The sapphire industry: back to the future

“The sapphire industry is still plagued by overcapacity and rapid price declines,” asserts Yole Développement (Yole) in its latest report Sapphire Applications and Market 2016: LED and Consumer Electronics. Demand for LED is increasing but will not provide enough volumes to sustain the close to one hundred sapphire makers competing in the market.

Yole estimates that up to 30 companies have stopped sapphire-related activities over the last 18 months. The most prominent were OCI, DK-Aztek, HQC, Shangcheng etc. Many more have frozen most of their capacity and China counts dozens of “zombie” companies only alive by political will.

This autumn is showing a new interest for sapphire and its numerous applications. Under this context, the “More than Moore” market research and strategy consulting company presents its latest report entitled Sapphire Applications & Market 2016: LED & Consumer Electronics report.

Moreover, in collaboration with CIOE, Yole also announces the Sapphire Forum, 2nd edition: 2nd International Forum on Sapphire Market & Technologies, taking place in Shenzhen, China, on September 6th and 7th.

Is there still a future for sapphire display covers? How much can LED demand sustain the industry? Is China going to completely dominate this industry? Save the date and learn more about the sapphire industry with Yole’s analysts.

“Capacity increased again over the last 12 months, although the pace is abating, thanks to a reduction in the number of new projects and significant attrition,” explains Dr Eric Virey, Senior Market and Technology Analyst, LED and Sapphire at Yole. And he adds: “But continuous excess supply combined with the significant drop in LED wafer demand in Q3 and Q4-2015 led to an acceleration of ASP decrease over the last 12 months. Prices for cores and wafers have dropped 50 to 70% over the last 2 years. Four inch wafers have been hard hit and 2” cores now sell for no profits, as a fall-off of 4 and 6” manufacturing and for the sole purpose of absorbing fixed cost.”

The 2” core market is disappearing as the LED industry transitions to larger diameters and optical wafers are now a captive market. Suppliers need to find new applications for the parts of the boules that are left over after extracting 4 or 6” cores. For now, those are often sold by the kg at low prices for the manufacturing of small optical and mechanical parts.

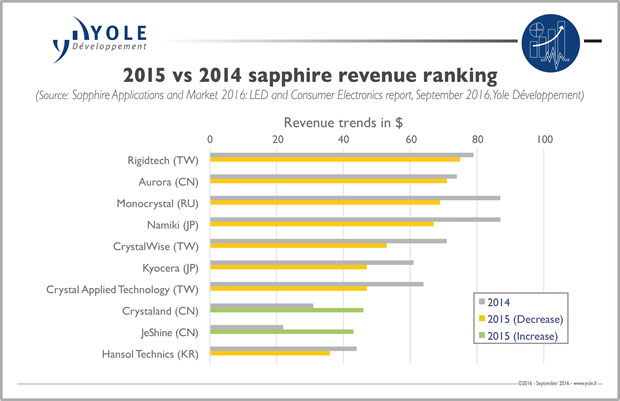

With strong price pressure and an increasing fraction of the market being captive, revenue of sapphire companies have dropped 20% in 2015 despite a volume increase of 20% across all applications.

Unless strong signals emerge soon to indicate that the display cover opportunity could finally materialise in 2017, many more companies will disappear within the next 12-18 months. While this situation is critical for many players, on the longer term, the market will finally be weeded out of its weakest players. The survivors could emerge stronger and the overall industry healthier. “Despite a slight reshuffle in the ranking, the top 5 companies by revenue in 2015 remained the same as in 2014. But 2 newcomers from China, TDG and JeShine appeared in the top 20,” asserts Eric Virey from Yole.

On the way to industry maturity, new applications such as µLED displays could emerge. While they won’t represent an opportunity of the same scale as display covers, they could offer nice upsides to the companies that can capture them.