Latest report on emerging non-volatile memory

A report recently released by Yole Développement (Yole) has shown that emerging NVM sales are still moderate, announcing a $53m market in 2015. According to the ‘More than Moore’ market research and strategy consulting company, this market is limited to niche markets due to the limited density available.

“Higher density products’ introduction have been delayed by MRAM pioneers such as Everspin, Crocus and Avalanche,” explained Yann de Charentenay from Yole. He added: “Moreover, Micron/Intel delayed their PCM sales to 2017.”

The emerging NVM market in 2015 was thus considerably lower than the dominant volatile DRAM and non-volatile flash memory businesses, which had combined revenues of almost $80bn in 2015. However, the global emerging NVM market will soar from $53m in 2015 to $4.6bn by 2021, exhibiting an impressive growth of +110% per year.

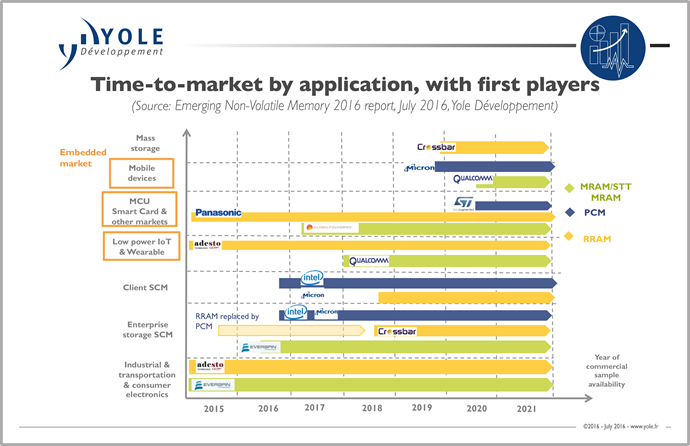

These results are part of the new report from Yole, entitled, ‘Emerging Non-Volatile Memory 2016’. Under this new analysis, the consulting company describes why and how emerging NVM technologies will be increasingly used in various markets. The key market segments identified by Yole’s analysts are - enterprise storage SCM; client SCM; low power IoT and wearable; MCU smart card and other markets; mobile devices; mass storage; and industrial, transportation and consumer electronics.

“SCM will be the clear go-to market for emerging NVM in 2021,”announced Charentenay. “SCM will be adopted in enterprise storage and client applications, and later in mobile. SCM will greatly enhance systems’ speed and data protection, especially in data centres where traffic will explode in the coming years.”

Customers will use either PCM or RRAM for SCM Storage (S) type applications that require high capacity and STTMRAM for SCM Memory (M) type applications where high endurance and speed are required.

In the stand alone market mostly focused on SCM for the next five years, the big players’ technological choices are now quite clear - Micron/Intel have chosen PCM, SK Hynix and Sandisk/Western Digital have selected RRAM as the competitor to PCM for SCM applications, and Samsung seems also to favour RRAM thanks to its compatibility with the vertical 3D approach used for 3D NAND.

Substitution of 3D NAND by RRAM and DRAM by STTMRAM will commence very slowly before 2021, focused in niche applications where price is less sensitive. Indeed, incumbent technologies have found new solutions to further scale down their technologies, as has happened many times in the past.

Embedded MCUs often use eflash NVM technology, but this technology consumes lots of power and its scalability becomes cost prohibitive at 28nm node. With its recent scalability progress, emerging NVM will be increasingly used in low power IoT and wearable, smart card and other markets, first at 40nm thanks to its lower power consumption, and then at 28nm thanks to its competitive cost. The big question is, which emerging NVM to choose?

Some early movers like Panasonic and SMIC have selected RRAM, while top foundries (TSMC, GF, Samsung) will propose STTMRAM in 2017-18, and ST Microelectronics selected PCM for the 28nm node in 2020. However, many key players including Renesas, Infineon, Texas Instruments, MicroChip and Cypress have not yet officially chosen. Considering the trend toward STTMRAM among the foundries, Yole expects STTMRAM will lead the embedded market in 2021. However, thanks to its lower cost, RRAM/PCM could take a larger market share if it is selected by some players.