What is the automotive power electronics market driven by?

Power electronics technology helps in the efficient conduction and control of electric power in a vehicle. The electrical components of a vehicle - which can be classified into engine electronics, transmission electronics, chassis electronics, active safety, driver assistance, telematics, passenger comfort, and entertainment systems - require power systems such as DC/DC, DC/AC, and AC/DC. The power electronic components, such as controllers, gate drivers, power integrated circuits, and converters, are used to supply and regulate these power systems.

Author: Ankita Munot, Research Analyst, Automotive and Transportation Domain, MarketsAndMarkets

The conventional automobile is more than a century old. The automobile sector has evolved over the decades from being mostly a sum of heavy mechanical systems to the integration of mechanical systems and electronic controls. This has happened mainly due to the advent of power electronics technology and its successful incorporation at various levels in a vehicle. Advances in materials and technology have made automobiles cheaper, leading to their widespread adoption. In this regard, the progression of transportation is a harbinger of the age that we live in. At present, many technological innovations are coming together to create a completely new blueprint for automobiles.

Automotive power electronics, market dynamics

The key features of any vehicle include the powertrain and chassis system, body electronics, safety and security system, telematics, and infotainment. All these applications require power electronic components for their operation in existing vehicles. Electronic systems continue to contribute to more than 90% of the innovation in new features that are being introduced in automotive applications. The power electronics market is driven by such advances in vehicle electronics technology. Apart from the increasing demand for conventional fuels, other factors such as regulations concerning exhaust gas emissions, growing preference of customers for advanced technologies, and increasing limits imposed on fuel efficiency to reduce the carbon footprint are driving the trend of vehicle electrification, which consequently is influencing the power electronics market in the automotive domain.

As mentioned, with increased vehicle electrification, the demand for power electronic components has also increased, especially in applications such as powertrain, chassis, safety, body electronics, and telematics and infotainment. Power electronic devices are used for safety, in airbag systems or ECS systems and in monitoring tire conditions (tire pressure monitoring systems), among others. Sensors used in radars and Complementary Metal-Oxide-Semiconductor (CMOS) cameras are the basis for advanced safety solutions aimed at preventing collisions and accidents, warning drivers, and assisting them in critical situations.

Furthermore, due to a continuous decline in oil prices, the demand for gasoline and diesel vehicles is expected to increase in the near future. With the advent of electric vehicles such as battery electric vehicles (BEV), hybrid electric vehicles (HEV), and plug-in hybrid electric vehicles (PHEV), this market has gained traction. However, the emergence of autonomous cars and connected cars would make the market more lucrative for existing players as well as new entrants.

