Shortages weigh on industry buoyancy

“Water, water everywhere nor a drop to drink.” Distributors must know how the Ancient Mariner felt. They are buoyant on an ocean of orders; it’s sourcing the product to slake the thirst of their customers that’s the problem.

“Unbelievable,” was the first word from Anglia CEO Steve Rawlins’ lips. “It’s the best market I have seen in 45 years in distribution. Our order book is 57% up year-on-year and our forward orders are up 40% year-on-year.”

“Lead times are six months plus. Suppliers are cancelling orders we have put in, effectively quoting force majeure, all bets are off.”

“Demand from Asia is rocketing. They are trying to book orders through our Anglia Live website, and we are saying ‘No’,” said Rawlins. “We look after our UK and Ireland customers first and foremost.”

As Rawlins indicates the shortages problem is exacerbated by companies running down their inventory in the teeth of the COVID-19 pandemic last year. “It’s a pile on. Every market is converging on product to feed growth – automotive, consumer and 5G. It’s a component desert out there.”

“Happy, sad, stressed and stretched,” was Graham Maggs’ opening comment. The Vice President of Marketing and Business Development at Mouser continued: “I can’t say I’m sitting here enjoying it.”

The market turnaround has been rapid for Mouser. “Looking back at the first three quarters of 2020, we were about three to four percent down on 2019. A surge in the last quarter propelled us forward to end the year six to seven percent up on 2019,” explained Maggs. “It’s a different market, definitely. We are looking at longer lead times, allocation, price increases. Then Brexit concerns saw customers stock up ahead of the UK’s exit. What with COVID, US/China trade tensions and unseasonable February winter storm in Texas, wherever you looked there was uncertainty.”

Rob Rospedzihowski, President of EMEA Sales at Farnell has seen different dynamics in geographic regions. “Initially there was a V-shaped recovery in Asia/Pacific, a slower improvement in Europe and the US rebounded. Asia-Pacific has now been strong for the past four to five months, the US has been back since Christmas and Europe has been very strong in the first quarter of this year.”

“Some areas of Europe are still patchy,” he added. “Germany, Nordic and Eastern Europe have been the strongest markets. And there is growth in the UK, France and Italy.”

This growth could be maintained throughout the year. Rospedzihowski questioned whether Europe will close down for the traditional August summer holiday following factory closures through the pandemic. “There could be an unusual summer cycle with companies keeping plants open through August,” he argued. “Especially as it is difficult to travel for holidays.”

At Solid State Supplies, preparations to alleviate allocation started nine months ago. “We increased our inventory by 25%,” said Managing Director John Macmichael. “There is double ordering going on,” he warned. “We can look after our key customers up to September.”

He noted that most of Solid State’s key customers took COVID-19 and the ensuing allocation problems seriously. “Unfortunately, there is a tail of people with no experience of these market conditions and they have not reacted fast enough.”

Double and even triple ordering is the distributors’, and come to that, a supplier’s nightmare.

Anglia has software that seeks any unusual ordering patterns that might indicate double ordering. “If a company suddenly orders four times more product than in the past we can pick that up,” explained Steve Rawlins.

Avnet CEO Phil Gallagher is also on guard. He told analysts recently: “We do watch the Materials Resource Planning (MRP) for inflated demand. We get a customer that comes in and is using 100 pieces a week. And all of a sudden, they want 300 or 400 a week. We try to catch that and go back and reverify - that is true demand. I'm not feeling that at this point in time. Our cancellation rates, push outs, and all that we look at are pretty consistent right now in that 25-30% range, which is for those that aren’t aware that that’s normal. It’s the buffering, the shock absorber we take care of for our customers and our suppliers as we always sit in at the centre of technology.”

Distributors will have to stay on alert for the foreseeable future. Remarked Graham Maggs: “The standard six to eight weeks doesn’t even apply for slow-moving parts, or in markets where demand for components is low.”

Passive components lead times can be anything from 14 to 53 weeks, and the wait for microcontrollers can be up to six months. “MOSFET lead times are also lengthening,” said Maggs.

With $815m worth of inventory, Maggs believes Mouser is well placed to ride out the market fluctuations. “We have product available to ship, that’s inventory on the shelf not allocated to a specific customer.”

Solid State’s John Macmichael noted: “It’s not just microcontrollers and passives, we are seeing Bluetooth, WiFi devices and other components used in communications all in shorter supply.”

To bring some order to the market, suppliers are introducing no cancellation, no refund (NCNR) clauses in their terms and conditions.

Maggs endorsed these initiatives: “It’s transparent and cuts out the double and triple-ordering merchants.”

Added John Macmichael: “It’s being honest to the market. It doesn’t guarantee product, but it does bag a place at the front of the queue when product is available.”

As might be expected in step with demand, pricing is on the rise: “Anything from five percent to 25%,” said Macmichael. “It’s just a fact of allocation, supply and demand.”

Alongside informing customers that their products may not arrive at the time expected, the price rises also make for difficult customer conversations.

“We are having to tell customers that prices are going up on orders already placed,” attested Anglia’s Rawlins. “Most are understanding.”

Rob Rospedzihowski confirmed the 25% price increases. Where possible Farnell has absorbed some costs, some have had to be passed on to customers.

