Sensor price erosion slows total O-S-D growth

The worldwide O-S-D (Optoelectronics; Sensors and actuators; and Discrete semiconductors) market has turned into a mixed bag of double-digit growth for several major product categories (lamp devices, infrared circuits and CMOS image sensors) combined with single-digit declines in sales for nearly a dozen other categories (including most sensors, diodes, rectifiers and power transistors).

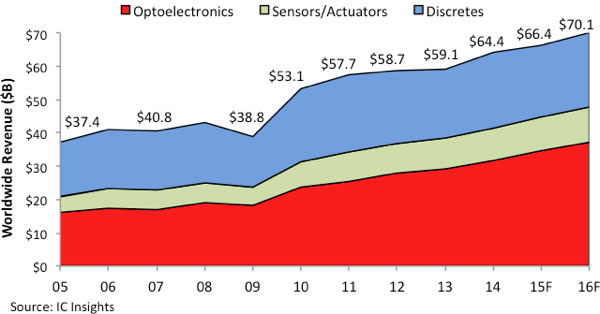

Combined revenues for O-S-D products are expected to grow 3% in 2015 to a new record-high $66.4bn from the current peak of $64.4bn set in 2014, when sales increased by 9% (see figure below). With IC sales on track to decline by 1% this year, the marketshare of O-S-D products is projected to reach nearly 19% of total semiconductor revenues in 2015, which are now expected to drop by less than a half percent to $354.1bn.

O-S-D segments lift combined sales higher

IC Insights expects growth in the sensor/actuator market segment to slightly strengthen in 2016 with revenues projected to rise 4% to $10.5bn after increasing just 2% in 2015 to $10.1bn due to significant price erosion in many sensor product categories. The commodity-filled discretes segment is expected to recover and grow 3% in 2016 to $22.2bn after being knocked down 6% in 2015 to $21.5bn because of a slowdown in equipment manufacturing and weakness in the global economy during the second half of this year.

Optoelectronics is expected to continue to be the strongest growing segment in the O-S-D marketplace during the second half of this decade, primarily because of increasing demand for CMOS image sensors in a wide range of embedded applications (such as automotive, medical, video-surveillance networks and image recognition systems) along with the spread of solid-state lighting products built with high-brightness LEDs and the need for more laser transmitters in high-speed optical communication networks.

The other two O-S-D segments (sensors/actuators and discretes) have struggled to maintain consistent growth after rebounding in 2014 from slumps in 2012 and 2013. Discretes semiconductor sales continue to be whipsawed by volatility in product purchases, which have quickly switched on or off depending upon changes in the economic outlook or end-use market demand. Power transistors, which account for more than half of discrete sales, have also seen tremendous swings in demand since 2010.