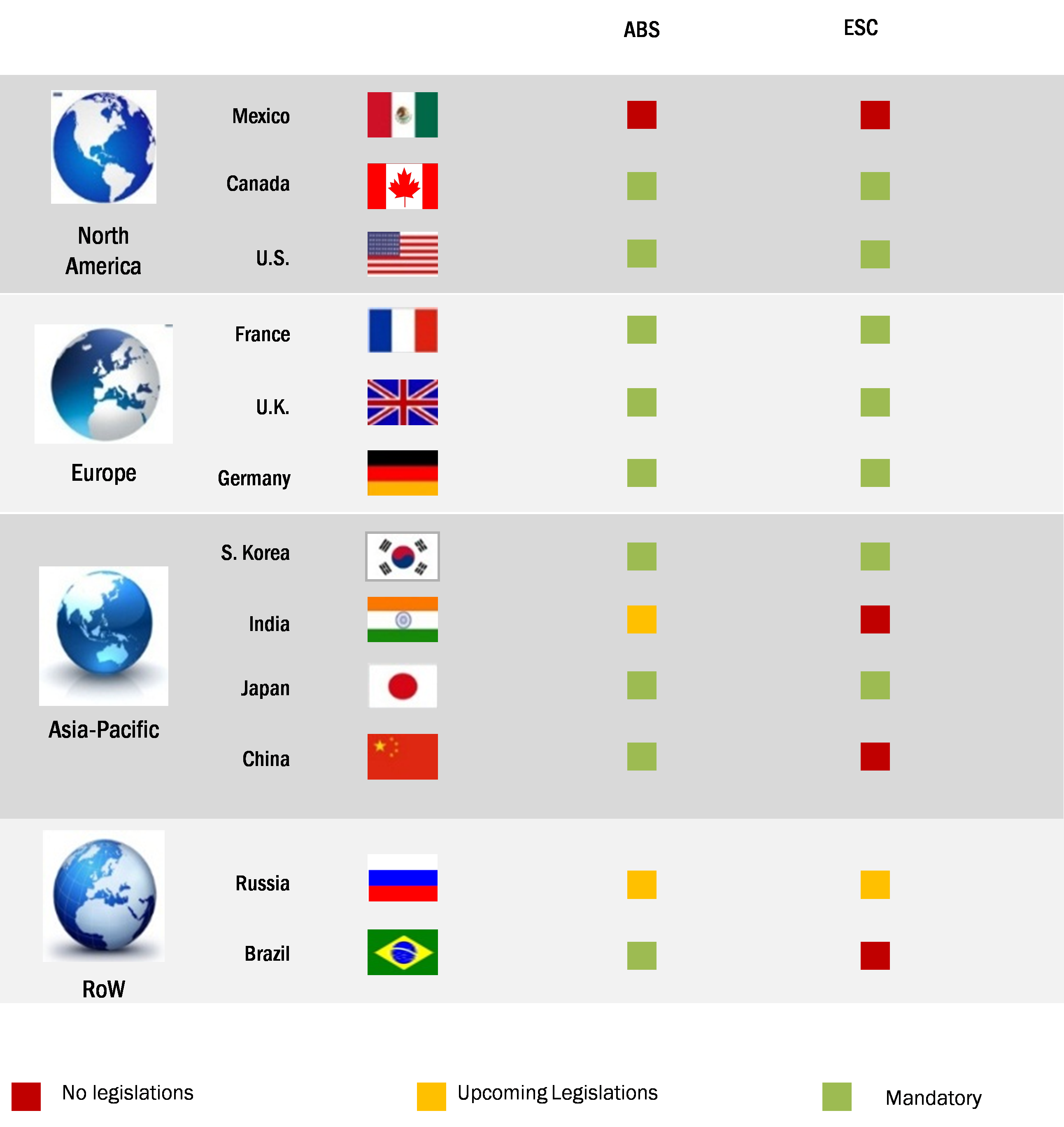

Stringent safety regulations exert significant pressure on OEMs and tier-1 suppliers to develop better safety systems for vehicles. According to the European General Safety Regulation (EC) No 661/2009, from 1 November 2014, various new safety features have been made compulsory for new passenger cars, light trucks, and heavy commercial vehicles. In addition to Electronic Stability Control (ESC) systems, new cars will have tire pressure monitoring systems, gear shift indicators, and driver seatbelt reminders. A few of the new safety features will need additional power electronic components to be deployed in each vehicle. From 1st November 2015, according to the regulation, all new trucks and buses are to be equipped with advanced emergency braking systems as well as lane departure warning systems, which will also need power electronics for their operation.

