Automotive ECU market set to exceed $50bn by 2023

The latest report by Global Market Insights has found that the automotive electronics control unit (ECU) market size is set to exceed $50bn by 2023. Incorporation of various electronic technologies such as safety, advanced control, communication, and security to enhance vehicle functionalities will drive the automotive electronics control unit market size. Connected navigation and telematics systems require embedded software to manage an increasing number of services such as superior communication access and management.

Efforts for ensuring security and safety, energy-efficient drivetrains, and passenger comfort levels will directly contribute towards telematics and infotainment control systems growth.

Global automotive electronics control unit market share has witnessed gains due to strong demand for interactive infotainment systems in the vehicle. Electronic component installations have increased consequently in the mid-sized segment due to advanced technology adoption. Rising consumer preference towards sophisticated equipment for navigation purposes will offer potential growth opportunities to automotive electronics control unit (ECU) market players.

The electric vehicles industry will enhance features of electronic components and technologies to augment passenger and driver comfort levels. Electric vehicle powertrain is equipped with ECUs to regulate power electronics systems, battery, and electric motors depending upon the engine load. Increasing demand for these vehicles among consumers will favour low cost developments of associated components.

High functionality required to control the rising communication options between electronic components has increased its complexity. The prioritisation of development between hardware and software architectures will hamper the automotive ECU market growth. Low awareness about subsystems and difficulty of OEMs in maintaining and managing embedded controller enabled process is expected to challenge industry growth.

Regional outlook

Stringent automotive guidelines particularly in Europe and North America have given a fillip to safety features in the vehicle. For instance, in December 2016, NHTSA (National Highway Traffic Safety Administration) in the US proposed a rule to mandate V2V communications on LMVs to reduce crashes on roadways. Formation of AUTOSAR (AUTomotive Open System ARchitecture) alliance in 2003 between worldwide automotive suppliers, manufacturers and semiconductor vendors, offer a standard approach to design and develop software applications and hardware of electronic control unit. By 2020, it is estimated that all vehicles will have AUTOSAR based ECUs.

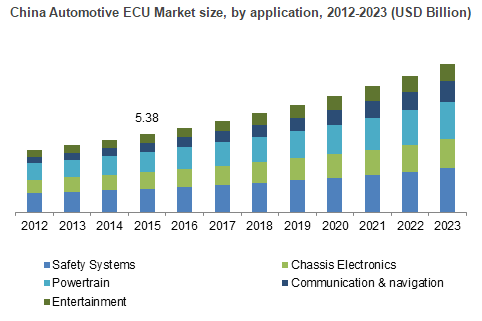

The communication and navigation segment is expected to witness high gains from 2016 to 2023. This can be attributed to rising consumer preference towards convenience technologies for enhanced driving experience. By 2021, India’s emerging and middle-class segment population base will be around 900 million, thereby providing new opportunities for automotive electronics control unit market demand. MEA automotive ECU market will grow at over 4.5% from 2016 to 2023. Nigeria, Algeria, Egypt and Iran are likely to improve their factory capacity, supporting the regional growth.

Mexico automotive electronics control unit market size was valued at over $1bn in 2015 and is expected to witness significant gains. Surging investments in new auto factories will support the regional demand as the installed capacity is expected to grow at over 50% over the next five years.

Competitive analysis

Global automotive ECU market providers are Autoliv, Continental AG, TRW Automotive, Bosch, Delphi and Denso. Industry players focus on long-term contracts for their products supply to retain their revenue share. The suppliers and OEMs aim to provide low cost ADAS (advanced driver assistance systems) for medium and compact-sized car segments.

Automotive electronics control unit market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue from 2012 to 2023, for the following segments: powertrain, chassis electronics, safety and security, entertainment, communication and navigation.