Chinese companies climb 2014 fabless IC ranking

IC Insights will release the 2015 edition of 'The McClean Report' later this month, which will include a ranking of the top 50 fabless IC suppliers for 2014.

Despite China’s ambitious late-1990s plan to create numerous high-volume indigenous IC manufacturers in the pure-play foundry segment, the government is still very serious about keeping China and Chinese IC suppliers relevant in the future IC industry. Last year, new semiconductor industry programmes were announced that will utilise investment by both the Chinese national government ($19.5bn) and local government and private equity investors ($97.4bn). IC Insights believes that these outlays have to potential to significantly change the future IC supplier landscape.

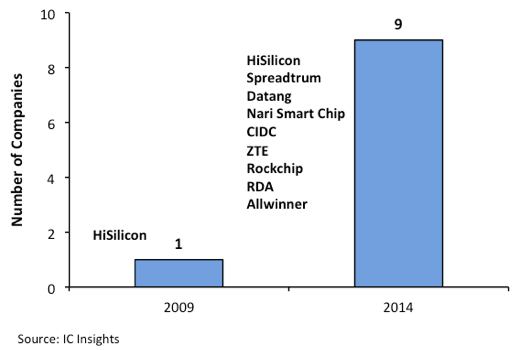

As Chinese IC design houses continue to advance, IC Insights expects an increasing number of China-headquartered companies to move up in the ranking of top fabless IC suppliers. As shown in Figure 1, below, there were nine Chinese companies among the top 50 fabless companies in 2014, up from one in 2009.

Figure 1 - Chinese companies in the top 50 fabless IC supplier ranking

In total, the Chinese fabless IC suppliers held 8% of the top 50 fabless IC market ($80.5bn) in 2014 and currently hold twice as much top 50 fabless IC marketshare as the European and Japanese companies combined. Nineteen U.S. companies were represented among the top 50 fabless suppliers in 2014, accounting for 64% of the total top 50 fabless company IC sales. In 2014, Japan held less than 1% and the 'other' countries (e.g., South Korea, Singapore, etc.) represented only 6% of the market held by the top 50.

Although its original plan of establishing numerous large indigenous IC manufacturers in China was not successful, it is obvious that the Chinese government still intends to create a dynamic environment in the China-based IC industry, including placing additional emphasis on establishing new fabless IC suppliers. IC Insights believes that the Chinese government’s commitment to creating a more powerful Chinese presence in the future IC industry is alive and well and should be taken seriously.

More details on the 2014 top 50 fabless IC suppliers and China’s future role in the IC industry will be provided in 'The 2015 McClean Report'.