Bulk GaN: from technology to market

The 'More than Moore' market research and strategy consulting company, Yole has released a new technology and market report focused on Bulk GaN substrate, titled 'Bulk GaN Substrate Market'.

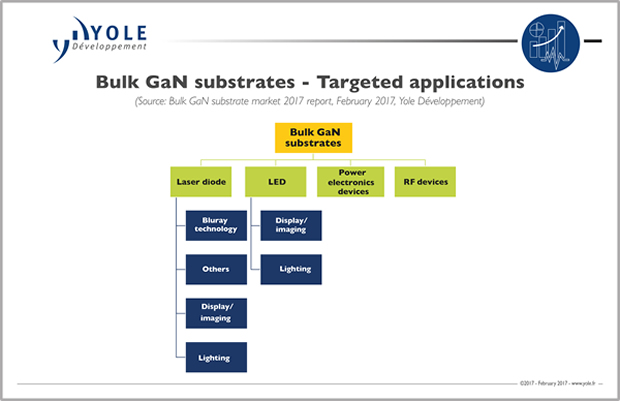

Under this analysis, the consulting company presents the different market segments and related drivers and details the status of GaN technologies today. Commercial GaN-based devices are available for both optoelectronic and electronic applications, confirm Yole’s analysts. Indeed optoelectronics applications, particularly GaN-based laser diodes and GaN-on-GaN LEDs, are expected to drive the bulk GaN substrate market from 2016-2022.

"The past 30 years has witnessed the impressive progress of GaN-based technology in various fields”, commented Dr Hong Lin, Technology & Market Analyst at Yole Développement.

Specific to the laser diode market, the Blu-ray segment, which in the past was the GaN-based laser industry’s main driver, continues to decline. In recent years, a much greater percentage of movies were viewed via streaming than on optical discs, and in many cases flash memory is replacing optical discs and magnetic storage. The current crop of mobile phones, netbooks, tablets, and even laptops lack a Blu-ray/DVD/CD drive. UHD Blu-ray’s recent development is expected to have only a novelty effect on sales - not enough to reverse the general downward trend identified in the coming years. However, decreasing Blu-ray demand is expected to be offset by nascent, growing segments like projectors including office projector, mobile pico projector, HUD , etc… And automotive lighting, leading to new growth opportunities for bulk GaN substrates.

In the LED market, improvements in GaN substrate manufacturing have lowered substrate prices enough for various niche LED applications. In addition to Soraa (US) and Panasonic (JP), this seems to have revived the interest of other LED manufacturers which are beginning to seriously consider using GaN substrates for either spotlighting or automotive lighting. New GaN-on-GaN LED players are expected in the market in the coming years.

In this context, Yole’s analysts expect laser diodes and LEDs to drive continuous growth of bulk GaN substrate demand.

In 2016 the bulk GaN substrate market was estimated at about 60K wafers (Two Inch Equivalent (TIE)). “Essentially all commercial GaN wafers are produced by HVPE technology, but details of the growth process and separation techniques vary by company,” asserted Dr Lin from Yole. Other techniques, such as Na-flux or Ammonothermal, are still under development. “At Yole, we still do not see large volume of these wafers on the market”, confirmed Dr Lin. And the market is expected to grow at a ten percent CAGR between 2017 and 2022 to reach more than $100m in 2022.

What about the Japanese players? The current GaN substrate market is heavily concentrated. More than 85% share is held by three Japanese firms: Sumitomo Electric Industries (SEI), Mitsubishi Chemical Corporation (MCC) and Sciocs. The Japanese companies are clearly dominating the bulk GaN substrate market, confirms Yole in its Bulk GaN report. However other Japanese and non-Japanese players are still in small-volume production or at the R&D stage: it is too early today for them to challenge these market leaders.

Yole’s Bulk GaN report provides a complete summary of GaN laser diode and GaN-on-GaN market data, including Blu-ray, laser office projectors, pico-projectors, HUD, automotive lighting, and more. It also conveys a detailed analysis of GaN-on-GaN power and RF applications. This analysis outlines Yole’s understanding of the market’s current dynamics and future evolution, covering technical and economic aspects.