MCU sales growth slows despite unit shipments increase

According to IC Insights’ Mid-Year Update to its 2015 McClean Report on the IC industry, MCUs are in the middle of an incredible wave of unit growth, but unprecedented price erosion is keeping a lid on the increase of revenues. The mid-year forecast shows MCU shipments rising 33% in 2015 to 25.4bn units worldwide as a result of a tremendous upsurge in units for smartcards and 32-bit applications - many of which are aimed at the IoT market.

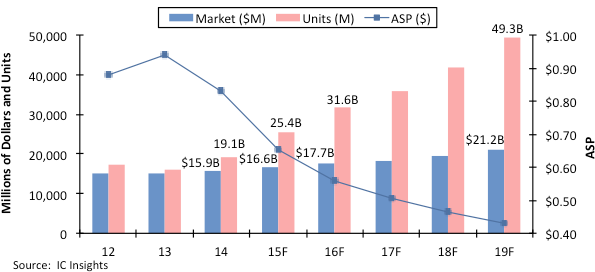

Despite the blistering pace of unit growth, dollar-volume sales of MCUs are now expected to rise by just 4% in 2015, reaching a new record high of $16.6bn from about $15.9bn in 2014, when total MCU revenues also increased 4%. As seen in Figure 1, ASPs for MCUs are expected to continue plunging, nose-diving 21% in 2015 to $0.65 compared to $0.83 in 2014, when the ASP fell 12%. IC Insights’ Mid-Year Update forecasts a 14% drop in MCU ASPs in 2016 with revenue growing 7% to $17.7bn and unit shipments climbing 25% to 31.6bn worldwide.

Figure 1 - MCU market history and forecast

Starting in 2014, MCU unit growth accelerated, driven by rocketing shipments of low-cost MCUs used in smartcards for protection in electronic banking and credit-card transactions, mass-transit fares, government IDs (such as electronic passports), medical records and security applications. After a 26% increase in 2014, smartcard MCU shipments are now expected to surge by 41% in 2015 to 12.9bn units worldwide, followed by 25% growth in 2016 to 16.1bn.

The mid-year forecast significantly raises the projection for smartcard MCU shipments through 2019 as US credit card companies, banks, retailers, government agencies and other industry sectors begin to broadly adopt secure 'chip-card' technology, much like Europe and other country markets have done since the 1990s. In the US, massive data breaches in credit card transactions at retail stores and growing concerns about identity theft have finally resulted in a major move to smartcards for higher levels of security, anti-fraud encryption and greater protection of lost or stolen debit and credit cards.

While price erosion weighs on total MCU sales growth, total MCU shipments are also accelerating because of strong demand for 32-bit designs and other single-chip solutions that can serve the explosion of sensors in wireless systems and connection to the IoT. IoT-related MCU sales are forecast to grow 16% in 2015 to $405m with unit shipments climbing 40% to 431m.