Illuminating the automotive lighting industry

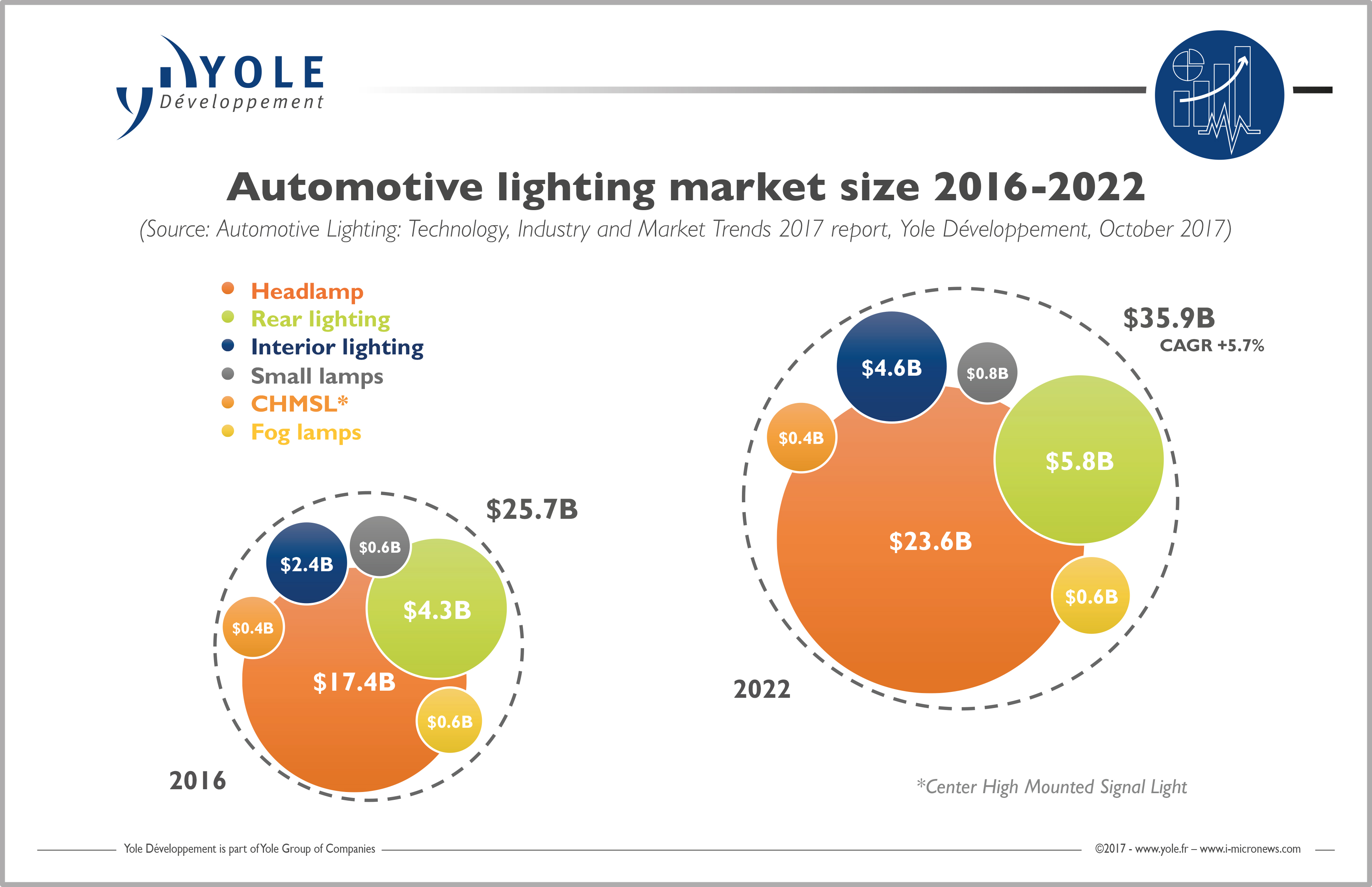

According to Yole Développement (Yole), the automotive lighting market totalled $25.7bn in 2016 and is expected to reach $35.9bn in 2022, with a 5.7% CAGR between 2016 and 2022. In 2017, Yole estimates that the market should be close to $27.7bn. This growth is driven by natural LED cost erosion, increasing the LED penetration rate. Standardisation of LED modules and their optimisation are key factors behind decreasing costs. This has resulted in more vehicles equipped with LED technology.

The market research and strategy consulting company Yole proposes a detailed analysis of the automotive lighting industry: Automotive Lighting: Technology, Industry and Market Trends 2017. This new report presents all automotive lighting applications and associated market revenue between 2013 and 2022. Yole’s analysts detail the integration status of different lighting technologies and systems, technical trends, market evolution and market size by application.

The automotive lighting is facing to an unexpected fast growth combined with technology revolution that will reshape the industry.

Since the first full LED headlamp was introduced in 2007, LED technology has gradually penetrated headlamp design. LED technology has allowed lighting to become a distinctive feature and enabled innovative functions like the glare free adaptive high beam introduced in 2013. LED technology use had been limited to high-end vehicles and has had to compete with traditional light sources, namely halogen and high-intensity discharge (HID/Xenon). Improved LED performance, lower power consumption and flexible design were the first enablers. Then, cost reductions helped LED technology spread to all vehicle categories.

Automotive lighting is driven by exterior lighting and especially headlamps, generating more than two-thirds of the total market revenue. Rear lighting is the second largest area, representing 17% of total market revenue. Interior lighting represents almost ten percent of revenue but growth is expected to be linked to the development of autonomous vehicles and the creation of vehicles as 'living homes'. Other types of lighting, such as fog lamps, CHMSL or small lamps, comprised the remaining seven percent of revenue in 2016.

“More than 100 million vehicles will be sold in 2022, but this has only a limited impact on the lighting market,” commented Pierrick Boulay, Technology & Market Analyst at Yole. He added: “The main reason for lighting growth is that the penetration of LED technology is spreading from high-end cars to mid-range and low-end cars. LED technology propagation and more generally SSL technologies will enable the development of new functionalities.”