Microprocessor slump snaps nine years of record sales

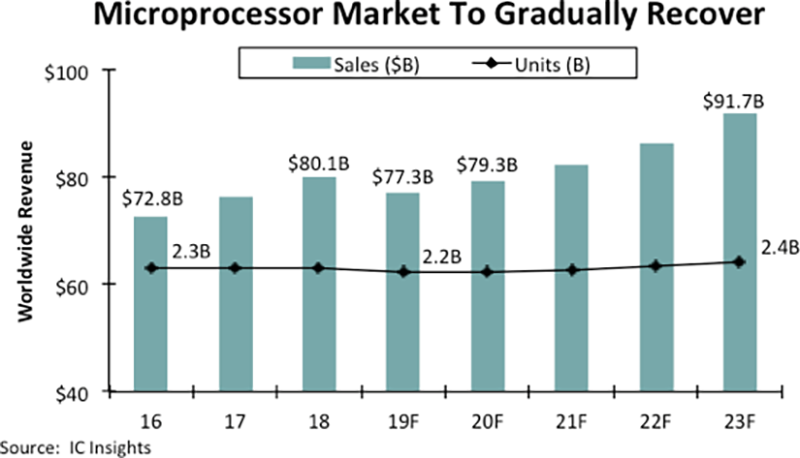

The microprocessor market’s string of nine straight record-high annual sales between 2010 and 2018 is expected to end this year with worldwide MPU revenue dropping four percent to about $77.3bn because of weakness in smartphone shipments, excess inventories in data centre computers, and the global fallout from the US-China trade war, according to IC Insights.

Microprocessor sales are expected to stage a modest rebound in 2020, growing 2.7% to $79.3bn and then are forecast to reach a new record-high level of about $82.3bn in 2021, based on IC Insights’ outlook for MPUs in the ‘Mid-Year Update’ to the ‘2019 McClean Report’.

The Mid-Year Update projection pulls in the previously expected 2020 slowdown in MPU sales to this year and deepens the decline compared to the 2019 McClean Report’s original January forecast, which showed a 3.9% increase in microprocessor sales in 2019 followed by a negligible decrease of 0.1% in 2020.

Total MPU revenue is now expected to increase by a compound annual growth rate (CAGR) of 2.7% between 2018 and 2023, reaching $91.7bn in the final year of the forecast. Total microprocessor shipments are projected to rise by a CAGR of just 1.0% in the forecast period to reach 2.4 billion units in 2023.

About 29% of microprocessor dollar-sales volume in 2019 is expected to come from cellphone application processors ($22.2bn) and three percent from similar mobile MPUs in tablet computers ($2.5bn). Nearly 52% of total MPU revenue in 2019 is forecast to come from central microprocessors used in notebook and desktop PCs, ‘thin-client’ Internet/cloud-computing systems, servers, mainframes and supercomputers ($39.8bn).

Nearly all of the central-processing unit MPUs in computers are based on the x86-based designs sold by Intel and rival Advanced Micro Devices and just one percent of the sales total having RISC architectures, such as those licensed by SoftBank’s ARM subsidiary in the U.K.

About 17% of total MPU sales in 2019 are now expected to come from embedded-processing applications ($12.9bn), according to the ‘Mid-Year Update’ of the ‘2019 McClean Report’. Embedded MPUs continue to be a bright spot in the market with sales forecast to grow ten percent in 2019 from $11.7bn in 2018, when these processors represented about 15% of total microprocessor revenue.

Embedded processor sales are being driven by increased connection to the Internet of Things (IoT), growing automation and artificial intelligence in systems, and the spread of sensors in cars, industrial equipment, consumer products, and other end-use applications.