A stable quarter for technical consumer goods market

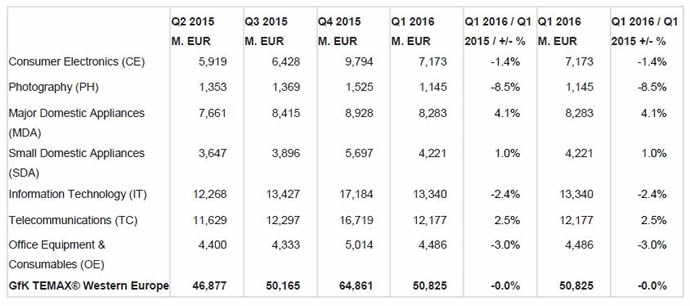

The Western European Technical Consumer Goods (TCG) market is currently stable in Q1 2016, with a mixture of ups and downs in the seven sectors, compared to Q1 2015. There were sales value increases in the Major Domestic Appliances (MDA), Small Domestic Appliances (SDA) and Telecommunications (TC) sectors. In all other sectors sales value declined, although very marginally. The overall TCG market in Western Europe in Q1 2016 generated €50.8bn.

Western Europe: Technical consumer goods – sales value by category

Consumer Electronics: The CE sector remained in negative territory in Q1 2016 - down by 1.4%, compared to the same quarter in 2015.

There was significant value growth in France as TV broadcasters switched from standard definition television (SDTV) to high definition (HD) signals. This stimulated demand in the TVs category.

Video game consoles, loudspeakers and docking mini-speakers all achieved double-digit growth in Q1 compared to the same period last year. For European consumers, using gaming devices and products for listening to music became more common than watching TV.

Photography: In Q1 2016, the PH sector was worth €1.1bn - down by 8.5% on the same period in 2015.

Fixed lens devices registered a double-digit decline - down by 16% in value terms compared to Q1 2015. High value products, such as interchangeable lens cameras and single lenses, registered a fall of just seven percent.

Major Domestic Appliances (MDA): The overall sector grew by 4.1% in Q1 2016, compared to 2015’s Q1. The sales value in all product groups increased with the exception of freezers.

All countries registered an increase of sales value in Q1 2016 compared to the same period last year. Denmark, Greece and Portugal reported double-digit growth of 14.1%, 11%, and 13%, respectively.

Smart connect products continued to grow in terms of sales value in Q1 2016, but on a limited basis.

Small Domestic Appliances (SDA): In the first quarter of 2016, the SDA sector registered a modest increase of one percent, compared to Q1 2015.

There was a double-digit increase in the Danish market compared to last year`s Q1 (up by 14.8%).

The overall value of the SDA sector in Western Europe was €4.2bn in Q1 2016.

Information Technology: IT was the Western European market’s biggest sector in Q1 2016 – worth around €13.3bn – although it was slightly down on the same period in 2015. In Greece, the sales value declined 38.1%, compared to Q1 2015.

Core IT categories continued to struggle, although the mobile computing products segment did well, supported by sales of convertibles and computing tablets. Larger models and desktop computing products were down in terms of value growth.

Finally, media tablets continued their decline, and the limited growth of hardware products had a detrimental effect on sales of peripherals

Telecommunications (TC): In Q1 2016, the TC sector rose by 2.5 percent, compared to Q1 2015. With a value of €12.1bn it is the TCG market’s second largest sector.

There was mixed success in the smart and mobile phones market. Several territories suffered from the market saturation of smartphones - including Denmark, Spain and Greece. On the other hand, the UK, France, Italy and the Benelux countries enjoyed sales value growth.

Wearables are a growing product group in the TCG market. In some instances, sales value growth of more than 100% has been reported.

Office Equipment and Consumables: With a decline of three percent in Q1 2016, the year started badly in the OE sector, compared to the same period in 2015.

There was a small fall in demand for printing hardware, while inkjet multi-functional devices (MFDs), inkjet cartridges, and laser toners also lost market share. Only sales of laser MFD (colour) printers continued to increase.

View the GfK TEMAX reports for all 41 individual countries, including data tables, at: http://temax.gfk.com/reports/