Signify announces top-line growth in second quarter 2022

Lighting specialists, Signify, has announced the company’s second quarter 2022 results.

“In the second quarter, we continued to deliver top-line growth. This was driven by strong traction of the professional segment, which more than compensated headwinds from the lockdowns in China, the effect of the war in Ukraine on our Eastern European market, and a weaker consumer environment. This top-line increase – achieved despite a challenging comparison base – illustrates our improved profile for growth, fuelled by the continuing shift towards connected lighting. At the same time, currency movements and inflationary pressures affected our gross margin and adjusted EBITA, although the impact on the latter was partially compensated by cost management. We maintain our CSG guidance for the full year, given continued momentum in the professional segment and our solid order book. The challenging external environment has led us to revise our outlook for the adjusted EBITA margin. In addition, persistent supply chain disruption and long supplier lead times will impact our free cash flow performance,” said CEO Eric Rondolat.

“We are taking adaptive measures and expect margin headwinds to ease in the second half of the year. Cash flow generation will normalise once supplier lead times shorten. We remain firmly committed to investing in our business and driving our long-term growth objectives. Our extensive portfolio of sustainable and connected lighting solutions uniquely positions Signify to capture the heightened demand for energy efficient lighting.” Brighter Lives, Better World 2025

In the second quarter of the year, Signify was on track for three of its Brighter Lives, Better World 2025 sustainability programme commitments that contribute to doubling its positive impact on the environment and society.

- Double the pace of the Paris Agreement: Cumulative carbon reduction over the value chain is ahead of track. This is mainly driven by the sales of energy-efficient and connected LED lighting, which drive emissions reduction in the use phase.

- Double Circular revenues to 32%: Circular revenues increased to 31%, well on track for the 2025 target of 32%. This positive trend continues to be driven by the upgrade of luminaires to serviceable luminaires.

- Double Brighter lives revenues to 32%: Brighter lives revenues of 26% were off track, yet Signify remains confident that it will achieve the 2025 target of 32%.

- Double the percentage of women in leadership positions to 34%: The percentage of women in leadership positions was 27%, on track. This quarter, Signify continued to drive actions to achieve its 2025 commitment, including inclusive job posting and diverse hiring panels. In addition, Signify conducted training sessions together with Hult International Business School. These training sessions equip teams with the right tools to realise the company's diversity ambitions.

Outlook

Signify maintains its CSG guidance of 3-6% for the year, driven by continued momentum in the professional segment and its solid order book.

The company revises its Adjusted EBITA margin guidance for the full year to 11.0-11.4%, reflecting the lower margin performance in Q2 2022.

Signify also revises its 2022 free cash flow guidance to 5-7% of sales, including the proceeds from real estate divestments. Signify expects to return to the target of over 8% as soon as supplier lead times ease and no longer require the company to carry higher inventory.

