DRAM leads in revenue in 2020

IC Insights is in the process of updating its comprehensive forecasts and analyses of the IC industry for its 24th edition of The McClean Report, which will be released in January 2021. Among the revisions is a complete update of the sales and unit shipment growth forecast growth rates through 2025 for the 33 main product categories classified by the World Semiconductor Trade Statistics organisation (WSTS) to be lead by DRAM.

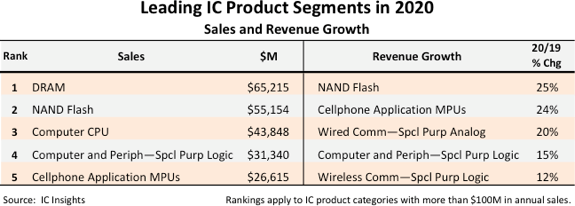

Shown in this bulletin are the top five largest product categories for sales and revenue growth for 2020.

Coming as no surprise, each of the top-five IC product categories in terms of sales all have ties to computing or communication applications. With estimated sales of $65.2 billion, DRAM tops the list with the greatest sales revenue in 2020, followed in second place by NAND flash (Figure 1). Computer and cellphone processors also make the list along with Computer—Special Purpose Logic.

Figure 1

DRAM has been the largest revenue-generating IC segment since 2017, even through the steep memory market downturn in 2019. DRAM is forecast to retain is place as the largest IC market in 2021, as well. Computer CPUs are expected to place third in terms of revenue in 2020. The COVID-19 pandemic led to upgrades in computing systems as consumers and businesses transitioned to home-based online activities.

In addition, an increase in shipments of data centre servers to process and store all this information also helped sales in the segment. Sales of higher-priced 5G processors in the second half of 2020 have been key to the rise in mobile phone application MPU sales this year.

In terms of the strongest revenue growth percentage for 2020, NAND flash is expected to top the list with a sales surge of 25% this year. NAND flash sales were exceptionally strong in the first quarter of this year as strong demand from makers of data centre servers led to a steep increase in the average selling price. Prices for NAND flash continued to rise through the remainder of the year, but at a much more modest pace, resulting in a solid 25% increase in sales for this segment.

The advent of 5G processors that power new smartphones is expected to boost mobile phone application MPU sales 24% this year. Most 5G processors are based on 5nm process technology—leading-edge technology that comes at a higher price. Faster and more technology-rich 5G smartphones also helped provide a strong increase to sales in other communications-related IC product segments.

The IC industry has been one of the most resilient markets during this corona-virus plagued year. Although causing a deep global recession in 2020, the COVID-19 pandemic spurred an acceleration of the global digital transformation resulting in 21 of 33 IC product categories that survived (and even thrived) with positive growth.

With the promise of a vaccine being developed and administered worldwide next year, a strong global GDP rebound and double-digit IC market increase are forecast for 2021.