Semiconductor marketshares surged over past ten years

As 2019 gets underway, IC Insights is in the process of completing its forecast and analysis of the IC industry and will present its new findings in The McClean Report 2019, which will be published later this month. Among the semiconductor industry data included in the new 400+ page report is an analysis of the top-50 semiconductor suppliers.

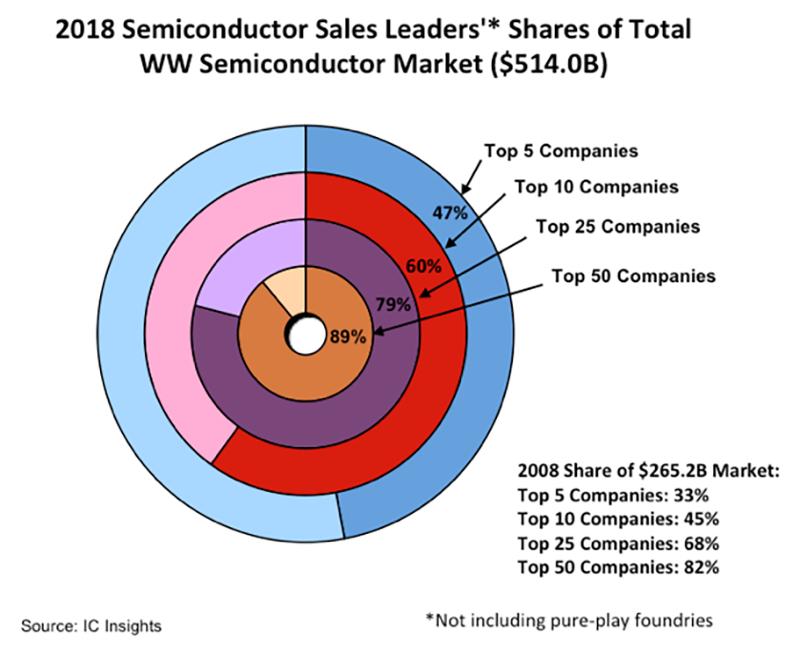

Research included in the new McClean Report shows that the world’s leading semiconductor suppliers significantly increased their marketshare over the past decade. The top five semiconductor suppliers accounted for 47% of the world’s semiconductor sales in 2018, an increase of 14% points from ten years earlier. In total, the 2018 top 50 suppliers represented 89% of the total $514.0bn worldwide semiconductor market last year, up seven percentage points from the 82% share the top 50 companies held in 2008.

As shown, the top five, top ten, and top 25 companies’ share of the 2018 worldwide semiconductor market increased 14, 15, and 11% points, respectively, as compared to ten years earlier in 2008. With additional mergers and acquisitions expected over the next few years, IC Insights believes that the consolidation could raise the shares of the top suppliers to even loftier levels.

There was a wide 66% point range of year-over-year growth rates among the top 50 semiconductor suppliers last year, from +56% for Nanya to -10% for Fujitsu. Nanya rode a surge of demand for its DRAM devices to post its great full-year results. However, evidence of a cool down in the memory market last year was evident in the company’s quarterly sales results, which saw its sales drop from $826m in 2Q18 to $550m in 4Q18 (a 33% plunge).

Overall, four of the top seven growth companies last year (Nanya, SK Hynix, Micron, and Samsung) were major memory suppliers. Although Nanya registered the highest percentage increase, Samsung had the largest dollar volume semiconductor sales increase, a whopping one-year jump of $17.0bn!

In total, only nine of the top 50 companies registered better growth as compared to the 2018 worldwide semiconductor market increase of 16%, with five companies logging increases of ≥30%. In contrast, only three of the top 50 semiconductor companies logged a decline in sales last year, with Fujitsu being the only company to register a double-digit sales drop.