ITSA members report sales up by 12% over Q4 of 2022

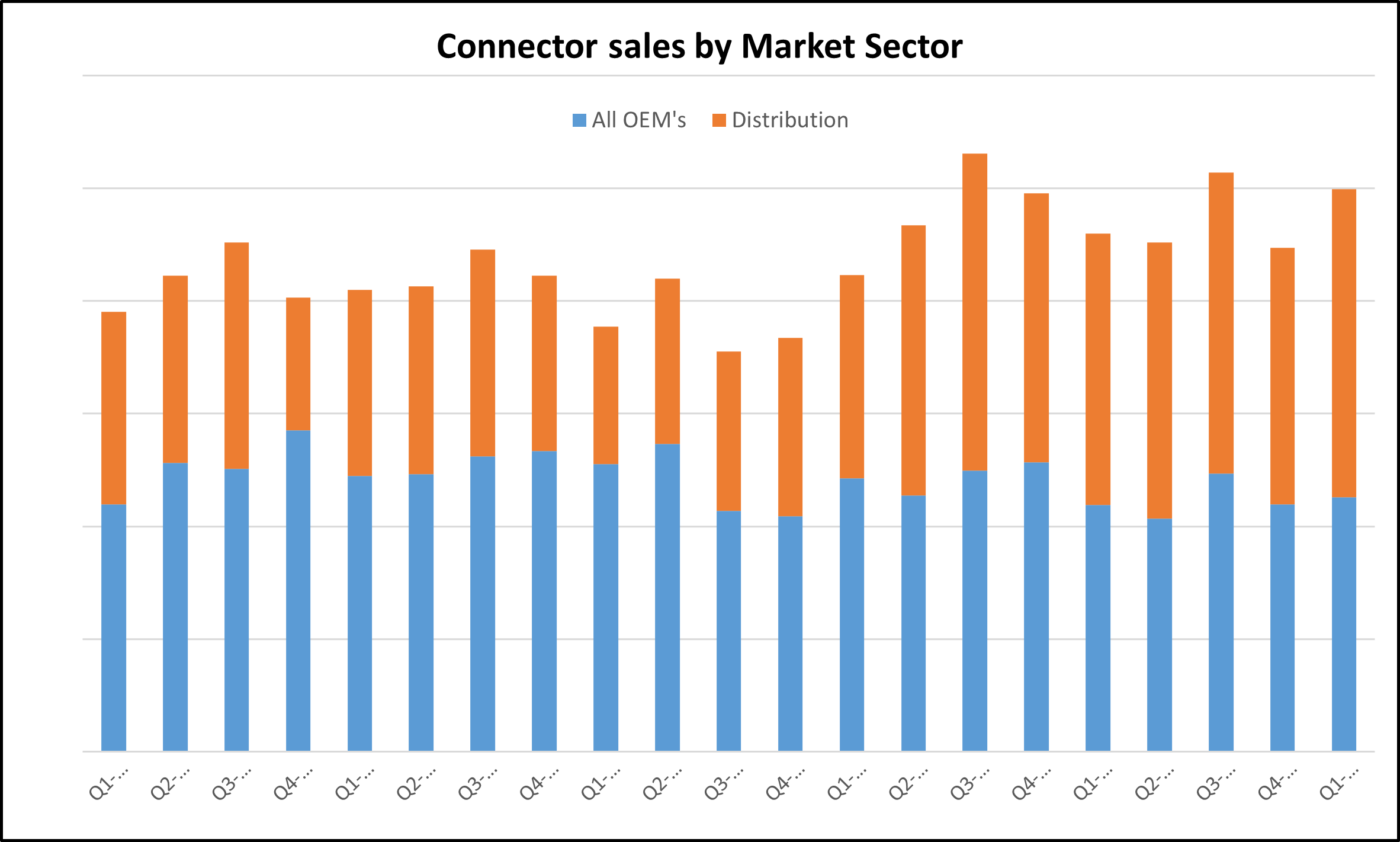

ITSA members have enjoyed a strong start to 2023 with most technologies and markets performing well and revenues up 12% against Q4 of 2022 and ahead of the same time last year, however, bookings slowed again and BtoB was flat at 1.0:1.

The strong order book carried into 2023 should result in positive revenues in Q2 but there may well be a slowdown.

