AR/VR), and home entertainment systems. Optical elements can shape the light from an infrared source into a pattern (structured light) or sheet of illumination, and measuring the light reflected from objects provides depth information.

Compared to edge-emitter laser diodes, VCSELs can produce more accurate data due to their superior beam quality and wavelength stability, and the single emitters are easily scaled into mass-producible 2D arrays. Apple (USA) adopted VCSEL-based 3D sensor technology for the TrueDepth camera in iPhone X smartphones.

VCSELs also offer enhanced security for mobile devices via their biometric identification capabilities. Conventional 2D facial recognition relies on the identification and analysis of key biometric points to verify a person’s identity. Images from two perspectives can be analysed to differentiate between a living face and a photograph used by a criminal.

A major limitation of 2D facial recognition is the inability to differentiate between a living face and a pre-recorded video. VCSEL-based 3D facial recognition is more reliable because the facial structure is measured by a depth sensor, and the emotions conveyed via muscle movements can also be identified if required. Therefore, it is possible to differentiate between a living head and a pre-recorded video or 3D printed model.

In 2018, Osram (Germany) launched their first VCSEL product (BIDOS) for 3D facial recognition. In the same year, ams AG (Austria) announced that their infrared VCSEL arrays enable facial recognition in Xiaomi (China) Mi 8 Explorer Edition smartphones via a structured light process. IDTechEx forecasts increased adoption of VCSEL-based 3D sensing technology in consumer electronics – in mobile devices and beyond. Increased market consolidation is also expected as companies make strategic acquisitions to enhance their business position.

Sensors for driver-assistance and autonomous vehicles

Another rapidly evolving laser technology is lidar, originally an acronym of Light Detection And Ranging (LiDAR). While lidar is an established technology for high-value sensing applications in aerospace and defence, many companies now focus on developing cost-effective and compact lidar modules optimised for the automotive industry.

IDTechEx analysts are tracking more than 100 lidar companies worldwide that develop products for advanced driver-assistance systems (ADAS) and autonomous vehicles. Each company claims to offer a unique, next-generation product that is superior to competing technologies. The more mature lidar technologies use a mechanical system to scan a pulsed laser and determine 3D depth information via the light reflected from objects.

Companies like Velodyne (USA) and Hesai (China) have successfully scaled up the production of their mechanical lidars. However, the trend towards micro-mechanical and pure solid-state lidar threatens the growth of the mechanical lidar market segment. Micro-mechanical and pure solid-state systems are attractive to the automotive industry because such lidars offer lower unit price and longer product lifetime compared to mechanical products.

While most automotive lidar products are amplitude-modulated systems based on pulsed laser diodes, frequency-modulated continuous wave (FMCW) lidar is an emerging technology trend. FMCW lidar uses CW laser diodes and radar signal processing methods to deliver accurate information on object velocity in addition to object distance.

Another advantage of FMCW lidar is the reduced risk of interference from other light sources, such as lidars in passing vehicles. Companies developing innovative FMCW lidar technologies include ZVISION (China) and Blackmore (USA). Blackmore were acquired by the self-driving car company Aurora (USA) in May 2019. As automotive companies compete to achieve higher levels of vehicle autonomy, IDTechEx expects increased adoption of laser diodes in automotive markets for lidar systems and in-cabin monitoring applications.

These topics are discussed further in the IDTechEx report titled ‘Laser Diodes & Direct Diode Lasers 2019-2029: Technologies, Markets & Forecasts’.