Supply and demand beginning to realign quickly

It was around this time last year that Adam Fletcher, Chairman of the Electronic Components Supply Network (ecsn), predicted that supply and demand of electronic components in the global market would begin to realign at some point in 2H’22.

He did however suggest that he might be a calendar quarter or so out, and this now looks likely to be the case.

In this article Fletcher reviews the current situation and outlines his thoughts twelve months on.

Latest data published by numerous global sources strongly suggests that the global electronic components market supply and demand is progressing towards achieving ‘balance’ in Q4’22 and into Q1’23. However, manufacturer lead-times differ significantly by product group, so the outlook for many UK OEMs next year is far from clear.

Semiconductors

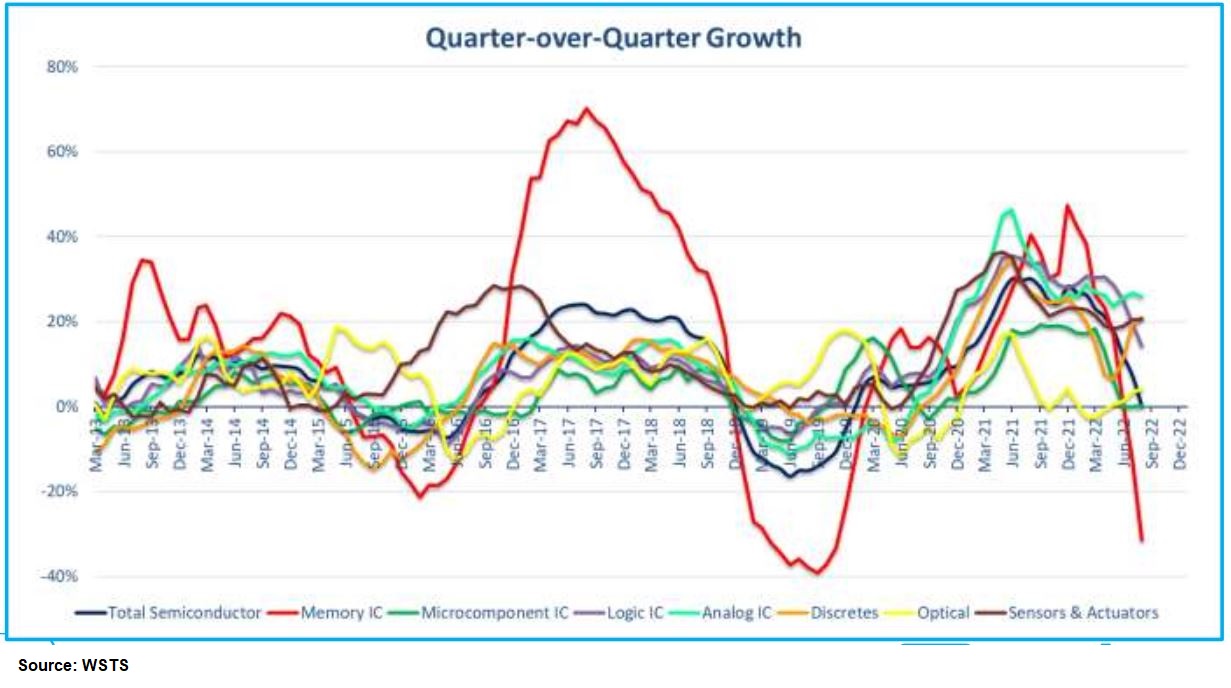

Semiconductor have been increasingly difficult to source over the last two years but at long last manufacturer lead-times for these components are rapidly declining. Availability of the majority of semiconductors seem set to ‘normalise’ to an average lead-time of 12-to-14 weeks by the end of Q1’23 but some ‘outlier’ devices will remain on significantly extended lead-times, probably until 2H’23. Availability of most device types is progressing in the same general direction, but careful analysis of the admittedly complex graphic from global industry trade body WSTS (World Semiconductor Trade Statistics) reveals important leading and lagging indicators.

