Aerogels: is China taking over the market landscape?

The high-volume production of silica aerogel products is not a new business. Despite being known since the 1930s, the adoption of the ultralightweight insulator has faced many false-starts across the 20th century; the commercial ramp-up has only been seen in the last two decades, but it has still not been the rapid profitable expansion model that many hoped.

Realistically there have been two key companies: Aspen Aerogels, producing blankets via supercritical drying, and Cabot Corporation, producing granules via ambient pressure drying. The question is: Is the market landscape shifting?

IDTechEx forecast the aerogel industry to exceed $700m by 2031. The market report ‘Aerogels 2021-2031: Technologies, Markets and Players’ provides the most comprehensive overview of the industry including forecasts, end-use applications, profiles, and property and pricing benchmarking studies.

As with nearly all manufacturing of functional materials and beyond, there has been a shift to China, and the aerogel industry has been no exception.

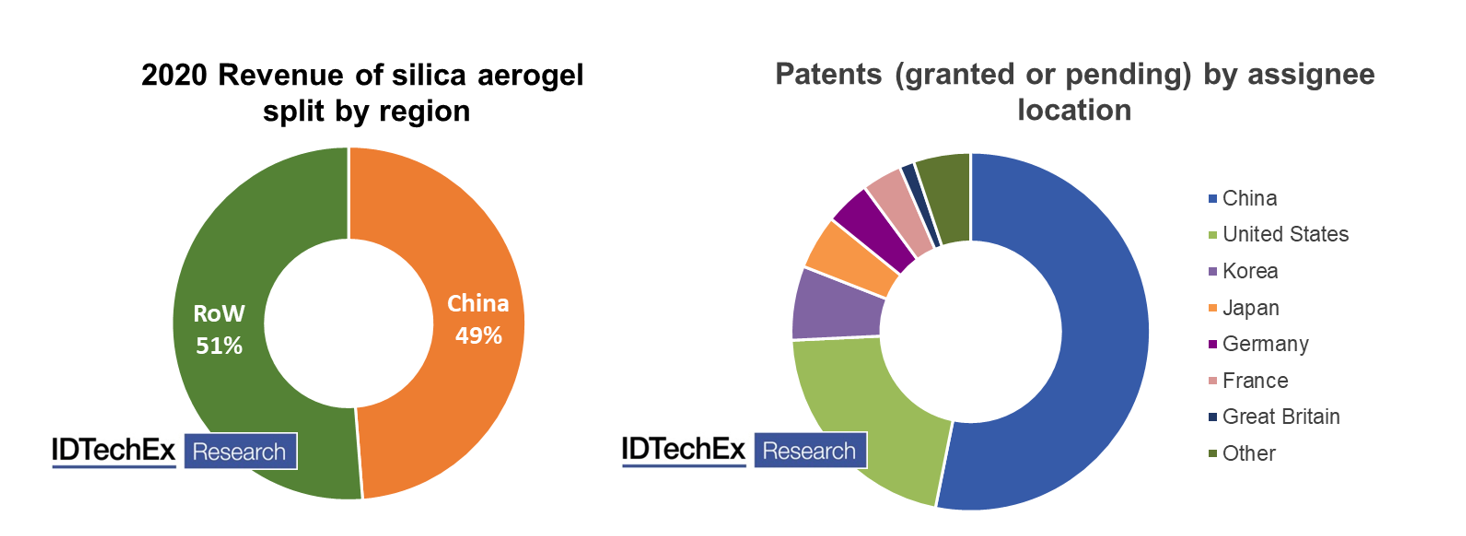

Over the past five years, IDTechEx has observed the market share of production capacity from Chinese players rise from a relatively small proportion to over 50%. Production capacity is just one part of the story, but price reduction, demand, and utilisation are all quickly following. See the image below for more information.

The market leader, Aspen Aerogels, based in the US has been fighting back; they are expanding their site and most notably were successful in filing lawsuits against two of the major Chinese manufacturers, Nano Tech Co and Guangdong Alison Hi-Tech Co, in North America and Europe for infringing on their IP. However, with a significant domestic market this has not perturbed the growth of the Chinese companies and with key patents from Aspen Aerogel due to expire this battle is expected to continue.

There are more than 20 notable aerogel companies based in China, all of whom have been formed since 2014. The key players are Nano Tech Co and Guangdong Alison Hi-Tech Co, but many more are rapidly gaining traction with IBIH being the standout amongst these younger entrants, particularly for their expansion plans and traction, and relationships in the electric vehicle market. For more detail on all the manufacturers see the ‘Aerogels 2021-2031: Technologies, Markets and Players’.

More competition is typically a good thing for an industry as end-users like to see multiple options, it can cause prices to decline, and increases the overall knowledge of the market, but as shown this can be at the expense of a lot of time and money spent defending IP. If we look at the patent landscape more broadly, we see a similar trend to capacity installations.

The number of aerogel patents is increasing with a particular rise from Chinese companies and academic institutes, see image. Over the past decade, we have seen a large west-to-east shift in the top assignees with many notable North American companies having numerous now inactive patents.

China is not the only Asian country to see a rise in commercial aerogel activity; Japan, Korea, Singapore, Vietnam, and more have all been responding as the industry finally shifts from ‘material push’ to ‘market pull’.

IDTechEx expects a more diverse industry to emerge over the next decade with new applications and key companies. With the increasing number in China, a large local demand, and an increasing amount of research and development, the epicenter of the aerogel industry could very easily shift from west to east in the next decade.