European Electronic Components Market Trends – Q1 2019

The European Distributor electronic components Total Available Market (DTAM) continued to make progress in the first quarter of 2019, reports Adam Fletcher, Chairman of the International Distributors of Electronics Association (IDEA).

Consolidated returns from the association’s member companies confirm average ‘Billings’ (sales revenue invoiced, less credits) grew by 3.6% in Q1 2019 when compared to the same calendar quarter 2018, extending a period of growth that now spans 22 consecutive calendar quarters. The indications are that growth in the European electronic components market will prove to have slowed in the first half of 2019, exacerbated by a slight general decline in manufacturer lead times for almost all electronic components. Any respite is likely to be short lived. Strong demand and manufacturing capacity constraints will almost certainly begin to extend lead times once again into the second half of the year and continue significantly into 2020.

Each month IDEA collates the statistical data reported by its member associations throughout Europe and consolidates the figures before publishing them as headline information.IDEA uses three primary metrics in its reporting process: ‘Billings’ (sales revenue invoiced, less credits), ‘Bookings’ (net new orders entered), and the ratio of the two known as the ‘Book to Bill’ (or B2B) ratio. All three metrics are important, but the consolidated ‘Billings’ number is possibly the most critical value. “The ‘Billings’ number is the most accurate indicator of the performance of all organisations operating in the market”, said Fletcher. “Organisations are able to use this figure to compare their actual operating performance with the market’s average sales revenue performance”.

The data presented in the following graphics is shown in Euros and where necessary has been converted from local currency at a fixed exchange rate for the year.

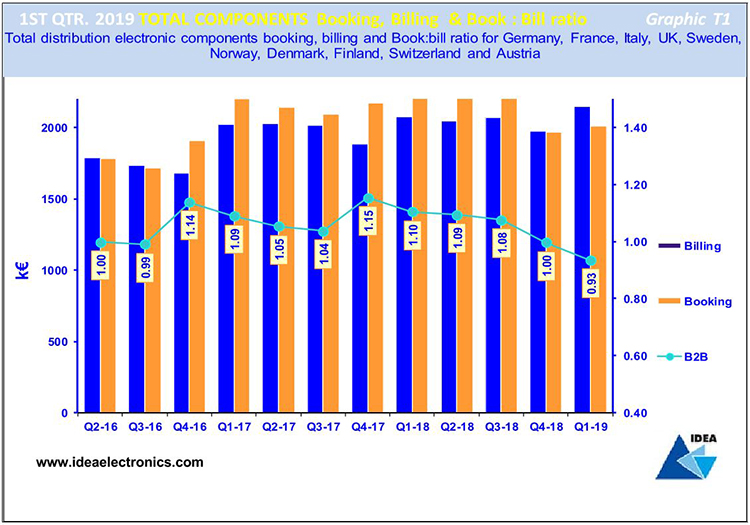

Q1 ’19 Bookings, Billings & B2B - Graphic T1

Graphic T1 is a visual representation of 12 quarters of ‘Billings’ and ‘Bookings’ in European electronic components markets together with the corresponding ‘Book-to-Bill’ (B2B) ratios. A positive B2B number - i.e. greater than one – indicates growth but a number below one is evidence of a decline. A quick glance at the chart suggests that there has been an uptick in growth in the first quarter of 2019, an outcome in-line with historical precedence and IDEA member guidance. Further analysis reveals a likely continuation of the established pattern of a strong Q1 followed by a declining Q2, Q3 and Q4, but the final outcome is likely to reveal growth in the range 3% to 6%, with a mid-point of 4.5%. A ‘B2B’ of 0.93:1 also strongly suggests lower growth into Q2 ’19.

