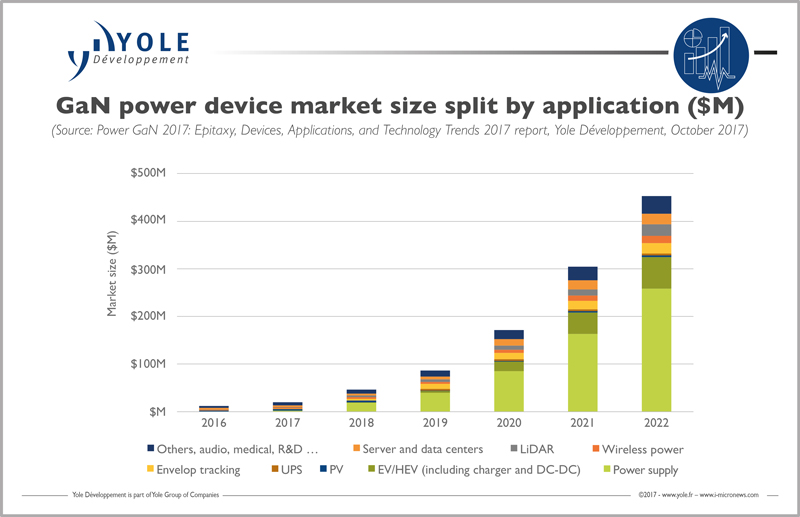

Power GaN market expected to be worth $450m by 2022

According to Dr. Ana Villamor, Technology & Market Analyst at Yole Développement (Yole): "The GaN market promises an imminent growth. 2015 and 2016 have been undoubtedly exciting years for the GaN power business. we project the explosion of the market with 84% CAGR between 2017 and 2022. The market value will so reach $450m at the end of the period.” What make the power GaN technology so promising?

The 'More than Moore' market research and strategy consulting company Yole pursued its investigations based on numerous exchanges with power GaN companies and through its participation in leading conferences. Yole announces this month the Power GaN 2017: Epitaxy, Devices, Applications, and Technology Trends report. Things are going on the right way: the power GaN supply chain prepares for production and 2017 has been showing significant investments that confirm the added-value of power GaN technology and its strong potential in numerous applications. The new Power GaN analysis conveys Yole’s understanding of GaN implementation and details the different market segments, the related drivers, metrics and technical roadmaps.

In 2016 the power GaN market reached $12m: it is still a small market compared to the impressive $30bn silicon power semiconductor market. However its expected growth in the short term is showing the enormous potential of the power GaN technology based on its suitability for high performance and high frequency solutions.

“LiDAR, wireless power and envelope tracking are high-end low/medium voltage applications, and GaN is the only existing technology able to meet their requirements,” explained Dr. Villamor. “Beginning of the year, Velodyne Lidar opened a ‘megafactory’ to ramp up the latest 3D sensor for LiDAR manufacturing and this October they already announced a fourfold production increase.”

Other major companies, like Apple and Starbucks, started offering wireless charging solutions. Moreover, since 2016, EPC has been working with Taiwan’s JJPlus to accelerate the wireless charging market’s growth. The power supply segment is still the biggest application for GaN. The data centre market is adopting GaN solutions with a phenomenal speed, driving a 114% CAGR for power supplies through to 2022. Existing solutions from Texas Instruments and EPC for data centres, consisting of a DC/DC converter and point of load supply that steps down the voltage from 48 to 1.2V in a single chip, will propel the market. AC/DC power adapters for laptops or smartphones can be also implemented with GaN power IC solutions, which further reduces the size and cost of the system.

Therefore the consumer market is expected to grow during coming years and Yole’s analysts envisage two different scenarios, depending on the acceptance in key markets like AC/DC adapters for laptops and cellphones.

GaN needs to hurry to gain adoption in the EV/HEV market because SiC MOSFETs are already replacing silicon IGBTs in the main inverters. However, a future market for the 48V battery’s DC/DC converter is still possible for GaN due to its high-speed switching capability. Some main players, such as Transphorm, have already obtained qualification for automotive, and this would help to finally ramp-up GaN production for EV/HEV.

In parallel, the GaN power devices supply chain is acting to support market growth. Therefore it is close to being settle for the power GaN market and deals during 2017 show confidence that GaN will be a successful market. “First of all, there have been big investments from the main foundries to increase their capacity to handle mass production,” asserted Zhen Zong, Technology & Market Analyst at Yole Développement. He added: “Navitas just announced the partnership with TSMC and Amkor to ramp production capacity. Moreover, BMW i Ventures has just invested in GaN Systems. The Taiwan’s Ministry of Economic Affairs is also interested in using GaN for clean and green technologies, also in collaboration with GaN Systems.”

GaN manufacturers clearly continue developing new products and provide samples to customers, as is the case with EPC and its wireless charging line. For example, during 2017, Panasonic announced the mass production of its 650V products and Exagan successfully produced its first high voltage devices on 8" wafers. Other players are in the final phase of R&D or qualification for their GaN products to be launched in 2018. In both cases, manufacturers and clients are pushing to use GaN HEMTs in emerging technologies.