MEMS sensor market to bounce back, says IC Insights

According to the '2014 O-S-D Report - A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes' from IC Insights, multi-sensor platforms, wearable systems, and the rush to connect things to the Internet are reigniting MEMS sensor sales once again.

For much of the last decade, microelectromechanical systems (MEMS) technology spread quickly into high-volume electronic products, accounting for 70% of today’s semiconductor sensor sales, but MEMS has suffered growing pains in the last two years with total device sales declining 1% in 2012 and being flat in 2013 at $7.0bn (USD). Price erosion in MEMS-based sensors - especially accelerometers and gyroscope devices used in smartphones and other portable products - along with slower unit growth have caused this segment to languish.

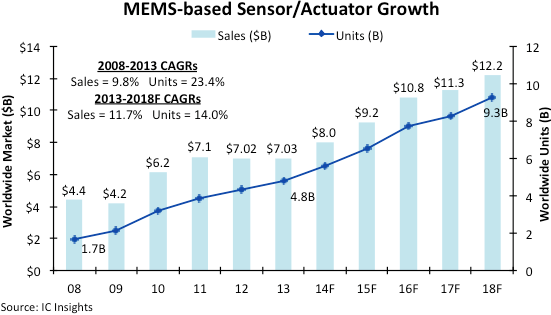

Total MEMS-based semiconductor sales - sensors and actuators - are forecast to grow 14% in 2014 to reach a new record-high of $8.0bn (USD), surpassing the current annual peak of $7.1bn (USD) set in 2011, says the 350 page O-S-D Report. The 2014 report shows MEMS-based sensor and actuator sales climbing 16% in 2015 to $9.2bn (USD) (see Figure 1).

Between 2013 and 2018, MEMS sensor and actuator sales are projected to rise by a compound annual growth rate (CAGR) of 11.7% reaching $12.2bn (USD) in five years compared to a CAGR of 9.8% in the 2008-2013 period. Unit shipments of MEMS semiconductors are expected to grow by a CAGR of 14.0% in the forecast period, going from 4.8bn devices in 2013 to 9.3bn in 2018. In the 2008-2013 period, MEMS-based semiconductor unit growth surged by a CAGR of 23%. This growth was driven by the introduction of accelerometers and gyro sensors into smartphone handsets for intelligent control and motion-sensing applications for navigation and a range of new uses, such as activity tracking, health monitoring and hand-gesture interfaces.

Figure 1

Growth rates in the large-but-fragmented actuators category has restricted overall sales in MEMS semiconductors in the last 10 years, but sensors have been more consistent in climbing higher. For instance, MEMS sensor sales grew by a CAGR of 19.2% between 2008 and 2013 to $3.8bn (USD), while actuator revenues rose by an annual average of just 2.8% in the five-year period to $3.3bn (USD) last year. In the 2013-2018 forecast period, both MEMS sensor and actuator sales are expected to rise by a CAGR of about 12%. IC Insights expects actuator sales to strengthen and become less volatile as more devices move into high-volume systems and new application concepts finally taking off in the commercial market - such as inexpensive disposable lab-on-chip devices for low-cost drug development, DNA analysis, and infectious disease identification.

The challenge for MEMS sensors will be coming off extremely high growth rates in the past five years, which were mostly concentrated in a few major applications, such as smartphones and interactive video games, along with steady increases in automotive electronics. MEMS sensor unit shipments surged by a CAGR of 35% between 2008 and 2013, which is more than double the 15% annual growth rate expected in the next five years, according to IC Insights’ 2014 O-S-D Report, which forecasts 7.7bn devices to be sold in in 2018 compared to 3.9bn sensors in 2013. MEMS sensor sales in 2014 are forecast to grow 16% to $4.4bn (USD) after increasing just 4% in 2013.

While overall annual unit growth rates are expected to be lower in the next five years, shipments of MEMS-based sensors will be driven by a much wider range of system applications, including more devices in smartphones and automobiles, but also new uses in consumer electronics, portable products, wearable systems, handheld test and instrument equipment, home automation, factory gear and personal medical devices. The spread of MEMS-based sensors and actuators into a broader range of new applications will help keep ASPs from eroding in the coming years because higher-priced designs will become more specialised, and thus, dollar sales growth is expected to be stronger in the years ahead despite the easing of unit volume increases in the 2013-2018 period.