MOSFETs market recovered in 2016

In its latest power electronics report, Power MOSFET: Market & Technology Trends, Yole Développement (Yole) announced that 'in 2016, the MOSFET market recovered, after a minor downturn in 2015.” With stable growth, mainly in automotive and industrial sales in 2016 the overall silicon power MOSFET market size surpassed 2014’s performance. “We expect the market to grow steadily thanks to increasing demand for efficient electronics, in which power MOSFETs play a vital role,” explained Zhen Zong, Technology & Market Analyst, Power Electronics at Yole.

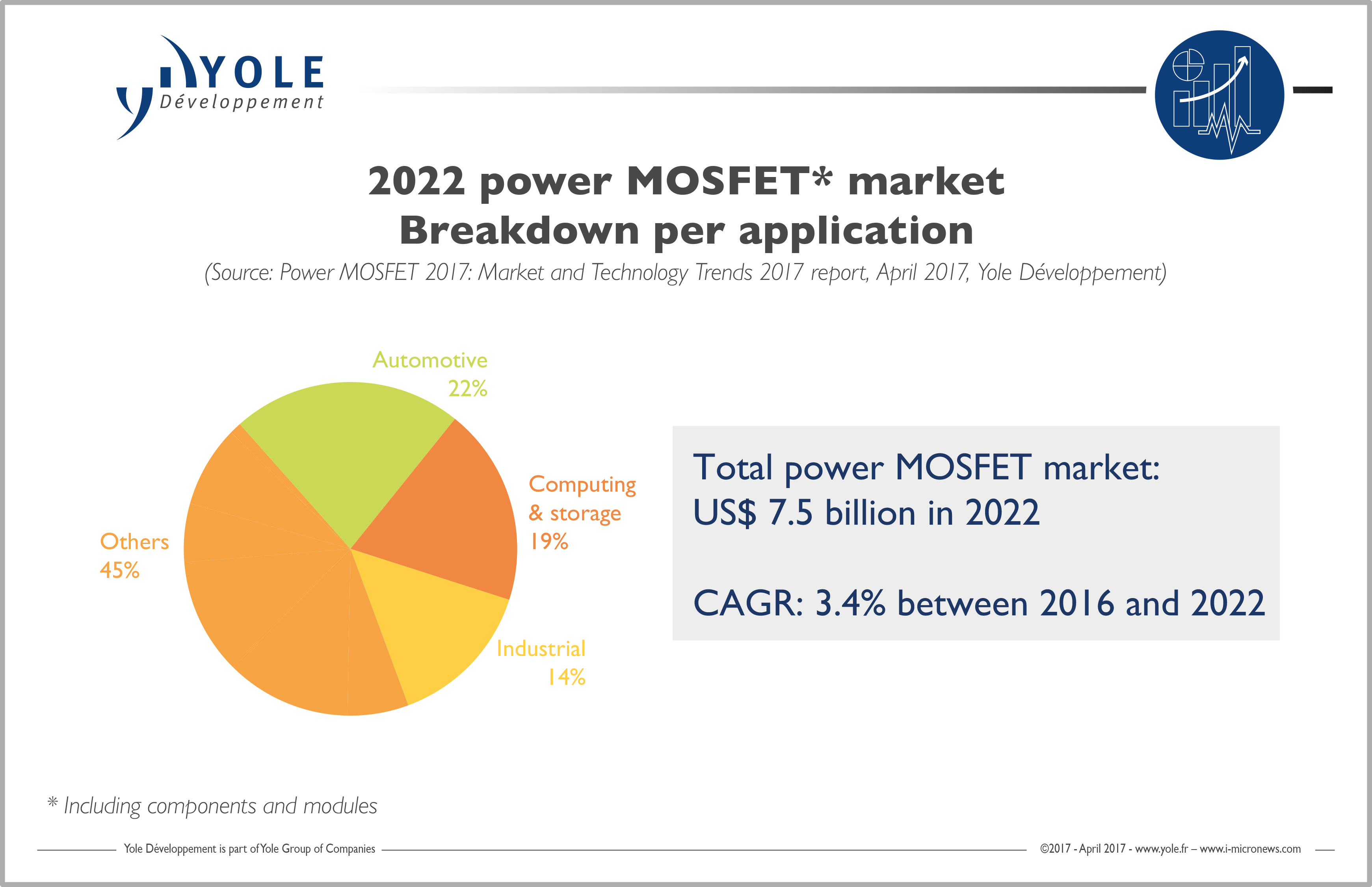

Overall market revenue neared $6.2bn and from 2016 to 2022 Yole estimates a 3.4% CAGR. The 'More than Moore' market research and strategy consulting company is covering step by step the whole power electronics supply chain: from substrates with innovative WBG materials including GaN, SiC, Bulk GaN to devices (IGBT, MOSFET, gate drivers IC), modules and systems. Yole’s strategy is to propose a deep understanding of the overall power electronics industry by taking into account technical innovations such as WBG technologies, analyse the impact on the supply chain and identify business opportunities.

