Solar PV is fastest growing renewable energy segment

There are many driving market opportunities in the power industry including increased decentralisation, the need to decarbonise electricity generation, and digitisation to boost operational efficiency. Continued regulatory support for renewable energy in key markets will see global power investment reach $443.5bn in 2017. Solar photovoltaic (PV) will be the fastest growing segment, followed by wind power, accounting for 37.5% and 21% of global investment, respectively, by 2020.

The evolving market will compel power sector participants to craft innovative business models, offer customer-centric solutions, and create flexible portfolios. There will also be higher consolidation as companies seek funding to expand and introduce novel products.

Global Power Industry Outlook, 2017, a new analysis from Frost & Sullivan’s Power Generation Growth Partnership Service programme, examines power market trends, including installed capacity, investment, and regional growth across coal-fired, gas-fired, nuclear, hydro, solar PV, wind and biomass power.

“As new geographies emerge, local legislation and pro-renewable incentives will impact the fuel mix, compelling industry participants to identify challenges and define localisation strategies for long-term growth,” said Jonathan Robinson, Energy & Environment Principal Consultant. “As the renewable and distributed energy markets mature, a large installed capacity of equipment that needs servicing will also offer the operation and maintenance sector attractive growth prospects.”

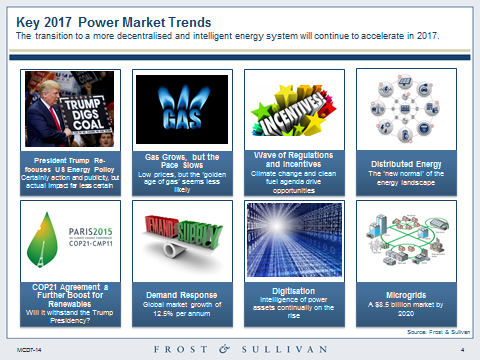

Key trends in the global power industry include:

- Continuing transition to more decentralised and intelligent energy systems

- Demand from utilities for energy management solutions, on both the supply and demand sides

- High growth rates for solar PV, with investment forecast to increase by 11.5% to $141.6bn in 2017. International agreements, such as COP21, and declining renewable technology costs, will ensure more capacity per dollar invested.

- China will be the largest market in terms of revenue investment, but the fastest growth will come from India, which will see double-digit growth in investment to 2020.

- 73.4% of power generation investment in Europe will be for renewable technologies, while Russia and CIS buck the trend and focus on nuclear power and hydro.

- There will be an overall increase in global coal capacity, even as the utilisation rate of existing coal-fired plants falls in most regions.

- New business models that incentivise smarter consumption patterns, coupled with growth of energy storage technologies, will reduce the need for peak capacity investment in mature energy markets.

- Strong investment in hydropower, despite it being a mature technology; China, Asia-Pacific, and Latin America will be key regional markets.

“Digitisation has the potential to drive efficiency gains and unlock new revenue streams for market participants in business areas such as demand response, utility as an energy service company or ESCO, predictive and real-time analytics, vehicle to grid, and virtual power plants and microgrids,” noted Robinson. “However, implementation will take time and significant investment.”