Large-screen smartphones erode total PC unit growth

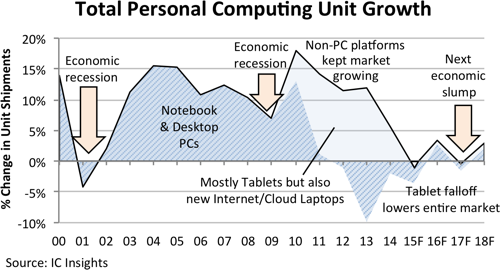

Five years ago, touchscreen tablets began pouring into the personal computing marketplace, stealing growth from standard personal computers and signaling the start of what has been widely described as the ‘post-PC’ era. Led by Apple’s iPad systems, tablet shipments overtook notebook PCs in 2013, and it appeared as if they would surpass total personal computer units by 2016. However, that scenario no longer seems possible after tablet growth lost significant momentum in 2014 and then nearly stalled out in the first half of 2015 due to the rise in popularity of large-screen smartphones and the lack of interest in new tablets that do not add enough features or capabilities to convince existing users to buy replacements. Consequently, IC Insights has downgraded its forecast for the overall personal computing market, including much lower growth in tablets and continued weakness in standard PCs (Figure 1).

Figure 1

Figure 1

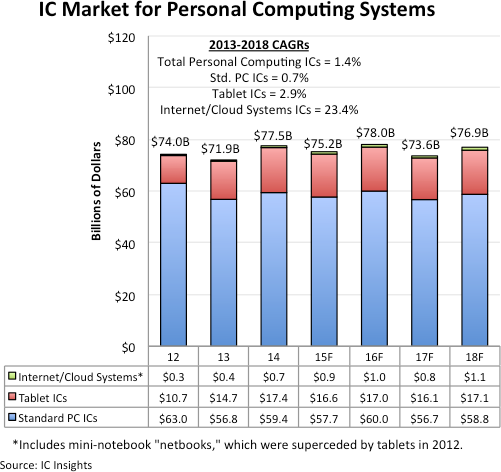

Figure 2 shows IC Insights’ forecast for integrated circuits used in standard PCs, tablet systems, and internet-centric/cloud-computing systems. PC and tablet IC sales are expected to decline in 2015 because of downward revisions to system shipments in both of those categories this year. PC integrated circuit sales are now expected to decline by 3% in 2015 to $57.7bn from $59.4bn in 2014, when revenues grew 5%. IC sales for tablets are now expected to decline 5% in 2015, dropping to $16.6bn from $17.4bn in 2014, which experienced an 18% increase. Sales of ICs for internet/cloud-computing laptops are now expected to rise 38% in 2015 to $931m from about $675m in 2014, which was an 83% increase.

Figure 2

The CAGR of IC revenues for standard PCs is now expected to grow by a CAGR of 0.7% in the 2013-2018 time period, reaching $58.8bn in the final year of the forecast. The reduction in tablet sales growth has also significantly lowered the projection of IC revenues in this category to a CAGR of 2.9% between 2013 and 2018. The outlook for integrated circuit sales used in internet/cloud-computing systems is forecast to grow by a CAGR of 23.4% in the forecast period, reaching $1.1bn in 2018.

Additional details on the market for smartphones and personal computing devices is included in the 2015 edition of IC Insights’ IC Market Drivers—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits. This report examines the largest, existing system opportunities for ICs and evaluates the potential for new applications that are expected to help fuel the market for ICs.

IC Market Drivers is divided into two parts. Part 1 provides a detailed forecast of the IC industry by system type, by region, and by IC product type through 2018. In Part 2, IC Market Drivers examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2018. Some of these applications include the IoT, automotive electronics, smartphones, personal/mobile computing (including tablets), wireless networks, digital imaging, and a review of many applications to watch, those that may potentially provide significant opportunity for IC suppliers later this decade. IC Market Drivers 2015 is priced at $3,390 for an individual user license and $6,490 for a multi-user corporate license.