Investigating the automotive embedded systems market

The technological advances in the electronics and telecommunications sector have enabled the development of various advanced systems in the automotive industry. The seamless integration of embedded systems in vehicles has enhanced their functionalities to provide services related to navigation, diagnostics, Internet connectivity, and advanced driver assistance systems (ADAS). Thus, the modern vehicle has grown beyond just a means of transport.

Author: Sharmili Tandulwadkar, Senior Research Associate, Automotive and Transportation, MarketsandMarkets

An embedded system is a system of hardware and software designed to control and access data. The automobile, as we know it today, has evolved over the decades from being mostly a sum of heavy mechanical systems to the integration of mechanical systems and electronic controls. This has happened mainly due to the advent of semiconductor technology at various levels of application in the automobile, such as body electronics, safety and security, and powertrain and chassis control, among others, which has helped in improving performance levels and operating efficiencies of vehicles.

Automotive embedded systems are typically microcontroller systems with one or few dedicated functions, usually with real time computation constraints. In automobiles, embedded systems are used in infotainment and telematics, ADAS, airbags, head-up displays, electronic brake systems, power steering, and active suspension, among others.

Increased awareness of global warming has led to the implementation of stringent emissions regulations across the globe, which has consequently fueled the demand for fuel-efficient vehicles. This increased demand has led to the development of new and advanced solutions by OEMs and automotive embedded systems providers. The increasing demand for electric and fuel-efficient vehicles and the growing trend of vehicle electrification are projected to lead to an increased use of embedded systems in the automotive industry to provide advanced features, in terms of safety, convenience and comfort systems, and connectivity.

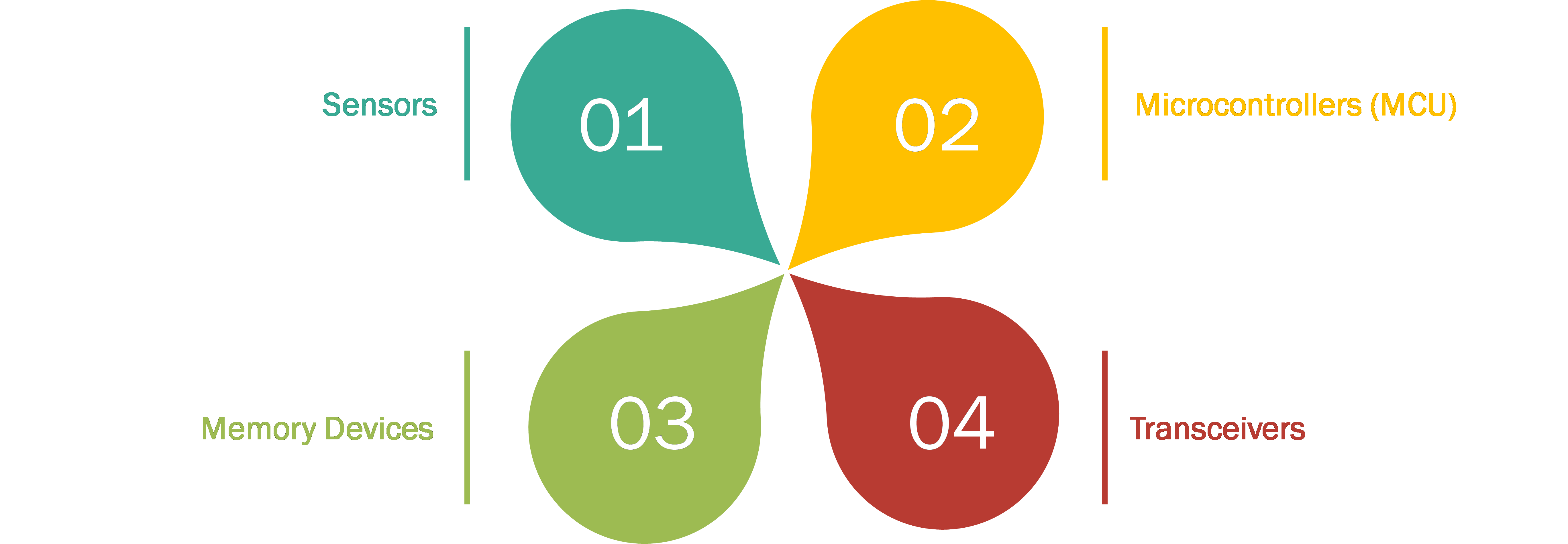

Major components: Automotive embedded systems

Semiconductor components used in an embedded system can be mainly categorised into sensors, microcontroller units, memory devices, and transceivers. Semiconductor technology has enabled manufacturers of automobiles to piece together multiple applications on a single chip by cutting down the board area, thus optimising performance. Therefore, it is a no surprise that it is one of the major drivers for the automotive embedded systems market.

Major applications: Automotive embedded systems

Automotive embedded systems can be broadly categorised into different applications such as infotainment and telematics, body electronics, safety and security, and powertrain and chassis control. Electronic systems contribute to more than 90% of the innovations in new features that are being introduced in automotive applications. The embedded systems market is mainly driven by such advances in vehicle electronics. Apart from technological advances, factors such as regulations concerning exhaust gas emissions, the growing preference of customers for advanced technologies, and the increasing limits imposed on fuel efficiency to reduce carbon footprints are driving the trend for vehicle electrification, which consequently, is influencing the automotive embedded systems market.

Growing demand for electric vehicles

According to the US Environmental Protection Agency (EPA), approximately 26% of the total greenhouse gas emissions can be attributed to the automotive and transportation sector. The demand for electric vehicles is on the rise due to factors such as reduced prices of vehicles, government regulations on emissions, and increased fuel efficiency. Stringency in emission norms across the globe has resulted in technological advances in the automotive sector. The advent of EVs is one of the most important steps towards environmental protection. These vehicles do not use conventional fuel and, thus, do not produce any harmful gases.