It reveals that total semiconductor market growth (the blue line) slowed to 0% in Q3’22 when compared to the previous quarter, with analogue products (the light green line) leading growth. Memory products (the leading indicator shown by the red line) continued to decline (>32%) in the quarter whilst ‘other’ semiconductor products remained positive. It is very likely however that growth across the entire semiconductor product category will enter negative territory at some point in the next two quarters.

Passive components

The passive components and module markets are mirroring the overall trends in the semiconductor industry. The passive components market analyst, Paumanok IMR, recently revealed that capacitor manufacturer lead-times declined for the fifth successive month in September ’22 and in the opinion of the analyst, will continue to decline into Q4 ‘22. Here too a few specific case size multilayer ceramic capacitors (MLCC) are bucking the positive trend and remain ‘outliers’. In this unenviable position, MLCCs are also joined by a small number of aluminium and EDLC supercapacitors.

Modules

Reliable global module market data is not readily available due to market diversity but extrapolating the results reported for some major players in the US and Europe suggests that a similar pattern of declining lead-times and growth is also occurring in this sector, again with some ‘outliers’.

Interconnect and electro-mechanical components

Manufacturing lead times in the interconnect and electro-mechanical markets have been comparatively stable over the past two years but manufacturers of these products are now also reporting a decline in growth. The interconnect market analyst, Bishop Associates, recently revealed that the global interconnect market grew by 4.5% in August ’22 compared to the same month last year, and that they too now expect that both Bookings (new orders) and Billings (sales revenues) will continue to decline in Q4 ’22.

It's the economy stupid

For the past sixty years or so a generally healthy inter-dependence has existed among nations, aided by internationally respected non-governmental organisations with a proud record in helping to regulate activity and resolve disputes. When ideologies clash governments either seek to accommodate the needs of others in a bid to achieve their aims or construct barriers, a route that almost always leads to internal political conflict, heightened tension between nations and occasionally, to military action. Currently, citizens and commercial organisations are finding themselves impacted by a number of disrupters, including the Russian invasion of Ukraine, US/China trade war, Covid lockdowns in China, rapidly rising inflation, rising bank interest rates and spiralling energy costs, alongside exchange rate volatility and logistics delays. No surprise then that growth in the Global economy is slowing quickly, giving rise to fears that many economies may be about to enter a recessionary period (defined as two consecutive quarters of declining growth), primarily because of the global imbalance between the demand and supply of raw materials and of intermediate and finished goods, together with shortages in their service sectors as they emerged from the COVID-19 pandemic.

Electronic components market sector review

The global electronic components market continues to be dominated by sales of mobile phone handsets and the roll-out of the 5G infrastructure, which in 2022 is surprisingly forecast to decline in the range (7%) to (8%). This situation was welcomed by the ‘automotive sector’ which saw it as an opportunity to replace their cancelled orders on suppliers but in many cases, they are still waiting for shipments of components crucial to production, particularly semiconductors. Pre-pandemic international car sales were on track to reach eighty million units by 2022 but total sales this year are only forecasted to reach around sixty-five million units, a huge miss, and a massive revenue loss. The critical ‘industrial market’ sector continues to post strong single digit growth that it looks likely to be maintained into the 1H’23, while the ‘military and avionics’ markets continues with modest growth, that for obvious reasons, now looks likely to increase.

Concluding thoughts

Although most of the supply issues in the electronic components supply network are beginning to be overcome, most partners in the global market are having to contend with many other macro-economic and geopolitical uncertainties. But electronic components supply is generally swinging back into balance and may hit oversupply, so it’s increasingly important that customer response remains nuanced, thoughtful, and carefully communicated. Organisations making abrupt changes will expose themselves and their supply network partners to substantially increased supply risks. Component manufacturers and manufacturer authorised distributors continue to work diligently to meet their customer needs. A tripartite collaboration between customers, component manufacturers and their authorised distributors in difficult times provides the best chance of achieving a ‘win-win’ result for all parties in the electronic components supply network and for the wider economy.