Will the market adopt MEMS timing?

Although MEMS timing products and their relative advantages have long been talked about, the market acceptance of these products is still relatively low. Sally Ward-Foxton investigates why.

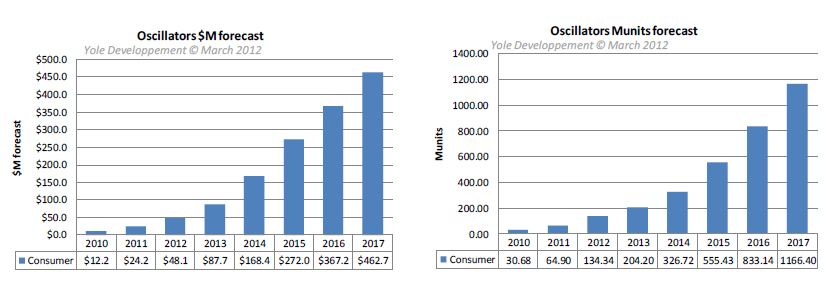

Despite some compelling benefits, MEMS technology’s share of the timing market is still relatively low, at around $100m today. This is predicted to rise to almost $500m by 2017 (Figure 1), indicating that this market is still at an early stage. There is certainly a lot of room for growth; considering that practically every electronic system requires clock and timing products as their ‘heartbeat’, it’s perhaps surprising that the figures aren’t even higher.

Figure 1 - Yole Developpement’s view of how the MEMS oscillator market will develop in the consumer electronics sector

According to Rami Kanama, VP and GM of the timing and communications group at Micrel, MEMS is still at the infant stage of adoption: “It’s a low profile market… the size of it is only covered by a couple of research companies. Timing products are already being used everywhere, and it’s somewhat second nature to those designers.” Designers may not therefore be aware of the benefits that changing to MEMS timing can bring. MEMS boasts several key advantages over its quartz counterparts. In terms of performance, because MEMS timing devices are made from silicon, they show extremely stable temperature characteristics over a wider temperature range than crystals, so temperature compensation unnecessary. Quartz’s other weakness is its robustness to shock and vibration; silicon MEMS parts can improve on this many times over. This is especially valuable to markets such as automotive and military, in which the electronics can be subject to this sort of environment.

Another quartz weakness is that it must be manufactured on a specific quartz processing line and vacuum-sealed into a special ceramic package. MEMS timing devices use standard MEMS fabs and ordinary plastic packaging, the same as any other IC. These factors can ease manufacture of the devices and therefore make high volume production as cost-effective as possible. Additionally, MEMS parts typically have a programmable aspect, meaning the frequency or voltage output can be adjusted. MEMS suppliers can have large volumes of the product in stock, then program the parts based on the customer’s request, keeping lead times very short, as little as two or three weeks. Given all of these advantages, why are engineers still seemingly reluctant to try MEMS timing products? It may be as simple as the existing technology works well enough, and ‘if it ain’t broke, don’t fix it’. Or perhaps designers remain sceptical about the new technology’s claims.

“It’s an ongoing process,” says Kanama. “We have to evangelise a new technology, and get over the hurdles to really convince old-school engineers that yes, you can get the same performance and reliability in silicon.” The supply chain may also be playing a part - quartz crystals have been used for more than 80 years and are currently supplied by at least 20 companies, so their supply chain is very well-established. By contrast, when MEMS timing technology was first commercialised, it was being brought to the market by startup companies such as SiTime, Discera and Silicon Clocks, all of which have gone on to become key players.

Discera was acquired by Micrel in 2013 and merged into the timing and communications group led by Rami Kanama. His explanation for the low takeup at that point is that customers didn’t want to buy from a startup, instead preferring to wait until the parts could be produced by a larger company. “We are already seeing, three Quarters after acquiring it, the revenue double Quarter on Quarter, without doing anything,” Kanama says. “[Purely] because it’s not being sold by a startup, it’s being sold by an established supplier.”

