Rolling off the throttle...

According to Adam Fletcher, Chairman of the Electronic Components Supply Network (ecsn), the pendulum of supply and demand in the electronic components market is beginning to swing back towards equilibrium.

But he cautions: “Customers must apply a lot of thought and careful planning to the realignment due to the current high levels of macro-economic and political uncertainty in international markets.”

In the UK, manufacturer authorised distributors of electronic components have always diligently managed the expectations, communication, and inventory on behalf of both the manufacturers they represent and the wide range of customers they support. I’m delighted to report that the supply situation for UK customers operating in what is loosely defined as the ‘Industrial/Medical’ sector – the largest segment of the UK electronic components market – has begun to ease and will continue to ease significantly for the rest of this year. The ‘Military and Avionics’ markets, which require specialised components with enhanced testing but in relatively low quantities, has always suffered from extended manufacturer lead-times. I expect manufacturer lead-time for these components to ease slightly in the short-term, but supply is likely to remain challenging into 2023 and beyond.

UK automotive sector

In the UK automotive sector, Tier 2/3 (sub-assembly manufacturers) customers rely on manufacturer authorised distributors for the electronic components they need, while Tier 1 customers (Ford, Nissan, Toyota etc.) are primarily supplied directly by the component manufacturers themselves. For all in the automotive sector the market for electronic components remains constrained but I expect it to ease somewhat in 2023. That said, the largely un-forecast growth in demand for electronic vehicles and the very specific semiconductors required in EV applications, particularly in power conversion control and monitoring, continues to be a significant concern and, as a result, supply of these components is likely to remain something of a headache until well into 2024.

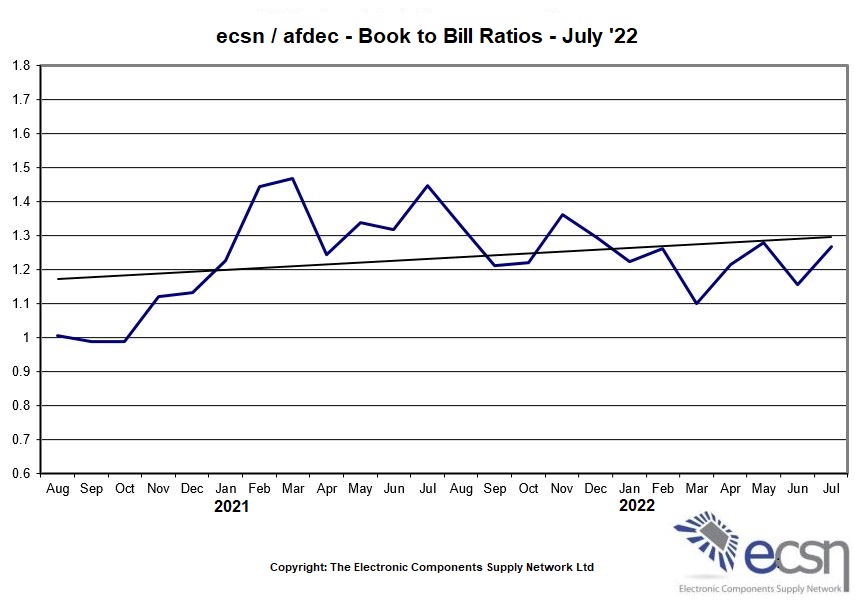

Let me share ecsn’s most recent performance stats with readers of Electronics Specifier: The chart ‘ecsn/afdec – Book to Bill Ratios – July ‘22’ plots the new orders received (Bookings) by ecsn’s manufacture authorised distributor (afdec) members, which when divided by their monthly sales revenues (Billings) arrives at the Book-to Bill (B2B) ratio. The B2B metric provides a very good indication of actual customer activity and of likely future growth. In a ‘normal’(?!) market I would expect the B2B ratio to hover around 1:1 to 1.1:1, indicative of a healthy market that’s set to grow around 6% to 8%. The polynomial trend line shows that over the period of August 2019 to July 2022 the B2B ratio has been between 1.2:1 and 1.3:1, indicating exponential growth that simply cannot be sustained. The B2B ratio will inevitably decline and may even go negative as manufacturer lead-times stretch out and customer backlogs are consumed.

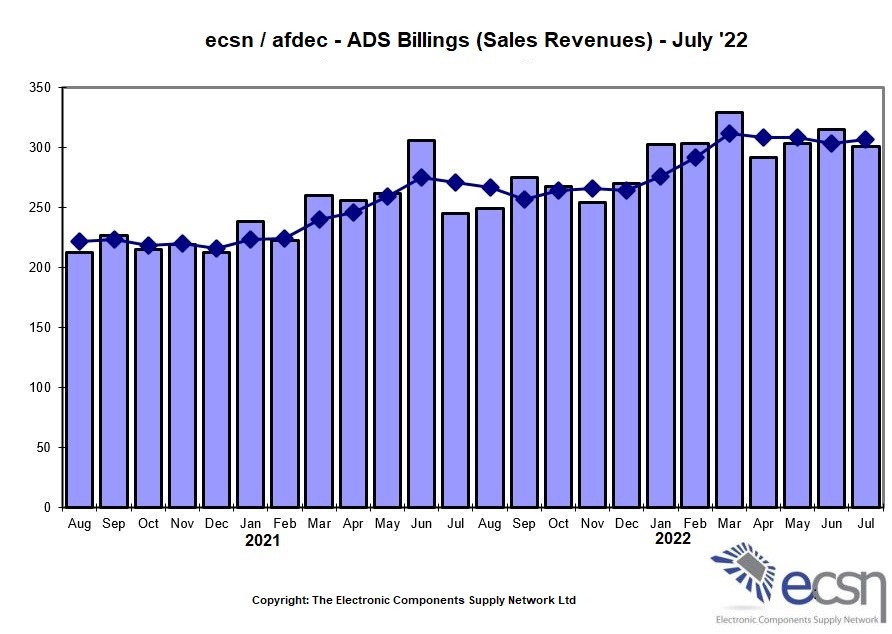

The chart ‘ecsn/afdec ADS Billings (Sales Revenues) – July ’22’ plots the monthly average daily sales across manufacturer authorised distributors in the UK and provides a very good snapshot of actual sales revenues achieved by manufacture authorised distributor in the UK market. Note that the market in 2021 grew by 17% over the previous year but in Q1 ’22 the sales revenue growth was 32% when compared to the same period in 2021, reflecting strong demand from UK customers and significantly outstripping our members’ forecast.

Concluding thoughts

Whilst the supply issues in the electronic components supply network are now beginning to be resolved, it’s important that the customer response is to ‘gently roll back the throttle’ and in collaboration with their supply network partners allow their orderbooks to come back into balance in a controlled way. Organisations ‘applying the brakes’ or making abrupt changes to their purchasing practises will expose themselves and their supply network partners to increased supply risks. Careful collaboration between customers, component manufacturers and their authorised distributors provides our best chance of achieving a ‘win-win’ result for all parties in the electronic components supply network and the wider economy.