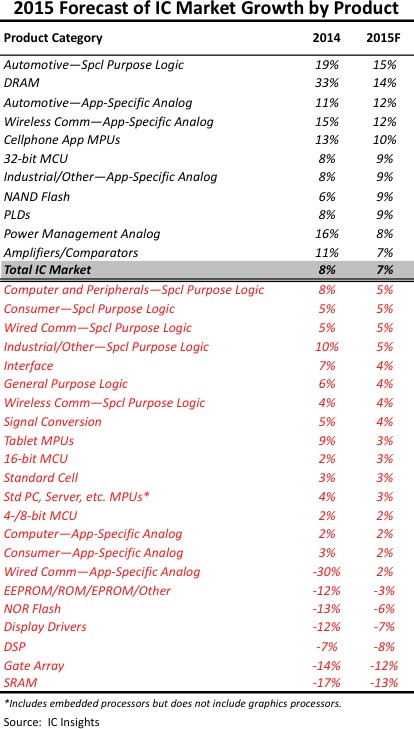

Eleven IC categories expected to exceed the 7% growth rate

As an update to the company's 2015 McClean Report, IC Insights has refreshed the forecasts for 33 major IC product categories through 2019. The complete list of all 33 major IC product categories ranked by the updated forecast growth rates for 2015 is shown below in Figure 1, with eleven product categories expected to exceed 7% growth rate.

Five of the eleven categories are forecast to see double-digit growth in 2015.

The total number of IC categories forecast to register sales growth in 2015 drops slightly to 27 products from 28 in 2014. IC Insights forecasts a solid growth year for automotive-specific ICs. In addition to automotive special purpose logic and automotive application-specific analogue, 'intelligent' cars are contributing to growth in the 32-bit MCU market. Driver information systems, throttle control and semi-autonomous driving features such as self-parking, advanced cruise control and collision-avoidance are some of the systems that rely on 32-bit MCUs.

In the next few years, complex 32-bit MCUs are expected to account for over 25% of the processing power in vehicles. Automotive is forecast to be among the strongest electronic systems market in 2015. The automotive segment is expected to register a CAGR of 6.5% in the 2014-2019 timeperiod compared to projected CAGRs of 6.8% for communications, 4.3% for consumer, 4.2% for computer, 4.5% for industrial and 2.7% for government/military. Despite automotive being one of the fastest growing electronic system markets over the next five years, automotive’s share of the total IC market is forecast to be only 8% in 2015 and remain less than 10% through 2019.

Big gains in the DRAM average selling price the past two years resulted in greater-than-30% growth for the DRAM market in both 2013 and 2014. DRAM ASP growth is expected to subside this year but demand for mobile DRAM is forecast to help this memory market category grow another 14%, placing it second among the 33 IC product categories shown, according to the newly refreshed forecast.

Growth of cellphone application MPUs (10%) is forecast to remain near the top on the growth list for a fifth consecutive year. Meanwhile, the previously high-flying Tablet MPU market is forecast to sputter to just 3% growth in 2015 as demand for tablets slows and average selling prices decline. Other IC categories that support mobile systems are expected to see better-than-industry-average growth in 2015, including gains of 9% for NAND flash and 8% for power management analogue.

Increased sales of medical/personal health electronic systems and the growth of the IoT will help the markets for industrial/other application-specific analogue and 32-bit MCU devices outpace total IC market growth in 2015, as well.