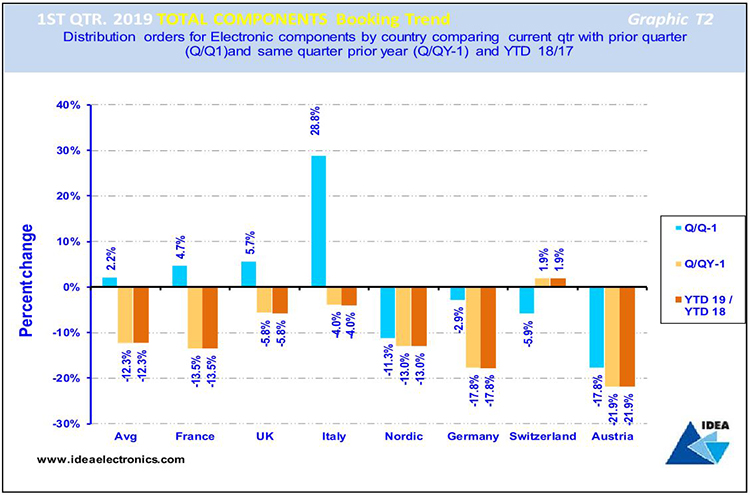

Q1 ’19 Bookings Trend -Graphic T2

Graphic T2 compares the total electronic components ‘Bookings’ result achieved by each European country in Q1'19 and contrasts and compares their returns with the previous quarter's results and those achieved in the same period last year.

The blue bar reveals that on average European ‘Bookings’ grew by 2.2% in Q1’19 when compared to the previous quarter. France, UK and Italy all showed growth, whilst other European countries reported a decline.

The light brown bar compares ‘Bookings’ growth by country in Q1'19 with those in the same quarter 2018 and indicates that on average ‘Bookings’ declined by (12.3%). Only the Swiss electronic components markets achieved ‘Bookings’ growth in the quarter.

The dark brown bar compares average ‘Bookings’ achieved in Europe year-to-date with the same period in 2018, revealing that the average Bookings growth rate declined by (12.3%) across Europe over the 12 month period. Once again, only the Swiss market showed growth.

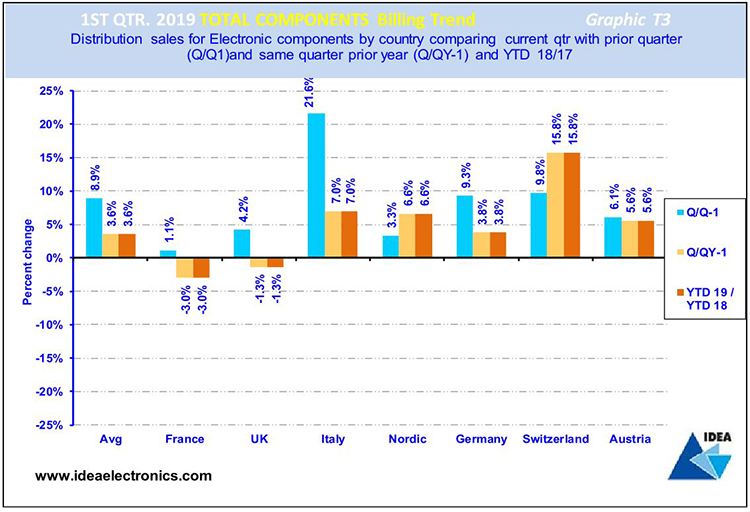

Q1 ’19 Billings Trend -Graphic T3

Graphic T3 illustrates total electronic components ‘Billings’ achieved in European markets in Q1'19 and contrasts and compares the results with the previous quarter's results and those achieved in the same period last year.

The blue bars compare Q1’19 ‘Billings’ with the preceding quarter’s figures, revealing that all European electronic components markets experienced growth in the period, achieving an average growth of 8.9%.

The light brown bars compare Q1’19 with the same quarter last year and shows that most European electronic components markets experienced growth averaging out at 3.6%. The exception was the French and UK markets, which was something of a surprise.

The dark brown bars compare current YTD ‘Billings’ with the same period 2018, revealing thatnearlyall countries are experienced growth, the average of which is 3.6%. Again, France and the UK are sadly bucking the positive trend.