It’s what’s underneath that counts

There is a growing concern about the safety of people’s personal identity information, especially when using contactless cards. According to new research from personal security company, Vaultskin, 80% of consumers in the UK are worried about their card’s safety when paying via contactless payment.

Adding to this, 82% of people have admitted to fearing the Radio-Frequency Identification Technology (RFID) skimming devices, that are widely available and allow fraudsters to clone contactless cards and aid identity theft, with shoppers and commuters at most risk.

Furthermore 75% of consumers now have access to contactless cards, and 66% of those with access use them regularly, meaning personal data is increasingly at risk of interception by fraudsters. According to the survey, 38% of Brits have either become victims of card or identity fraud, or know someone who has.

Vaultskin have heard these worries and concerns and to answer these issues have produced the Vaultcard, a card in which the company believes should simplify your movements and transactions throughout the day.

The card described as ‘the most advanced RFID protection for your wallet’ and will protect your RFID enabled cards, passports driving license, office door passes and more from the new ‘electronic pick-pocketing’ known as RFID skimming.

As contactless payment grows people have become increasingly worried and there has been a flood of products to try and prevent RFID fraud. All the different products on the market have the same concept of shielding the RFID card from electromagnetic waves using metal foils and materials; however this method is susceptible to flaws, due to the way that electromagnetic waves propagate through space.

Although RFID technology can offer the convenience and time-saving benefits that consumers and businesses enjoy, criminals can easily acquire equipment that allows access to the data stored on your cards or passports from several metres away.

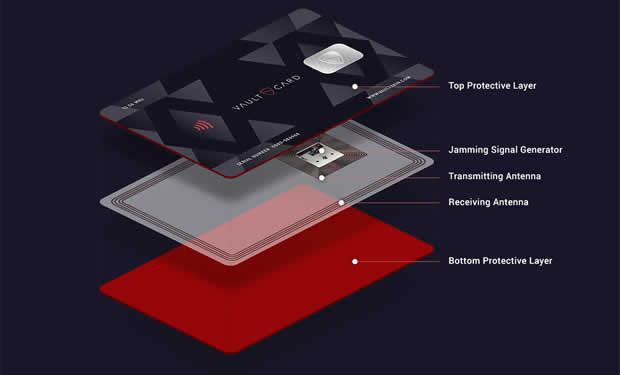

A card reader constantly transmits electromagnetic pulses during a typical RFID card payment, and when a RFID enabled card is in range of the card reader, it receives electromagnetic waves with its antenna and converts them to electric currents

Then the microprocessor will generate a coded message with the payment or identity data which is then transmitted back to the card reader using the card’s internal antenna.

The Vaultcard is effective as it switches on automatically when the electromagnetic wave from the RFID scanner is sensed, and it responds to a signal strength that is a hundred times smaller than what the RFID enabled card needs. The Vaultcard creates an electromagnetic jamming signal that blocks RFID readers.

The stronger the signal of the scanner, the stronger the jam signal that is generated, and all devices can be protected from the most powerful scanning devices.

And the biggest bonus of the Vaultcard - the face that it’s so simple to use - just placing your Vaultcard in the middle of your wallet, will mean all RFID enabled cards will be protected within four centimetres of the Vaultcard.

Cards can be placed either side of the Vaultcard, and to use your contactless card successfully it needs to be at least 20cm from your Vaultcard.

The research also found that nearly 90% of respondents thought that they should be able to opt out of receiving contactless cards, and despite having concerns, only nine percent have chosen to opt out of contactless cards, but a further 23% would like to be given the opportunity to opt out.

More than half of the consumers, 54% were concerned that they would lose money if their contactless card got into the wrong hands, with only 15% of people shared that they had taken steps to protect their contactless cards.

Vaultskin’s CEO, Thomas Kaprov, said: “The results of our study clearly show that consumers are all too aware of the problem of credit card and identity fraud. The rise in the use of contactless cards, combined with the increasing availability of skimming devices readily available to purchase online, is a serious issue.”

Kaprov added: “In the same way as we’ve learnt not to leave our valuables on display in our home or car, consumers also need to protect their card details against fraudsters. We’d advise that consumers utilise a contactless card protection device which jams RFID signals and blocks skimming devices from accessing personal data.”