Wearable devices boost IoT sales in 2015

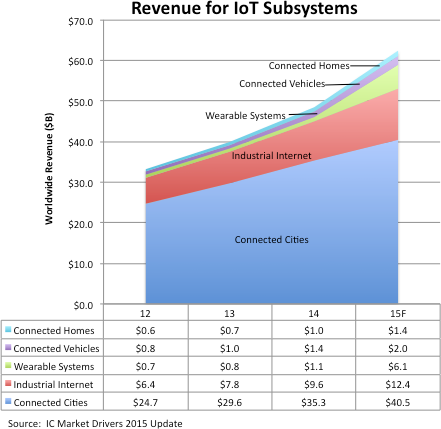

Market revenues associated with network communications, sensing and control functions in subsystems and objects attached to the IoT are forecast to grow 29% in 2015 to $62.4bn after increasing 21% in 2014 to about $48.4bn, according to data in IC Insights’ recently released Update to its 2015 IC Market Drivers Report. Figure 1 provides a breakout of sales growth in five IoT market categories, based on IC Insights’ updated forecast.

Figure 1

Figure 1

IC Insights raised its projection for IoT-related revenues in 2015 to show much stronger growth in wearable systems after the formal launch of Apple’s first smartwatches in April 2015. The long-term fate of smartwatches continues to be debated. Whether these wearable systems evolve into a major end-use market category or simply become a niche with a short lifecycle remains to be seen. In the short-term, however, the launch of the Apple Watch has provided a major boost to semiconductor unit shipments and sales to the wearable IoT category.

Total IoT-related revenues are now expected to rise by a CAGR of 21.1% from 2013 to 2018, reaching $104.1bn at the end of the forecast period.

Worldwide growth of ‘things’ connected to the internet continues to significantly outpace the addition of human users to the World Wide Web, according to the IC Market Drivers Update. New connections to the IoT are forecast to increase 40% in 2015 with 574m new internet connections expected to be attached to embedded systems, sensors, instruments, vehicles, controllers, cameras, wearable electronics and other objects. IoT connections grew to 410m in 2014, which was a 45% increase from 282m in 2013. The total installed base of connected things on the IoT is forecast to reach 13.2bn units worldwide in 2015 versus about 3.1bn humans using computers, cellphones and other system applications over the internet this year, based on IC Insights’ updated projections. By the end of this decade, more than 25bn systems and objects are expected to be attached to the internet versus about 4.4bn human users.

Additional details on the IoT is included in the 2015 edition of IC Insights’ IC Market Drivers—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits. This report examines the largest, existing system opportunities for ICs and evaluates the potential for new applications that are expected to help fuel the market for ICs.

IC Market Drivers is divided into two parts. Part 1 provides a detailed forecast of the IC industry by system type, by region, and by IC product type through 2018. In Part 2, IC Market Drivers examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2018. Some of these applications include the IoT, automotive electronics, smartphones, personal/mobile computing, wireless networks, digital imaging, and a review of many applications to watch. IC Market Drivers 2015 is priced at $3,390 for an individual user license and $6,490 for a multi-user corporate license.