![]()

Figure 2 - Silicon Labs acquired Silicon Clocks and its CMEMS technology in 2010

Another MEMS timing startup, Silicon Clocks was acquired by Silicon Labs in 2010 (Figure 2). Their technology allows MEMS resonators to be built directly on top of a CMOS die in a process called CMEMS, to make a fully integrated monolithic IC solution. SiTime, meanwhile, is growing; the company has sold $200 million of their MEMS timing product since inception in 2005. Bigger companies like Micrel and Silicon Labs entering the market in this way, as well as the growth of smaller MEMS specialists like SiTime, indicate that the supply chain is starting to mature, to provide secure, trusted sources of product. It also means that multiple sources can be qualified, which was previously an advantage for quartz. MEMS timing manufacturers point out that MEMS can even be made as a drop-in replacement for quartz, so that quartz is essentially the second source for the MEMS product, lowering the risks.

Qualification

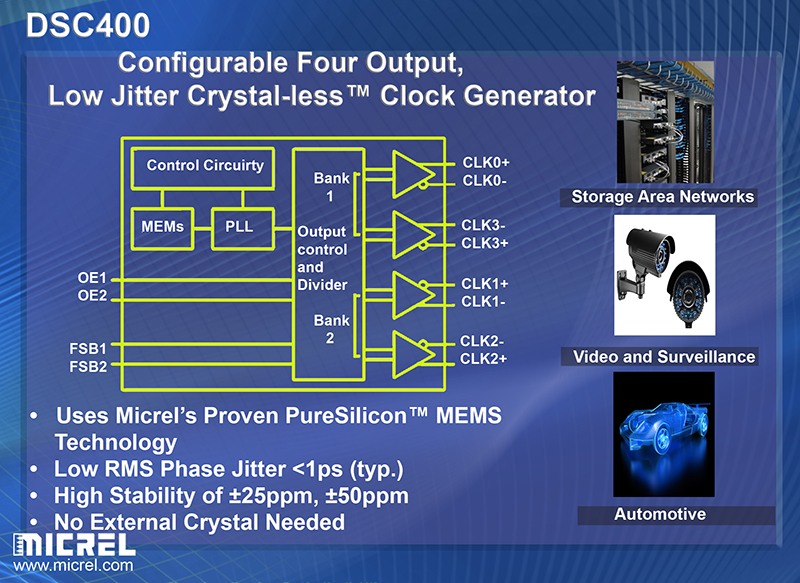

Kanama points out that small companies in the past had targeted the consumer sector, since resources were needed to prove that MEMS can meet the stringent requirements of the automotive and military industries, which require an investment in certification. Manufacturers therefore targeted the high-volume consumer sector, despite the devices’ temperature stability and shock and vibration performance making them ideal for the automotive world. As an example, Micrel has qualified its DSC400 four-output crystal-less clock generator to MIL-STD-883 and AEC-Q100 (Figure 3).

Figure 3 - Micrel’s DSC400 clock generator has low RMS phase jitter, high stability and is qualified to MIL-STD-883 and AEC-Q100

One area in particular where quartz outperforms MEMS timing devices is jitter performance, an important parameter for high-performance applications such as telecommunications. Though it isn’t possible to target these applications today, companies with more resources are now involved which may mean they can afford to fund new research to improve the jitter performance.

So, in which application areas should we expect growth for the MEMS timing market?

From Micrel’s point of view, the company already has a big customer base in network equipment, the company is working on design-ins for network systems that don’t require the lowest possible jitter or phase noise, such as server cards, enterprise storage and SSDs. The company is also selling to the automotive systems sector, in areas such as automotive camera systems, keyless entry and infotainment systems. Micrel’s MEMS products are automotive-qualified, and Kanama points out that the temperature stability plus shock and vibration performance of MEMS is perfect for this application. Industrial, military and medical applications may also be areas of growth for MEMS timing. These areas have their own demanding requirements for robustness which MEMS is able to meet, while being a little more flexible on the jitter figures.

Though the market for MEMS timing devices is still at the early stages, the supply chain is developing to provide multiple, stable sources of product. Acquisitions in the market mean these larger companies can invest in the required certifications and even fund new research to improve the technology’s jitter performance. All of which indicates that the market for these devices is indeed set to grow steadily in the coming years.