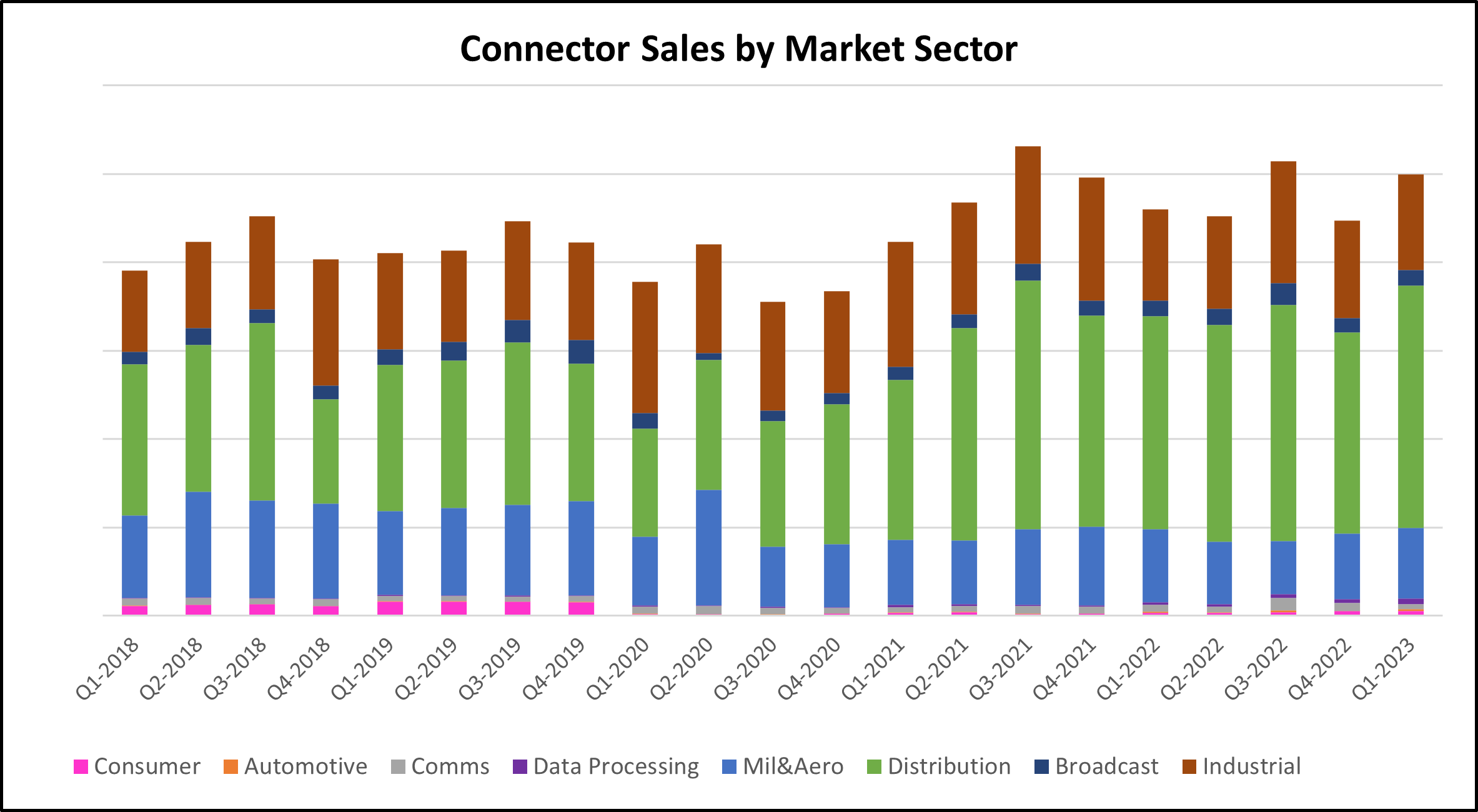

As indicated above, some UK markets continue to perform well with data processing, broadcast, utilities and T&M leading the way, all with significant double-digit growth.

However, this continues to be offset by declines in comms and mass transport both of which showed significant declines. Members mass transport revenues have now declined for three quarters in a row.

At a product level every area has grown in Q1 with only Coax showing a small drop. Circular connector products continue to thrive with another +13% increase in Q1 and are now almost back to the highs of pre pandemic levels.

Overall, 2023 appears to have started positively for ITSA members but with orders dropping we may see a flattening out in Q3/4.

There are conflicting market reports coming out now, as indicated below, and there still seems to be a question over are we or are we not in a severe recession? The IMF have been less than complementary about the UK economy, but history has shown that their analysis is usually far too pessimistic.

Interest rates are rising but remain at a very low level and inflation seems to be easing, however, the UK is facing a considerable number of industrial disputes which is having a real negative impact on confidence levels.

2023 will certainly be a challenge but I do believe our industry remains resilient.

S&P Global/CIPS UK Manufacturing PMI and IOD data

For our first report of 2023 I have obtained two contrasting sets of data which shows the different dynamics in the UK economy, the CIPS UK Manufacturing PMI fell to 47.9 in March which means that the index has remained below 50 for eight consecutive months which signals contraction, however, data I have obtained from the IOD (Institute of Directors) shows strong growth in the UK economy which confounds the forecast from the OBR expecting contraction in Q1.

Both reports rely on the input from companies in the UK and the IOD one covers much more of the UK economy than the CIPS one which focuses on manufacturing.

These differences in market/economy views goes to show the challenges our members are facing as you all supply into a multitude of markets with different dynamics.

What was consistent with both reports was the level of optimism being expressed about the next 12 months e.g., CIPS said almost 60% of respondents expected growth whereas the IOD report indicated 61% expected growth.

One of the stark differences was in the levels of order intake, CIPS suggest that order books remain depressed whereas the IOD reports that 50% of contributors saw order book increases.

Summary

2023 will, as usual, present ITSA members with another set of challenges but as already commented our members and the industry remain resilient.

Our Q1 positive data output should not be taken in isolation, and we believe that there will be some easing off of the levels of growth enjoyed so far.

As with the end of 2022 the economic, political, inflationary, and cost-of-living challenges, combined with the impact of the war in Ukraine, means the UK market remains challenging.

Skills shortages are still a challenge for ITSA member (along with the UK manufacturing sector in general) and this was reinforced by a recent report sent to members.