Automotive industry to be a big growth opportunity for conductive ink

The automotive industry has emerged as a significant market opportunity for suppliers of conductive pastes and similar materials. It has the potential to one day rival in significance the irreplaceable photovoltaic market. Almost every major paste supplier with a global profile is re-organising its team and its product portfolio to capture this rising trend.

In this article, IDTechEx discuss various trends and applications in the automotive industry that are impacting or will impact the functional paste supply business.

To learn more see the IDTechEx Research report Conductive Ink Markets 2019-2029: Forecasts, Technologies, Players. This report provides the most comprehensive and authoritative view of the conductive inks and paste market, giving detailed ten year market forecasts segmented by application and material type. The market forecasts are given in tonnage and value at the ink level.

Multiple significant trends are re-shaping the automotive industry in an unprecedent way. Vehicles are becoming increasingly electrified. This will change the powertrain and the energy source. In particular, this will increase the number and/or capability level of power electronic devices acting as inverters, DC-DC converters, on-board charges, and so on.

In parallel, vehicles are becoming more autonomous and safer. In fact, many higher levels of ADAS will need to be implemented on the way towards the long term goal of full autonomy. This trend inevitably translates into higher electronic content per vehicle both in terms of sensor and process unit content. This trend will be further accelerated by higher vehicle connectivity.

Vehicles also continue on their path of incrementally improving comfort functions and aesthetics. This manifests itself in functions such as seamlessly-integrated Human-Machine Interfaces (HMIs), in-seat heating, more efficient de-foggers, designer lights, and so on.

Electrification

IDTechEx Research forecasts that on-road electric cars will reach approximately 40m units by 2029. This forecast includes different degrees of electrification including 48V mild hybrid, plug-in hybrid, full hybrid, and full electric. All these vehicles will require power conditioning (power electronics) units to charge batteries, to convert high voltage batteries outputs to low voltage inputs for auxiliary electronics, and to drive electric motors or to capture energy from them.

Each power conditioning unit fulfils a different set of requirements. As such, it handles different power levels and is subject to different operating temperatures and thermal shocks. These conditions dictate many technology choices including the semiconductor (Si vs SiC vs GaN), device architecture (MOSFET vs IGBT), and power module/packaging materials.

The link to conductive pastes comes in the packaging materials. More specifically, the die attach and potentially even the substrate attach. The primary technology choice today is SAC solder. It is lead-free and low cost. It is also tried and test and comes in a variety of formats. Trends will however push performance requirements beyond its capabilities in some important cases.

In general, the performance trend is towards high operating temperatures and increased cycle life. The higher temperature tolerance translates into reduced die number/area and shrunk module and package size.

Metal sintering paste is developed as a response to these challenging performance requirements. This technology is now already qualified and is in use after more than seven years of development. This long period reflects the timelines involved in the automotive industry with its high liability risk and the adjustments and learning required by the value chain including module and semiconductor markers.

The technology is positioned as a more-for-more proposition, i.e., high performance and high-cost. The higher cost stems from higher material costs as well as from the need to adjust sintering process/equipment and electrode finishes.

Nonetheless, the technology is in its early phases of market growth because the use cases in which it will be required will expand. The technology itself is also now evolving. This evolution can be seen in the choice of the fillers (Ag vs Cu, or nano vs micro vs hybrid), sintering conditions (faster with lower or no pressure), non-paste formats (dry transfer films, dips, etc), lower costs, higher adhesion for larger dies, and so on. This is a space to closely watch.

Supplier numbers are increasing, and businesses are on the move. To learn more about metal sintering please consult Conductive Ink Markets 2019-2029: Forecasts, Technologies, Players. This report provides a detailed assessment of more than 25 application sectors. It analyses the market needs/requirements, discusses the business dynamics, market leadership and technology change trends, competing solutions, latest product/prototype launches, key players and market forecasts in tonnes and value.

