Global smartphone market ends 2018 on downturn

Global smartphone shipments recorded a negative year-over-year growth rate in the fourth quarter (Q4) of 2018, for a third consecutive quarter.

Authors: Gerrit Schneemann, Smartphones Senior Research Analyst, IHS Markit, Wayne Lam, Mobile Devices and Networks Director, IHS Markit, and Jusy Hong, Mobile Handset Devices Director, IHS Markit

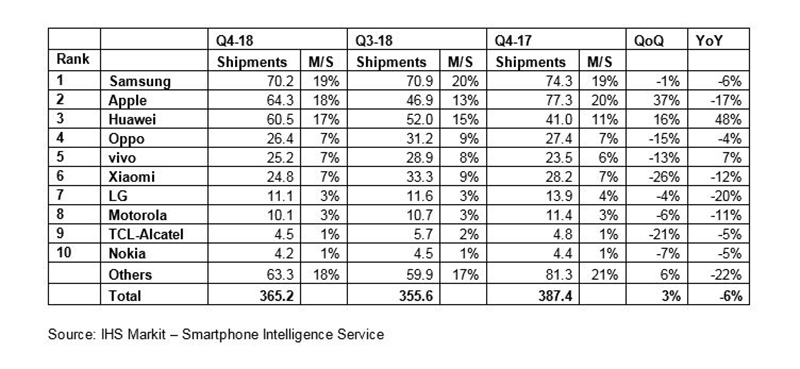

According to IHS Markit preliminary smartphone data, global smartphone shipments reached 365.2 million units in Q4 2018, which is a 5.7% y/y decline. For the 2018 calendar year, shipments declined 2.4% compared to the previous year, from 1.44 billion units in 2017 to 1.41 billion units in 2018.

Following is an overview of the smartphone market leaders in 2018, based on unit shipments:

Samsung Electronics

Samsung Electronics maintained its shipment-volume lead, shipping 70.2 million units in Q4 2018. Samsung’s negative growth rate in 2018 continued, as shipments declined 5.5% compared to the same quarter of 2017. As a result, its market share fell to 19.2% in Q4 2018, which is flat compared to the previous year.

Severe competition from Chinese rivals in many regions continued to impact Samsung’s business, and has led to Samsung changing its strategy for how new technologies are deployed in the company’s product range. For example, the first triple-camera Samsung device was a Galaxy A phone and, instead of a Galaxy S device, Samsung released the world’s first quad-camera smartphone, the Galaxy A9, last year.

Overall Samsung smartphone shipment volume declined eight percent, falling from 316 million units in 2017 to 290 million units in 2018. This is the first time Samsung shipped fewer than 300 million units in any year since 2014.

Huawei

Huawei shipped 60.5 million units in Q4 2018, rising 47.7%, year over year. The company continued its double-digit y/y growth for the fourth consecutive quarter, growing in most of regions, except North America where Huawei has little exposure. Fast growing markets for Huawei include Europe, Middle East and Africa.

In 2018, Huawei was able to exceed Apple in unit-based shipments for three consecutive quarters, propelling the Chinese brand to second-ranked position in the market, unseating Apple from its perch. However, the network infrastructure side of Huawei has faced increased scrutiny from the United States and other governments around the world, due to potential security concerns in to roll out of 5G networks.

Apple

Apple shipped 64.3 million units in Q4 2018, down 16.9% from 77.3 million units in Q4 2017. The company’s performance faced significant challenges in China and in the overall global smartphone market in Q4 2018. Furthermore, Apple’s super-premium handset pricing seems to have stunted its unit growth potential in the quarter. Importantly, there is no quick fix for Apple to change fortunes in China or India. In China, local competition is fierce; while in India, Apple’s products are ill-equipped to fit into the country’s price-cautious market.

Xiaomi

The recent trend of high double-digit growth halted for Xiaomi in Q4 2018. The company shipped 24.8 million units, down 12.1% from 28.2 million units in Q4 2017.

Oppo and Vivo

Oppo and Vivo shipped 26.4 and 25.2 million units, respectively. Oppo shipments declined 3.6%, while Vivo shipments grew 7.2%.

Conclusions

Xiaomi, Oppo and Vivo were adversely affected by the continued negative growth of the smartphone market in China. On the other hand, Huawei strengthened its market leadership in China. Tension between the US and China stimulated a feeling of patriotism in China, leading smartphone users to choose Huawei over other brands. Moreover, Huawei boasts significant international business, which other brands are still working to establish, enabling the company to achieve tremendous success in the fourth quarter.

The combined market concentration on the top six companies continued to intensify in Q4 2018, accounting for 75% of global smartphone shipments. Most of the rest brands saw their shipments and market shares fall in the quarter.

Meanwhile, Nokia increased its shipments to 15 million units in 2018, up from five million units in the previous year. Finland-based HMD Global is operating its Nokia-branded smartphone business, by focusing on mid-range and low-end smartphones in Europe, Asia and Africa. The company will soon expand into North America.

Quarterly global smartphone shipments (millions of units)