All these factors have accelerated the sale of electric cars, especially in developed regions such as North America and Europe. Additionally, various initiatives such as tax exemptions, subsidies for electric vehicles, and R&D and infrastructure development activities have been undertaken by governments of various countries to promote the sale of electric vehicles. These vehicles require embedded systems for basic as well as advanced functions. As they rely completely on electrical power supply, there is increased use of electronic devices in these vehicles. Thus, the growth of the electric vehicles market will provide opportunities for growth of the automotive embedded systems market.

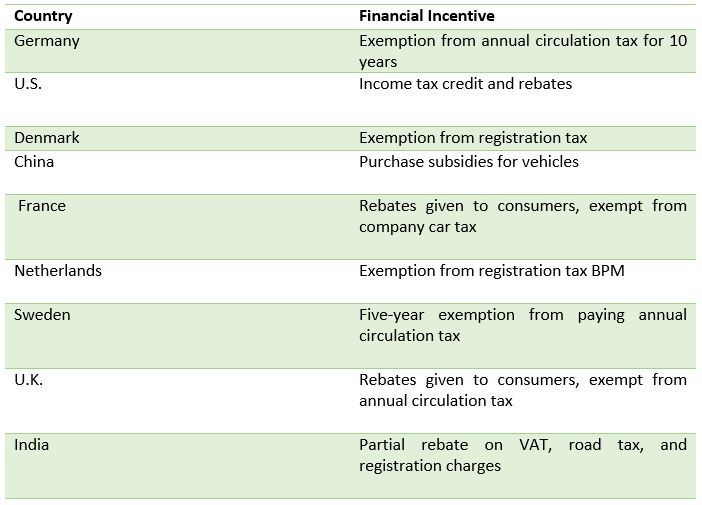

Government Incentives for electric vehicles, by country

Increasing demand for advanced safety, comfort, and convenience systems

Increasingly stringent safety norms laid down by governments and legislative agencies have driven automobile manufacturers to build safer vehicles by providing features, such as antilock braking systems (ABS), electronic brake-force distribution (EBD), and airbags. These safety features rely heavily on inputs from sensors. The US Highway Safety Act of 1991 made airbags and ABS features mandatory in all passenger cars. In India, airbags, ABS, and speed-warning systems will become mandatory for passenger cars from October 2018. Additionally, with changing buyer preferences, there is a growing demand for safety associated with comfort and luxury. This trend is more evident in developed economies where purchasing power is higher. As a result, embedded systems are being used to provide better safety, comfort, and convenience.

Safety features such as ADAS, ESC systems, electronic steering systems, brake-by-wire systems, and airbags, among others, are gaining popularity across the globe. The installation rates of ADAS have been increasing over the past few years, leading to a robust, reliable, and resilient system. Until recently, ADAS was implemented only in premium vehicles due to high costs. However, technological advances and expansion of the ADAS ecology have led to OEMs introducing the system in the mainstream market. Robert Bosch expects sales of radar systems to increase by 60% and video sensors by 80% this year. These factors are estimated to drive the market for automotive embedded systems.

Rising trend of vehicle electrification

The role of electronics has been crucial in improving vehicle performance. There has been an increase in the use of electronic components in various vehicle applications, such as safety and convenience features, infotainment, electronic steering, and braking, among others. Electronics account for nearly 40% of the components in a conventional internal combustion engine (ICE) vehicle. These innovations in safety, advanced connectivity, and expanded availability of telematics are expected to pave the way for the growth of electronics in automobiles.

With increasing the number of features in automobiles, the need for energy has also increased, which has, consequently, influenced fuel economy. Several sensors, control units, and components are being used in vehicles to provide comfort and safety and to control emissions. The use of electronics has played a key role in meeting safety parameters and has made automotive systems user-friendly and convenient. Efficient electrical systems facilitate optimum distribution of power to various parts of a vehicle and increase the overall efficiency of the vehicle, resulting in decreased emissions and increased safety and accuracy. A majority of the electronic applications are used in chassis, safety and control, networking, infotainment, and powertrain. These electrical systems increase overall comfort and improve the driving experience.

Advent of autonomous vehicles

The automotive industry is currently evolving with the introduction of autonomous vehicles. These vehicles are poised to fuel the demand for advanced embedded systems as the need to integrate every aspect of the vehicle would be much higher as compared to traditional vehicles. Nissan has predicted that autonomous vehicles would account for close to 15% of the automotive market by 2030, as compared to the current scenario where no such vehicle has been launched commercially.

Autonomous vehicles are self-driven vehicles that can sense the environment and navigate to the destination without any human physical input; they can be operated through voice commands. In recent years, there has been a focus on autonomous cars by the leading automakers such as Mercedes-Benz, Audi, Ford, Toyota, BMW, and Volkswagen. Mercedes-Benz has already started selling autopilot systems for freeways; however, it still requires a driver’s hand on the steering wheel.

Tesla has also launched the Tesla Model S Autopilot System, a semi-autonomous vehicle software that is capable of self-driving on highways. The process of autonomous driving requires two-way communication and feedback between the driver and the vehicle, for which an advanced embedded system is required to perform such comprehensive tasks. The manufacturers of automotive embedded systems and semiconductors have the opportunity to grow in this segment.

Major players: Automotive embedded systems market

The major players in the automotive embedded systems market include Robert Bosch (Germany), Continental (Germany), Panasonic (Japan), Toshiba (Japan), Johnson Electric Holdings (Hong Kong), and Denso (Japan). These companies have adopted various business strategies such as new product developments, expansions, and partnerships, among others, to enhance their positions in the automotive embedded systems market.