Report analyses cheap oil impact on IC market growth

The current price trend for oil gives credible upside potential to IC Insights’ current expectations for worldwide GDP and semiconductor market growth, say the company. As part of its release of the McClean Report 2015, IC Insights will present its McClean Report seminars on 20th, 22nd and 29th January that discuss its IC market analyses and forecasts through 2019.

IC Insights states that it has always believed that a semiconductor market forecast is essentially useless unless one knows the assumptions behind it. One way that IC Insights attempts to separate itself from other research organisations is by always including a detailed analysis of the assumptions behind its semiconductor market forecasts.

This is done with the aim of allowing clients to fully understand the forecast and make their own assessment of whether they believe the forecast looks good or, in their opinion, is too low or too high. Many of IC Insights’ clients have asked about our forecast methodology and what ‘model’ is used. IC says it has always focused on the various inputs and crosschecks that go into creating forecasts, and how it is not a model in the truest sense of inputting data into a formula and having the market forecast percentage figure come out at the end.

The image above describes the basic components that comprise IC Insights’ forecast methodology. IC describes its methodology as a ‘Top-Down/Bottom-Up/Cycle/Experience/Crosscheck’ model. One of the important inputs into IC Insights’ model is the worldwide GDP forecast, and a very important part of that input is oil prices.

Historically, there has been a good correlation between oil prices ($/barrel) and worldwide GDP growth, with lower prices correlating to stronger future growth. The average price per barrel of oil declined 31% in 2009 as compared to 2008, and the price of oil transitioned from being a ‘headwind’ on the fortunes of the worldwide economy to a ‘tailwind.’ Partially driven by lower oil prices, 2010 worldwide GDP registered a very strong 4.1% increase. Given the current forecast for the price of oil in 2015, IC Insights expects oil prices to once again be a ‘tailwind’ for worldwide GDP growth.

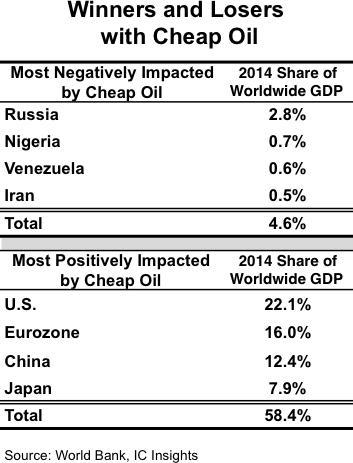

The steep drop in the price of oil in the second half of 2014 took many oil producing countries and companies by surprise. Although countries such as Russia, Nigeria, Venezuela, and Iran will likely face severe economic distress from slumping oil prices, these countries’ impact on worldwide GDP is very small, as shown in the table below. However, the countries and regions that will benefit most from low oil prices, namely the U.S.A., the Eurozone, China, and Japan, represented over 58% of worldwide GDP in 2014. Thus, when looking at the ‘big picture,’ low oil prices, in the long run, have always had a positive influence on worldwide GDP growth.

IC Insights' depiction of the countries and regions which suffer and benefit from low oil prices, and their respective shares of worldwide GDP.