Li-ion battery challengers: how to access the market?

Today, there is a relatively large variety of different battery technologies that can challenge Li-ion batteries. Under its report entitled Beyond Li-ion Batteries: Present & Future Li-ion Technology Challengers, Yole Développement (Yole) identifies: NAS, Li-S, Na-ion, Mg-ion, Li-air, zinc-air and flow batteries and LIC. Some of these technologies are at the R&D stage and some are already in commercial production.

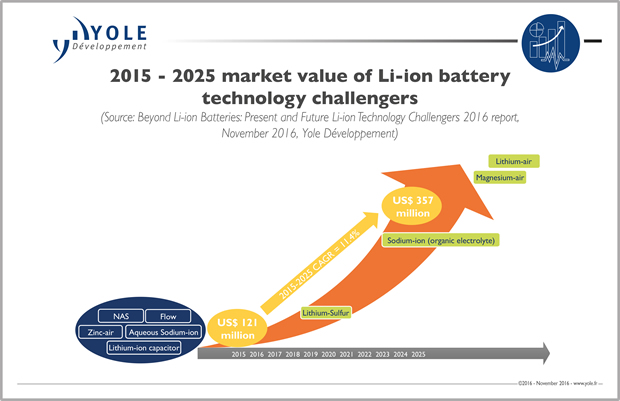

The energy storage market for these technologies reached $121m in 2015. According to Yole’s estimates, the market value for Li-ion challengers will reach $357m by 2025, with a 2015-2025 CAGR of 11.4%.

“The main demand for present Li-ion battery technology challengers will come via utility-size stationary battery energy storage”, announced Dr Milan Rosina, Senior Analyst for Energy Conversion and Emerging Materials at Yole. “Future battery technologies will find applications first in niche market segments with special requirements, namely in terms of energy density and safety: unmanned aerial vehicles, defense, etc.”

Future Li-ion challengers (i.e. technologies currently at the R&D stage) must overcome formidable technology challenges in order to achieve better performance and cost than Li-ion batteries. In the short-term, Li-S technology is considered the best candidate to reach sufficient technology maturity for wider commercial deployment. Li-ion battery cell supply is already well-consolidated. Three leading companies, Panasonic, LG Chem, and Samsung SDI continue to cement their position as cell suppliers by building production facilities and developing new supply partnerships with EV/HEV manufacturers. To oppose the established Li-ion industry, challengers pursue different strategies. The safest approach involves companies focusing on one specific technology part which can be applicable in different battery chemistries. Yole’s analysts mention for example the improvement of lithium-metal electrode during the battery charging/discharging cycles.

Oxis Energy’s initial focus is on niche markets where high energy density is a priority. The goal is to obtain the necessary income for funding further improvement of Oxis’ Li-S battery technology and achieve a cycle life that is satisfactory for other applications. EnSync Energy Systems (formerly ZBB Energy) has changed from a flow battery supplier to a micro-grid solution provider. Other companies are focused on partnerships with utility companies as a means of developing demonstration projects and gaining visibility and customer confidence before developing high-volume production capacities.

Most companies developing future battery technologies are not planning to produce batteries independently. According to them, the related risk is too high. Thus they are looking for a big company interested in a partnership or a technology license. The big Li-ion players’ positioning regarding Li-ion technology challengers could be affected by the arrival of new players from the EV/HEV industry. Indeed, novel battery technologies are a strong focus of automotive OEMs such as Toyota and Tier 1 companies with Robert Bosch.