Haptics industry expected to be worth $2.8bn by 2027

With regards to enhancing the user experience in many very familiar products today, haptics are key technologies found as an essential feature. Whether as notification provision in a vibrating smartphone, tension building in a video game controller, or input confirmation in an industrial scanner, haptics technologies have now reached billions of electronics devices. The IDTechEx Research report Haptics 2017-2027: Technologies, Markets and Players finds that the haptics industry will be worth $2.8bn by 2027.

The changing application landscape

After many years of deployment in devices such as games console controllers, the largest success for the haptics market in terms of volume has been their ubiquitous adoption in smartphones. However, as this market has become increasingly commoditised, players have become increasingly desperate to drive change, either within the core technologies or in the markets generating revenue for haptics.

The most attractive market to emerge for haptics has been virtual reality. The first widespread commercially viable VR platforms hit mainstream markets in 2016, and haptic feedback is a common and essential feature in many of the handheld controllers incorporate in these systems. Not only this, but haptics is commonly touted as one of the key areas with unmet technology needs, providing fuel to drive new investment for new players with new technologies to serve this future market.

In this report, IDTechEx have detailed an extensive section covering haptics in VR. This has been compiled via primary research over 18 months including visiting events and companies to interview all of the key players. Via these interviews and case studies, the report describes an application and technology roadmap for haptics in VR, as well as quantitative market forecasts detailing the market size today and a scenario for its progression over the next decade.

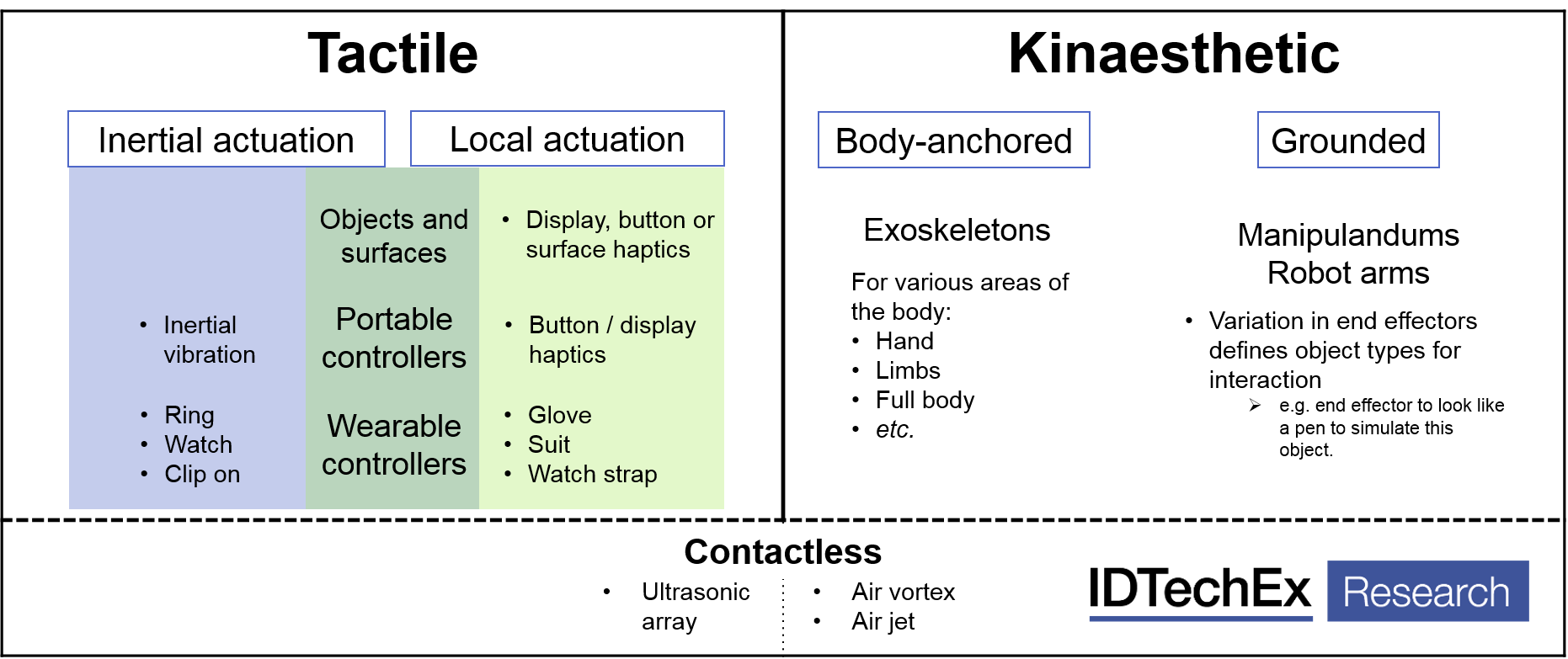

Haptics technology options

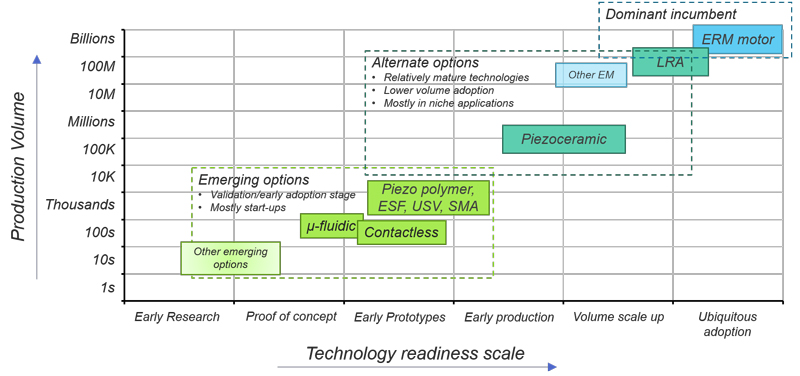

The eccentric rotating mass (ERM) motor has been the cheap, robust and very effective incumbent technology in haptics for the best part of two decades. However, changes at the core of the market have seen increasing adoption over linear resonant actuators (LRAs) in key products, by key players in key verticals.

However, the technology landscape is much more diverse than these incumbents. In this report, IDTechEx list all of the significant emerging haptic technologies being developed and commercialised today to enter the market in the coming decade. This includes technologies like voice coils or piezoceramics, which are not new but have not reached the mainstream like either ERM motors or LRAs.

There is also a large selection of emerging technologies, each with exciting properties that could potentially help to carve out specific niches within the competitive haptics market. These include actuators based on new materials like piezoelectric polymers, other electroactive polymers (EAPs) and shape memory alloys (SMAs). It also covers surface haptics including electrostatic (ESF), ultrasonic (USV) and even microfluidic solutions. The report also discusses contactless haptics, including prominent ultrasonic options but also various other emerging techniques to provide haptic feedback at a distance.

The competitive landscape

As changes are driven in both technologies and applications, it is most important to understand the dynamics, opinions and progress of all of the players involved. The report from IDTechEx mentions 120 different players in the haptics value chain, including materials suppliers, haptics component manufactures, technology developers, companies in the IP landscape, key integrators and manufacturers, right through to case studies from various end users by industry vertical.

The bulk of the research has been conducted through primary interviews, conducted in person on site visits or at events, or by telephone with key personnel at leading players. The report contains 22 full interview-based profiles, plus primary content from around 40 players from the haptics value chain.

As the industry develops, report customers can use the 30 minutes of analyst access to get the latest updates as IDTechEx's analysts continue to cover the space, with new interviews, event visits and case studies.