Automotive power electronics, regional analysis

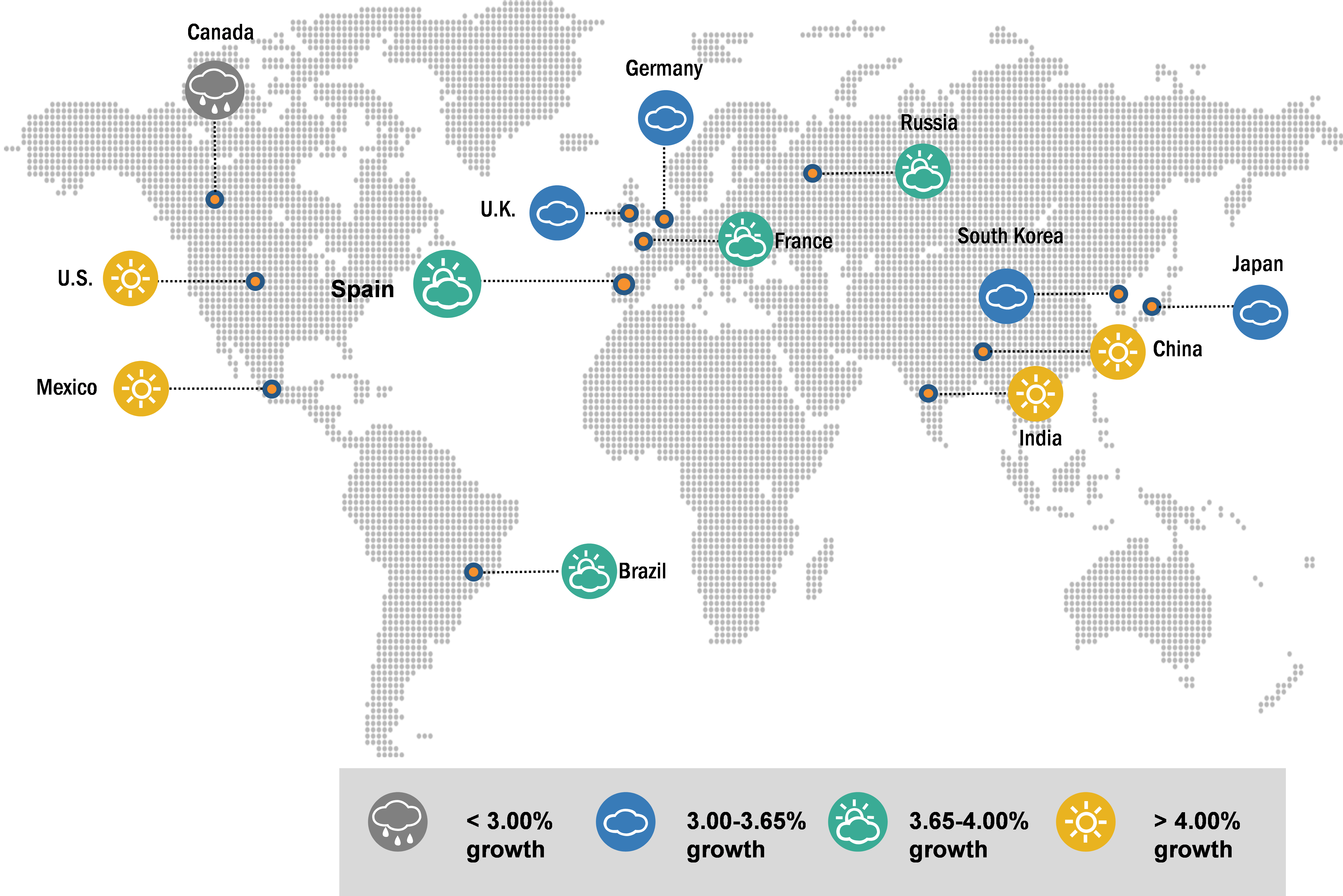

The automotive industry has witnessed rapid growth in the twenty-first century, especially in developing nations such as China and India. Keeping pace with this trend, automotive power electronics manufacturers are expanding their footsteps by establishing new and state-of-the-art production capacities. Stringent emission norms and the demand for fuel efficiency across developed and developing nations have led OEMs and automotive component manufacturers to develop fuel efficient solutions. Further, with increased demand for premium cars and electric vehicles, automotive tier 1 companies are in a constant pursuit to improve their products to increase competitiveness on a global level and meet various requirements of OEMs. The OEMs, in turn, are collaborating with semiconductor companies to manufacture technologically advanced vehicles, utilising efficient power electronic components such as active and passive sensors, high RAM-MCUs, and advanced power ICs. Automotive components are being developed in such a way that they maximise the cost–benefit ratio across different phases of production and purchase.

The most significant factor driving this market is increasing vehicle production, which, in turn, leads to a rise in demand for installation of these components. The rising trend of vehicle electrification and growing demand for advanced safety, convenience, and comfort systems are the other factors driving the growth of power electronics content in automobiles. Automated electronic control technologies for automotive systems such as advanced driver assistance systems (ADAS), body electronics, and electrification of powertrain have been evolving year after year. The need for high volume, low-priced, and advanced technology product manufacturing is also acting as a driving force for the market.

The automotive industry was initially concentrated in Western European and North American countries. However, factors such as economic turmoil, declining demand, and a saturating market forced automakers to seek opportunities in other regions of the world. Over the years, the automotive industry has shifted focus toward the emerging markets in Asia-Pacific and the Rest of the World (RoW). Countries attracting substantial attention from automotive OEMs include China, India, Brazil, and Mexico. These countries present the automotive industry with commercially viable opportunities. Factors compelling the automotive industry to focus on these regions include large population bases, improving economic conditions, and growing middle-class populations.

The current power electronics market across regions is characterised by sturdy and lightweight automotive electronic components. Due to the huge potential of the power electronics market, automotive component suppliers are investing in research and development for new feasible solutions for advanced applications. Innovations are focused on the development of lightweight components as OEMs are striving to reduce the carbon footprints of vehicles. Suppliers in developed regions such as North America and Europe are producing components to meet the stringent fuel economy and safety regulations.

Automotive power electronics, forecast trends

Automotive power electronics is a technology associated with the efficient conversion, control, and conditioning of electric power in an automobile. Currently, all the new electrical and electromechanical devices are integrated with power circuits. In the automotive industry, power electronics is the application of solid-state electronics for the conversion and control of electric power. These components are an extension of solid-state electronics, an effective and efficient method to manage communications and data in the business. Power electronics is the technique of minimising power and energy loss with the use of various materials and devices in an automobile.

The batteries installed in vehicles have a limited capacity of power supply. Power management integrated circuits (ICs) are used extensively to ensure that the supply of power is efficient when an electrically driven application is in use. Moreover, the power should be reduced to an absolute minimum when in standby mode. Along with this factor, the constant evolution of fuel efficient technology would further boost the growth of this market.

On the other hand, factors such as complex design and integration process for advanced technology devices and slow adoption of new technologies in developing countries are likely to inhibit the growth of the automotive power electronics market. Further, the major challenge faced by the power electronics market in the automotive industry is the increasing demand for compact devices with high efficiency, which will help reduce the overall weight of the vehicle. Hence, the future of this technology is more concentrated towards innovations in terms of compact sizing and simplicity in system topology in an automobile.