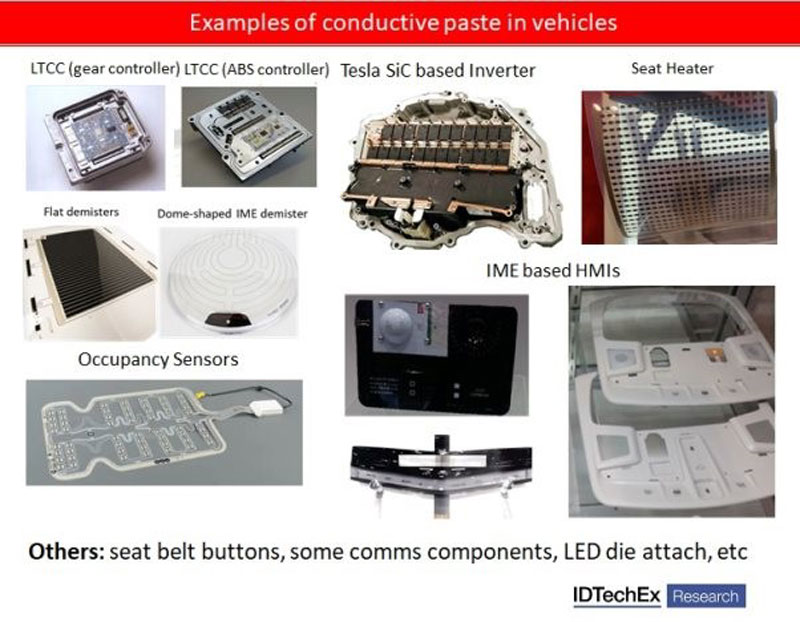

Examples of automotive parts in use or in development using conductive pastes. Source: IDTechEx.

High safety and autonomy

Pastes are already used in simple safety functions including occupancy sensors, de-misters, etc. The former (occupancy sensor) is a highly successful screen-printed product that measures the presence and weight of occupants to properly control the response of airbag deployment system.

Conductive pastes are also used in LTCC-based electronic boards regularly deployed in the automotive industry often for safety or monitoring functions. These ceramic boards are selected for their higher reliability, higher tolerance of heat, moisture, and vibration.

This trend is likely to accelerate. The number of electronic boards will increase. Today, there are many individual self-contained electronic systems. In the future, there may be more of a centralised architecture to handle and process all the date. Not all boards use or will use LTCC, but it is plausible to think that LTCC and similar will also benefit from this growing wave.

The type of sensors used in vehicles will also become more diverse. The technology of many sensors in in a state of flux with no established or dominant device technologies, architectures, or material sets.

In fact, a high and rapid technology disruption cycle can reasonable be expected in the evolution of many such sensor technologies. In such cases the door remains open to paste suppliers to participate in the game as a packaging material or as a die attach paste especially when high heats are involved, e.g., lasers, high power Pas for comms, etc.

In general, given the uncertainty and the rapidly changing state of the automotive sensor and electronic industry, paste makers must keep a close eye and cultivate ongoing relationships with the ecosystem. They must invest in evaluating technology options and in understanding customer pain points to translate their capabilities into well-positioned products. Our team can help therefore please feel free to contact us should you have any enquiries.

Improved comfort, design, aesthetics and energy saving

Conductive pastes are already part of the perennial trend to incrementally improve comfort, design, and aesthetics. In one example, pasts are used in seat heaters. Here, the entire large-area heater is printed. The conductive paste might also be used as a die attach for high power LEDs which are used for energy saving and aesthetically differentiated lighting.

One interesting trend is that pastes could also be used in novel HMIs. Here, special conductive pastes will enable In-Mold Electronics (IME), a process that enables the replacement of mechanical switches with structurally integrated electronics. This will give rise to elegant HMIs which saves space and weight. This technology is not straightforward to implement and has suffered from long learning and development times.

This trend however has been in the making for many years. Indeed, after the false-starts of the past, it is already available as an embedded heater (de-fosters) on the curved plastic cover of the LED lamps. There are many more close-to-conversion prototypes targeting the vehicle interior in the pipeline too.

In general, the global trends re-shaping the automotive industry act in favour of increased conductive paste deployment per vehicle. Unlike other significant markets such as PV, the automotive use cases will be very diverse. This will translate into the need to develop different conductive paste formulations and to engage with different customer bases. In some cases, the pastes need to act as sintered metals, providing die-to-ceramic adhesion, thermal conductivity, and reliability.

They might be used as screen printed and sometimes laser trimmed metallisation pastes for multilayer ceramic or thick film boards. In other cases, they might be screen printed onto a flexible PET or a similar substrate with low curing temperatures. In yet other scenarios they might need to demonstrate one-off stretchability and compatibility with thermoforming process as part of a stack of materials.

The application maturity levels are also very different. In some cases, the markets are well established and experience incremental performance gains. In others, the applications are emerging or are in a state of technological flux without clear-cut and well-established performance targets or even figures-of-merit.

These imply that pastes makers will not be able to rally their efforts around a one-product-fits-all approach or around a single blockbuster product that experiences only incremental improvements. Instead, they require to create an umbrella unit that pulls together a broad product portfolio supported by the technical ability to customise solutions. They will require the organisational ability to identify, segment, explore, and engage with diverse applications and value chains and to provide high volume global support.

To learn more please consult Conductive Ink Markets 2019-2029: Forecasts, Technologies, Players. This report provides the most comprehensive and authoritative view of the conductive inks and paste market.

It provides insights based on primary intelligence obtained through interviews, visits, conference exhibition interactions, personal communications, and so on. It also offers detailed ten year market forecasts segmented by application and material type as well as coverage of some 130 companies.