Financial review

Second quarter

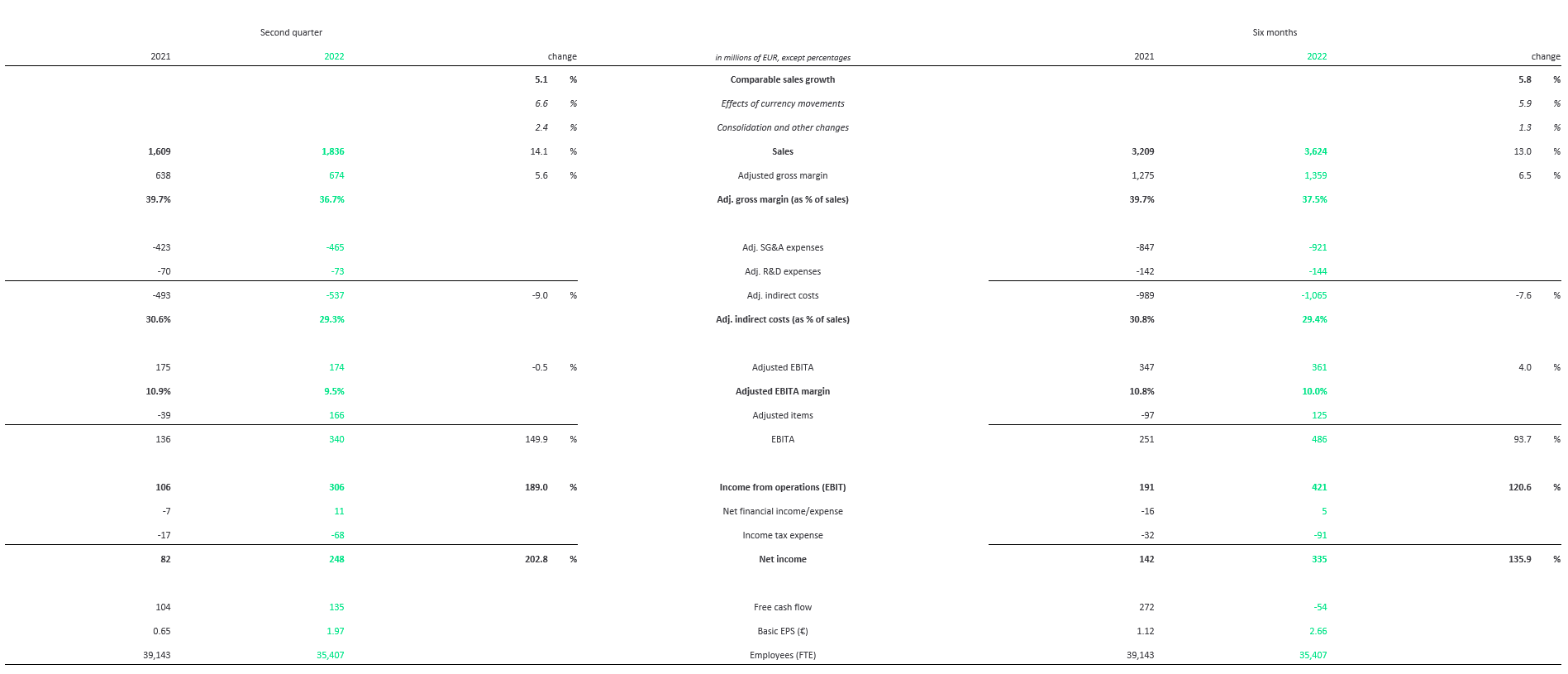

Sales increased by 14.1% to €1,836m, with a comparable sales growth of 5.1%, largely driven by continued strong professional demand across most markets except China, which was impacted by lockdowns during the quarter.

Nominal sales included a positive currency effect of 6.6%, mainly from the appreciation of the USD, and a positive contribution from the recently acquired Fluence and Pierlite businesses.

The Adjusted gross margin decreased from 39.7% to 36.7%. While continued price increases more than offset the input cost increases, Signify was not able to offset within the quarter the surge of energy costs, nor the negative impact from currency movements.

Adjusted indirect costs as a percentage of sales decreased by 130bps to 29.3%, driven by operating leverage and strengthened cost discipline in view of the pressure on gross margin.

Adjusted EBITA decreased slightly to €174m. The Adjusted EBITA margin decreased by 140bps to 9.5%, reflecting the lower gross margin, which was partly offset by operating leverage and indirect cost savings. Currency movements also had a negative effect of 110bps on the Adjusted EBITA margin.

Adjusted items of €166m include a €184m gain from the disposal of non-strategic real estate, while year-on-year restructuring and acquisition-related costs decreased from €22m to €12m. As a result, net income increased from €82m to €248m.

The number of employees (FTE) decreased from 39,143 to 35,407, reflecting the exceptionally high base in the previous year related to the strong volume recovery and additional staff requirements in factories, following the COVID-19 pandemic. The number of FTE can be affected by fluctuations in volume and seasonality.