Yole’s power electronics team will attend PCIM Europe with a booth and its annual Power Electronics Market Briefing. During this briefing, the consulting company is inviting industrial leaders to speak and proposes detailed presentations focused on the power semiconductor industry.

The Power MOSFET report is one of the key 2017 reports proposed by Yole’s team. It provides an overview of the entire market, with a comprehensive analysis of the players in each market segment with their product range and technologies. “Under this new report, our aim is to propose our vision of the power electronics industry, from an end-users perspective,” explained Dr Pierric Gueguen, Business Unit Manager at Yole. “Our analysis highlights the corresponding impact on MOSFET technologies and the introduction of WBG technologies which represent only less than 2% of the overall power electronics market today but are showing a real growth potential in a near future.”

In 2016, 25 million electrified vehicles were sold. Power MOSFET sales in automotive applications have surpassed computing and data storage, now representing more than 20% of the total market. As vehicle numbers increase worldwide and people adopt electrified vehicles, this sector’s rapid growth will continue at 5.1% CAGR between 2016 and 2022.

Power MOSFETs are widely used in various automotive applications involving braking systems, engine management, power steering and other small motor control circuits, in which a low conduction loss and high commutation speed device is very much appreciated. Silicon power MOSFETs are also becoming increasingly popular in EV/HEV converters, depending on their electrification level. For battery chargers MOSFETs can handle roughly 3-6kW, which is suitable for small size plug-in EVs or full EVs. They are also used for 48V DC/DC converters and other micro inverters in the start/stop function module. With the trend of EV/HEV adoption led by Tesla, Yole’s analysts believe this market segment will become increasingly important in the next 5-10 years.

Computing and storage market segment which includes desktops, laptops, as well as different kinds of servers in the datacentres comes to the second largest market. With the declining sales number of personal PCs this market segment is slowing down and has been surpassed by automotive part in 2016. However with the increasing demand for servers and datacentres, the whole segment is still having a steady increase, posting a 2.8% CAGR for the 2016-2022 period. Power electronics market future may depend on governmental decisions concerning electrified vehicles as well as renewable energies applications. It includes CO2 reduction targets and energy efficiency increases. Both markets could be the most important in 2030, announces Yole in its MOSFET report. On the other hand, other large volume applications may come, such as 5G, drones or robots. All those applications, demanding power supply, will clearly pull the MOSFET market.

Today it is not possible to get a comprehensive understanding of the MOSFETs market without taking into account the impact of the innovative WBG technologies including SiC and GaN.

Silicon power MOSFETs have been developing for 20 years. Ceaseless improvement and technology innovations from planar to trench structure and today’s super junction, have reduced silicon MOSFET device sizes and costs dramatically. They have been massively used in various application segments - but today, device performance has reached silicon’s theoretical limit.

Chasing better performance and even smaller devices size, today the power electronics industry is at the beginning of SiC and GaN’s adoption. Ever more new companies are promoting SiC and GaN solutions and new designs. At Yole, analysts believe this will be the next technology evolution stage. However, this does not necessarily mean doom for silicon power MOSFETs.

“Looking back at the development of bipolar transistors and power MOSFETs in the past 20 years in different applications, we expect that there will still be a very solid market share reserved for silicon power MOSFETs”, analysed Zhen Zong from Yole. With increasing need in the end applications, the overall market size for MOSFETs will not necessarily decline.

Over the next 5-10 years, Yole envisions some GaN devices coming out and being implemented for high frequency switch applications in the low-to-mid voltage 100-200V range, but remaining a small portion. Both SiC and GaN devices will penetrate the high frequency market around 600V, but will probably only be popular in particular markets, like EV on-board chargers and data centre power supply units. The majority of the market will still use silicon power MOSFETs, thanks to their proven reliability and good cost performance ratio.