MCUs enter next wave of growth thanks to the IoT & wearables

The outlook for MCUs continues to strengthen following a sharp recovery in smartcards, gradual improvements in the global economy, and the emergence of new embedded-systems applications, such as wearable electronics and the IoT. These market factors, along with steady growth in automotive and portable electronics, will drive up MCU sales by 6% in 2015 to a new record-high level of $16.8bn after a 5% increase in 2014, according to IC Insights’ 2015 edition of 'The McClean Report - A Complete Analysis and Forecast of the Integrated Circuit Industry'.

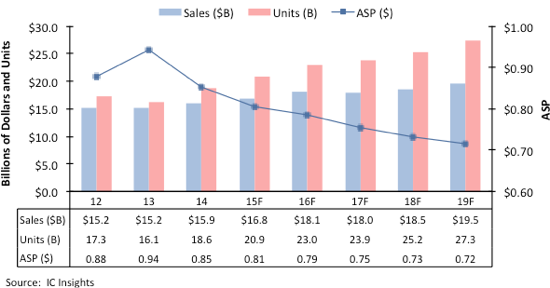

A new wave of expansion in MCUs is underway after the market fell 3% in 2012 and saw no growth in 2013, mostly due to a correction in the large smartcard segment and steep price erosion - especially in 32-bit MCUs. The report shows worldwide MCU sales rising by a CAGR of 4.2% between 2014 and 2019, reaching $19.5bn in the final year of the forecast (see figure below).

MCU market heads higher

MCU shipments surged 16% in 2014 to a new record high of 18.6bn units, surpassing the previous annual peak of 17.3bn set in 2012, based on market data in the report. Worldwide MCU shipments are forecast to grow 12% in 2015 and climb by a CAGR of 7.9% in the next five years, reaching 27.3bn units in 2019. The market report shows the Average Selling Price (ASP) for MCUs falling by a CAGR of slightly less than -3.5% in the 2014-2019 period, going from $0.85 to an average of $0.72 in the final year of IC Insights’ forecast.

Shipments of smartcard MCUs, which now represent about half of all MCU units sold worldwide, surged 25% in 2014 to 9.2bn after plunging 22% in 2013 due to a correction in this market segment and delays in new government smartcard programs around the world. Revenues for smartcard MCUs also rebounded in 2014 with dollar volumes growing 16% to $2.6bn after falling 11% in 2013. While smartcards account for about half of all MCUs shipped worldwide, this segment represents less than 20% of total MCU revenues due to very thin ASPs for smartcard MCUs.

The new edition of 'The McClean Report' also shows unit shipments of 32-bit MCUs surpassing 4-/8-bit MCUs for the first time in 2015 as demand increases for higher levels of precision in embedded-processing for clusters of sensors and systems that know their locations and automatically react to operating environments. Many new 32-bit MCU designs also contain support for wireless connections and IP communications for contact to the IoT. Counting all types of MCUs (8-, 16- and 32-bit designs) about 1.4bn MCUs will be used in new systems being attached to the IoT in 2019 compared to 306m in 2014, according to the report.