At Mouser, Maggs indicated a similar approach. “Some small increases we will absorb. Bigger increases on some products we will have to pass on.”

Talking to analysts, Avnet CEO Gallagher commented: “As far as the pricing, that’s been pretty, pretty public out there for many suppliers. We won’t comment on any one supplier. But yeah, we are definitely seeing some pricing increases in - whether it be shipping debit or just commodity costs. And we do have processes in place to go and work to pass that onto our customers.

Sometimes that's difficult based on the contract we have, and we need to do some further negotiation… we certainly can’t be the shock absorber to pick up the pricing increases. We then work with the customer to explain that.”

Another issue for distributors is logistics. “We’ve seen an increase in freight costs,” confirmed Rospedzihowski. “There is reduced availability of air freight, and shipping by sea takes longer. Charges are on the up.”

Both Mouser’s Maggs and Anglia’s Rawlins have concerns about getting product to customers. “Couriers are struggling to meet demand,” added Maggs.

Rawlins cites Brexit paperwork headaches too. “We have a system that informs us on the number of documents and invoices required for a shipment. Even then we had product turned back because we attached one document outside the packaging instead of inside. In the main though incoming isn’t the problem. FedEx have been excellent, other couriers are struggling both with paperwork and a shortage of drivers. Some customers have sent couriers here to collect their orders.”

“Farnell has encountered similar problems. UPS and FedEx have encountered some problems due to new documentation following Brexit, and a shortage of drivers.”

Pleasantly surprised that Brexit has had little impact so far is Farnell’s view. “There are pockets of problems in Eastern Europe where documents are interpreted differently - in Western Europe the process has been much smoother,” said Rospedzihowski.

Industry body DMASS which charts the semiconductor market in Europe is more positive about prospects.

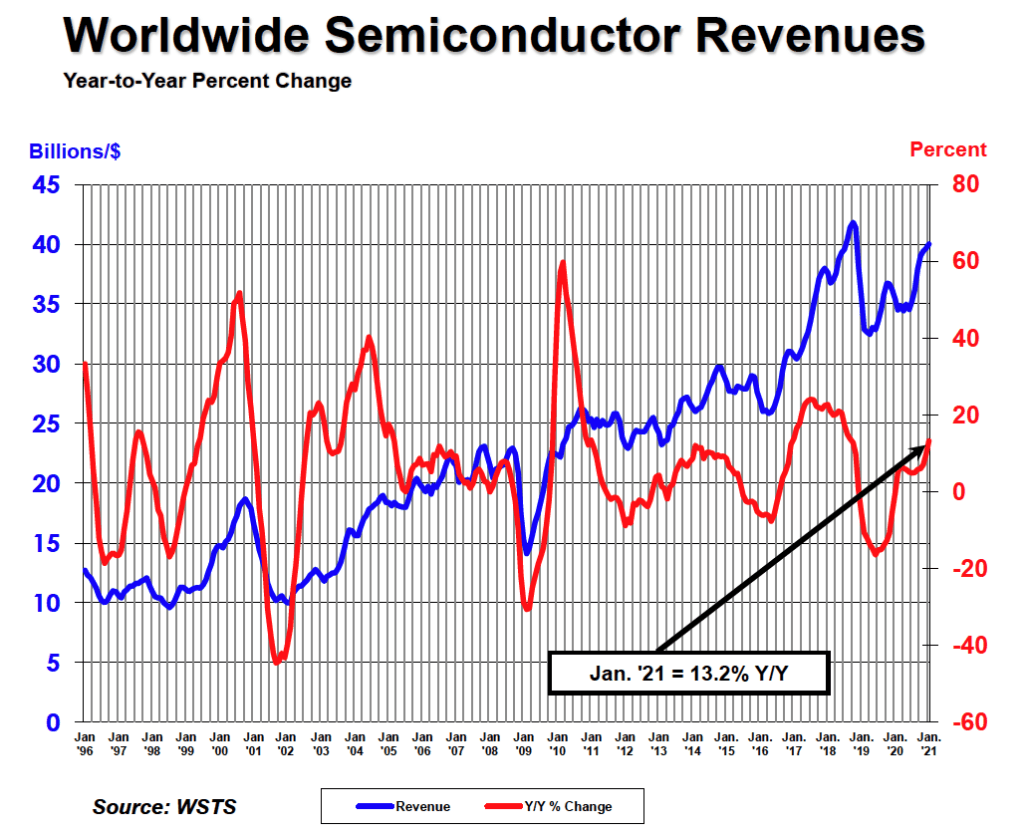

DMASS chairman Georg Steinberger added: “As with the overall market, 2020 was a year of significant double-digit decline for distribution. However, we see that bookings are strong and demand is returning, with some likelihood of shortages through the first part of the year. Interestingly, the current discussion about dependency on Asia with regards to component supply, is like groundhog day.

“For years if not decades, Europe’s focus on industrial and automotive led to an effect that leading-edge semiconductor production in Asia may not be centred around European needs. We became sub-strategic a long time ago. The positive news for distribution is that we are the best aggregator for demands of all colours and varieties and therefore the best option for European customers.