Power module materials market set to reach $1.8bn by 2021

Today, the main part of the power module cost is the power packaging materials. In 2016 almost 40% of the total cost was due to the cost of materials for packaging. “To understand the evolution of the power packaging market, it is now essential to look in details the selected materials and design and evaluate each innovation,” commented Mattin Grao Txapartegi, Technology & Market Analyst, Power Electronics at Yole Développement (Yole).

Yole is to release this month its new Power Module Packaging report entitled Power Module Packaging: Material Market and Technology Trends 2017. With a strong focus on designs and materials, Yole’s analysts propose a deep understanding of the current technical challenges and market evolution. Topics covered in this report include identification of the key technologies that will shape the future and analysis of the supply chain with key players.

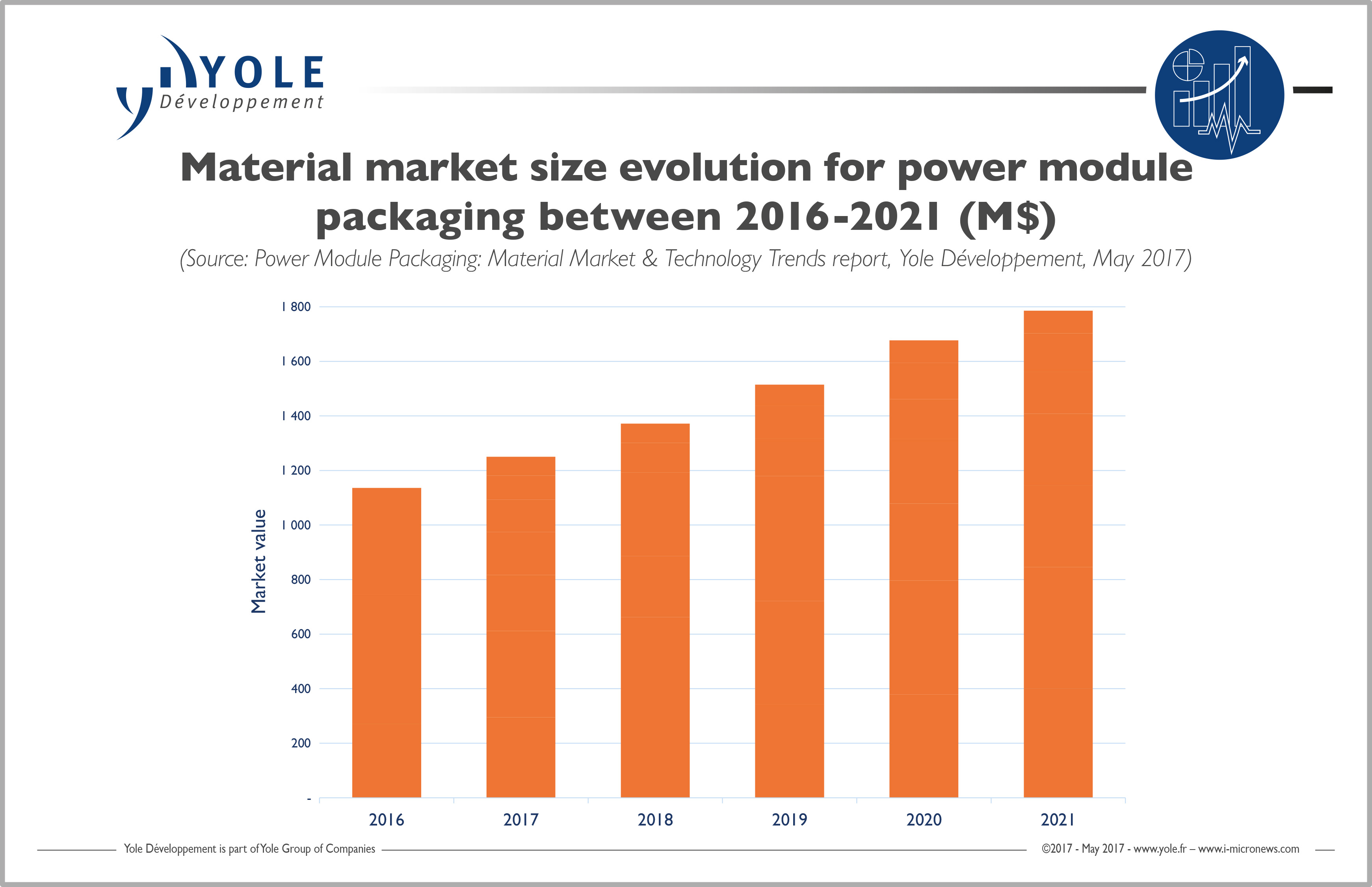

According to Yole, the power module materials market will grow at 9.5% per year between 2016 and 2021, reaching almost $1.8bn in 2021. How will new applications drive the growth of power electronics, especially with innovative materials and designs?

In 2016, the power module market was worth almost $3.2bn and from there it will grow steadily for the next five years. A large part of the power module cost is dedicated to raw materials for packaging: indeed materials for die-attach, substrate-attach, substrate, baseplate, encapsulation, interconnections and casings already constitute a $1.1bn market in 2016 and Yole announces a steady growth until 2021.

Yet the growth will not be even across all raw material markets. Die-attach materials have the highest forecast CAGR for 2016-2021, at over 13%. Casings and encapsulation have the lowest CAGR, at 5-7% for 2016-2021. The main differences arise from technology choices for those materials and their impact on the each market segment. For instance, the greater presence of epoxy resin will reduce the cost of encapsulation in power modules.

Substrates and baseplates account for half of the packaging raw material market, and together are worth over $550m. Therefore, the choice of technology in ceramic substrates or baseplates can have a great impact on final power module cost. Around 25% of the cost is related to die-attach or substrate attach material. Rest of the cost is divided between encapsulation, interconnections and the casing.

Industrial applications remain the biggest part of the power module market. However, EV/HEV market, with its double-digit growth forecast for the period 2016-2021, will represent around 40% of this market by 2021. Moreover, the automotive industry is leading in technological innovations in packaging, helping and accelerating the implementation of these new technologies thanks to high manufacturing volumes.

“The power module market is becoming extremely competitive with several new players arriving from different directions,” asserted Dr Milan Rosina, Senior Analyst for Energy Conversion & Emerging Materials at Yole.

In recent years, some consolidations among power semiconductor market leaders took place, with several acquisitions, such as Infineon Technologies buying International Rectifier and ON Semiconductor buying Fairchild. These moves were intended to strengthen positions in the overall power semiconductor business. Nevertheless, in coming years the market leaders will face strong competition from Tier-1 automotive manufacturers such as Denso or Robert Bosch and new entrants from China such as Starpower and CRRC. OSATs could also propose services to provide advanced packaging technologies to power module manufacturers. This will define a new business model that diverges from the traditional power module supplier business. Thereby, all companies involved in the power module market will need to adapt or rethink their offerings and especially secure their technological advances via continuous innovations.