Semiconductor equipment sales forecast to reach $124B in 2025

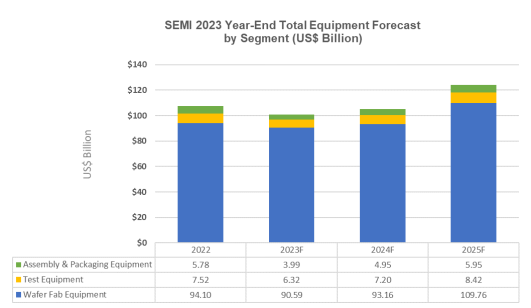

SEMI recently announced, at SEMICON Japan 2023, that global sales of total semiconductor manufacturing equipment by original equipment manufacturers are forecast to reach $100 billion in 2023, reflecting a contraction of 6.1% from the record $107.4 billion achieved in 2022.

This forecast was part of SEMI's Year-End Total Semiconductor Equipment Forecast – OEM Perspective. However, growth in the semiconductor manufacturing equipment sector is expected to resume in 2024, with sales projected to hit a new high of $124 billion in 2025, driven by expansions in both the front-end and back-end segments.

Ajit Manocha, SEMI President and CEO, commented: “We anticipate a temporary contraction in 2023 due to the cyclical nature of the semiconductor market. 2024 will be a transition year. We then expect a strong rebound in 2025, driven by capacity expansion, new fab projects, and high demand for advanced technologies and solutions across the front-end and back-end segments.”

In terms of sales by segment, the wafer fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, is projected to decline by 3.7% to $90.6 billion in 2023. This is a marked improvement from the 18.8% decline initially forecast by SEMI. The upward revision is attributed largely to robust equipment spending in China. The segment is expected to experience modest growth of 3% in 2024 and a further 18% expansion in 2025, reaching nearly $110 billion, driven by new fab projects, capacity expansion, and technology migrations.

The back-end equipment segment, on the other hand, saw a decline that began in 2022 and is set to continue into 2023, influenced by challenging macroeconomic conditions and a softening in semiconductor demand. Semiconductor test equipment market sales are forecast to contract by 15.9% to $6.3 billion in 2023, with assembly and packaging equipment sales expected to drop by 31% to $4.0 billion. However, both segments are expected to rebound in 2024, with respective growth rates of 13.9% and 24.3%. This growth is anticipated to continue into 2025, with test equipment sales rising by 17% and assembly and packaging sales increasing by 20%.

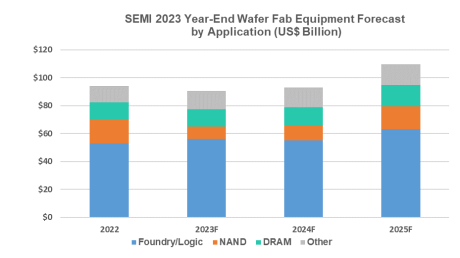

Regarding sales by application, equipment sales for foundry and logic applications, which account for over half of total wafer fab equipment revenue, are expected to increase by 6% to $56.3 billion in 2023, despite softer market conditions. In 2024, a contraction of 2% is forecast as mature technology expansion slows and leading-edge technology spending improves. By 2025, a 15% increase to $63.3 billion is anticipated, fuelled by greater capacity expansion purchases and the introduction of new device architectures.

Source: SEMI December 2023, Equipment Market Data Subscription

* Total equipment includes new wafer fab, test, and assembly and packaging. Total equipment excludes wafer manufacturing equipment. Totals may not add due to rounding.

Memory-related capital expenditures are set to see the most significant decline in 2023. NAND equipment sales are predicted to decrease by 49% to $8.8 billion in 2023 but are expected to surge by 21% to $10.7 billion in 2024 and rise a further 51% to $16.2 billion in 2025. Meanwhile, DRAM equipment sales are projected to grow by 1% and 3% in 2023 and 2024, respectively, with a 20% increase to $15.5 billion forecast for 2025, supported by ongoing technology migration and rising demand for high-bandwidth memory (HBM).

In terms of sales by region, China, Taiwan, and Korea are expected to remain the top three destinations for equipment spending through to 2025. China is projected to maintain its leading position, with equipment shipments to the region surpassing $30 billion in 2023. While equipment spending in most tracked regions is expected to decline in 2023 before resuming growth in 2024, China is predicted to see only a mild contraction in 2024 following heavy investments made in 2023.