Aircraft MRO market to grow at CAGR of 3.8% during 2017-2022

In 2016, the engine segment generated the highest revenue share in the global aircraft MRO market. Among major regions, Asia-Pacific was the highest revenue generating market, holding nearly 35% of the market share, in 2016.

“A surging trend of OEM partnerships is widely being accepted in the engine maintenance segment. Key market players are indulging into partnerships with contractors, local market players, or even military depots, in order to surpass the market fluctuations and hurdles. Moreover, the significantly slow growth in engine MRO compared with that of the global engine fleet has led to the advent of new technology.”

Business and General Aviation (BGA) segment expected to show an impressive growth rate during the forecast period, owing to the increase in number of air passengers

The surge in the number of air passengers, all around the globe, is the major determinant driving the growth of this segment. In 2016, the global air transports carried approximately 3.69 billion passengers, as per the data revealed by The World Bank.

In terms of region, the Bureau of Transportation Statistics revealed that in 2016 the US airlines carried the highest number of passengers, leaving behind the statistics of 2015. The US airlines carried a total of 823.0 million passengers, out of which 719.0 million were domestic and rest 103.9 million were international passengers.

The growth of global aircraft MRO market is likely to be hampered due to the stringent regulations imposed in this sector

National regulations are coordinated under international standards, maintained by bodies such as the International Civil Aviation Organization (ICAO).

A licensed staff is required to carry out all the tasks related to the maintenance and inspection of aircrafts. A regulatory rigor is seen in the FAA’s compliance database, which lists about 400 enforcement actions against MRO shops, airlines, and other aviation service providers, in 2015 alone.

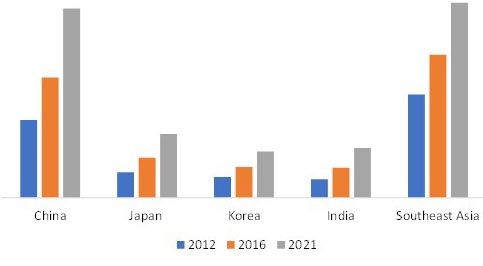

Asia Pacific accounted for the largest market share for global aircraft MRO market, owing to the rising aviation market in the region

Asia Pacific held nearly 35% market share, in terms of revenue, of the global market. The aviation industry in China is growing rapidly and there are more than 55 airlines that operate across the country. Development of new airports, expansion of existing airports, and expanding domestic fleets is anticipated to drive the MRO market growth in China.

Moreover, the daily average number of aircraft movements at Narita International Airport in Japan has also been increasing each year. In addition, the Korean government is offering a range of financial incentives to MRO companies to enter joint ventures in Korea. Expansion of MRO capabilities is seen as another important goal by the Korean government, keeping fast-growing low cost carriers in focus. However, the aircraft MRO industry in India is at a nascent stage with tremendous opportunities.

Asia Pacific Aircraft MRO market revenue by country, 2012-2021

Key findings of global aircraft MRO market, 2012-2022

- The presence of in- house airline MRO, third party airline MRO, OEM- affiliated MRO, and independent MRO is changing the trend by which the MRO services are being provided to the customers.

- The Middle East commercial aviation MRO market is growing at a faster rate than the global average and the majority of expenditures are driven by wide body aircraft.

- Tax breaks, better MRO infrastructure, cheap labor, and increasing joint ventures in China, have paved the way for new aircraft MRO facilities.

- Market players are focusing on joint ventures, mergers and acquisitions, in order to attain large share of the global market and become the market leader.

- Asia Pacific led the global aircraft MRO market in 2016, in terms of revenue, by holding nearly 35% of the total share.

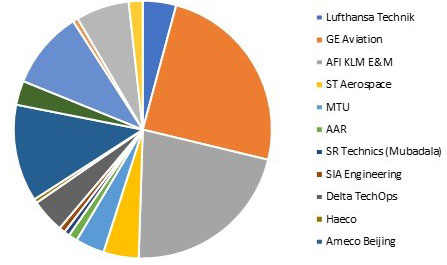

Global Aircraft MRO Revenue Market Share of Key Service Providers (2015)

Some key market players are Lufthansa Technik, GE Aviation, AFI KLM E&M, ST Aerospace, MTU, AAR, SR Technics (Mubadala), SIA Engineering, Delta TechOps, Haeco, Ameco Beijing, Iberia Maintenance, ANA, JAL Engineering, Korean Air, and KAI.