IoT ICs are fastest growing market through 2018

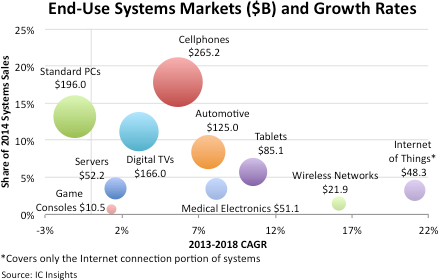

Total production value of electronic systems increased 5% in 2014 to $1,488bn. While the electronic system production is forecast to grow at a compound annual growth rate (CAGR) of 5.2% from 2013-2018. Figure 1, below, compares the relative market sizes and projected growth rates of 10 major systems segments covered in the 2015 edition of IC Insights’ IC Market Drivers report.

These 10 market categories represented a little over two-thirds of the total production value of all electronic systems in 2014. Cellphones expanded their lead over standard personal computers as the largest electronic systems market in 2014 after overtaking standard PCs for the first time in 2013. Cellphones accounted for 18% of total electronics systems sales, $265.2bn, versus about 13% for standard PCs ($196.0bn) in 2014. As seen in Figure 1, cellular phone sales are projected to rise by a CAGR of 5.6% in the 2013-2018 period, while standard PC revenues are expected to slump by an annual rate of -1.1%, partly due to the popularity of tablet computers and growing use of smartphones to access the Internet.

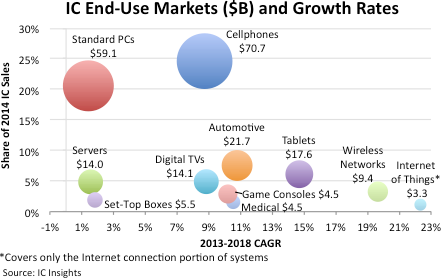

Figure 2, above, shows the market sizes and projected growth rates of IC sales for 11 major electronic system categories covered in the 2015 IC Market Drivers report. After dominating IC sales for most of the last two decades, standard PCs were unseated by cellphones as the largest end-use IC application in 2013 and the gap widened in 2014. Cellular handsets accounted for 25% of IC sales in 2014, while standard PCs represented about 21% of the total.

IC sales for standard PCs have stalled out while cellphone IC revenues are projected to grow by a CAGR of 8.7% between 2013 and 2018. Among these 11 end-use market segments, IC sales growth is expected to be the strongest in systems for connections to the IoT (a CAGR of 22.3%) in the five-year forecast period. IC revenues generated by these 11 end-use systems categories represented nearly 80% of total IC sales worldwide in 2014.