Netflix killed the physical video market

Just as video killed the radio star before it, Netflix availability is causing a decrease in spending on buying and renting movies and TV series on disc. IHS has announced key findings from its report measuring spend on movies and TV shows: Did Netflix Kill the Physical Video Market? The report found that there is a clear correlation between the regional launch of Netflix and a decline in video spending, as well as that spending on Netflix does not completely make up for the loss in physical spending.

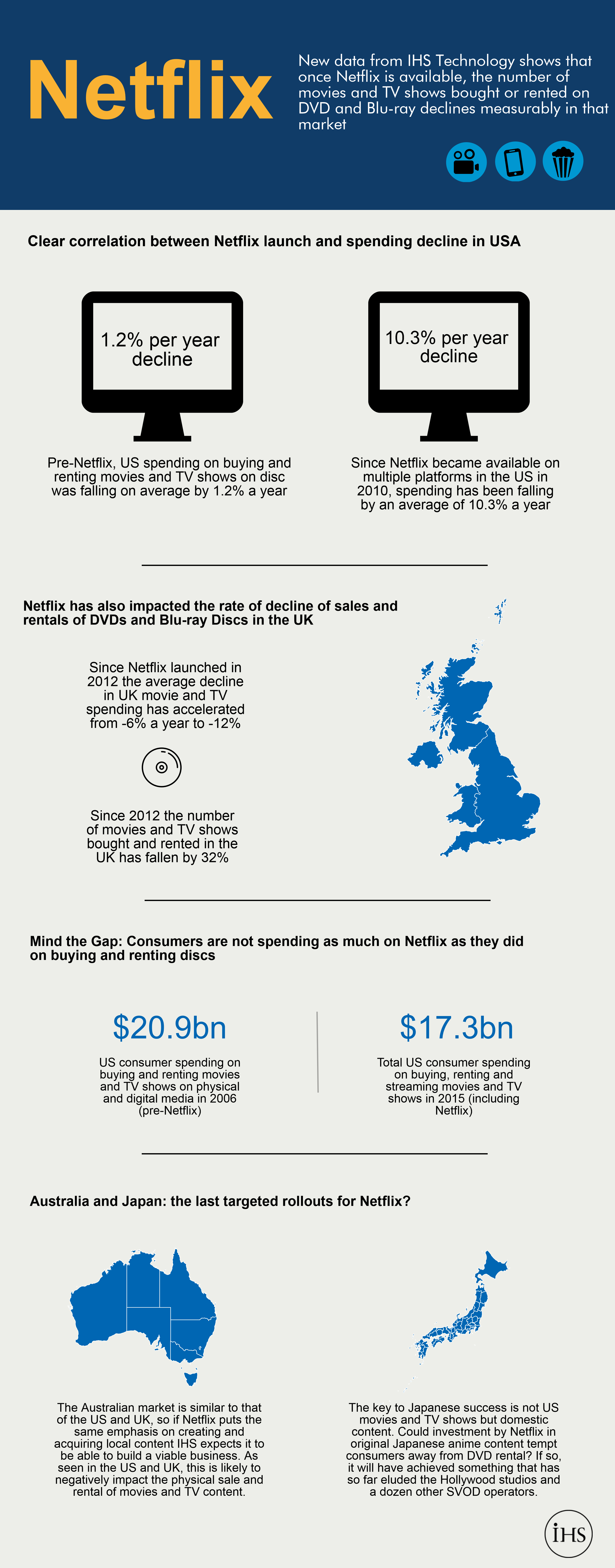

USA spend declines

Before Netflix launched its streaming service in the USA in 2007, spending on buying and renting movies and TV series on disc was falling by an average of 1.2% a year. Since 2010, the year in which Netflix access became ubiquitous across the US consumer electronics sector, spending has fallen by an average of 10.3% a year.

Helen Davis Jayalath, Senior Researcher, IHS Technology, commented: “The data shows that Netflix’s entry into a market has a noticeable effect on consumer behaviour, even in countries where they already had access to other streaming video services. Movies and TV shows are not only the biggest draw for Netflix subscribers, they are also the backbone of the home entertainment industry, generating 80-90% of the business in most countries.”

UK

In the UK, sales of movies on disc have more than halved since the first SVOD services launched in 2008, with the steepest annual decline (-14.5%) experienced in 2012, the year Netflix launched. The downturn in sales and rentals of TV series, traditionally an important genre in the UK market, has been even more significant. Not only have sales of box sets and other TV programmes on disc been falling by over 14% a year since 2012, but rentals of TV shows are down by almost 75%.

Mind the gap: Spending on Netflix does not make up the difference

“The year before Netflix launched its streaming service in the USA, consumers spent $20.9bn buying and renting movies and TV content, the most ever recorded. But by last year, total spending on these two key genres, including via transactional and subscription VOD services, was down by 17% to $17.3bn,” said Davis Jayalath.

In the UK, Netflix’s arrival in 2012 was pre-empted by Amazon’s 2008 investment in (and subsequent acquisition of) local SVOD service LoveFilm, which was already taking its toll on physical video spending.

Davis Jayalath added: “British consumers have taken Netflix and SVOD to their hearts. Last year, they spent £1.8bn on buying and renting movies and TV content, more than 26% of which was generated by SVOD services.”

Despite this, total spending is still £82m a year less than it was before Netflix launched and down over 20% (£474m) since Amazon’s investment in LoveFilm effectively kick-started SVOD in the UK.

Australia and Japan: the last targeted rollouts?

The Australian market is similar to that of the US and the UK, so if Netflix puts the same emphasis on creating and acquiring local content, IHS expects it to be able to build a viable business. As seen in the US and UK, this is likely to negatively impact the physical sale and rental of movies and TV content.

“The key to success in Japan, however, is not US movies and TV shows, but domestic content,” stated Davis Jayalath. “If Netflix can invest enough in original Japanese anime content to tempt consumers away from DVD rental it will have achieved something that has so far eluded not only the Hollywood studios but also a dozen other SVOD operators.”