Lattice details next growth phase strategy and long-term financial model

Lattice Semiconductor, the low power programmable specialist, has announced financial results for the fiscal fourth quarter and full year ended 31 December 2022.

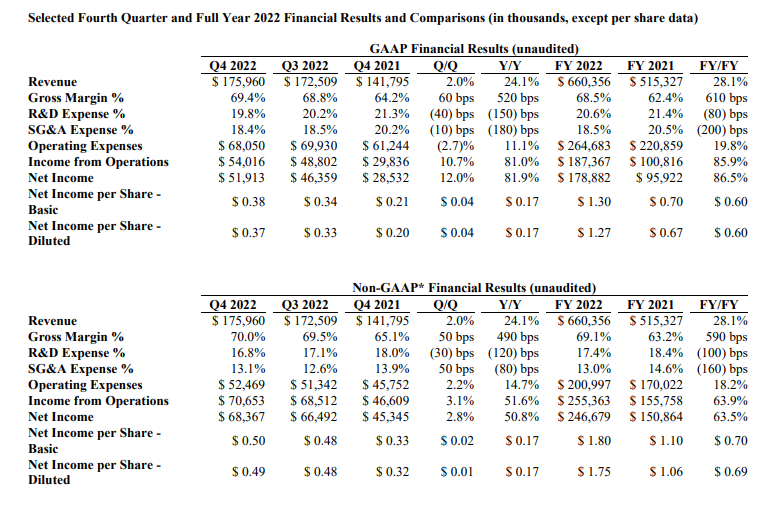

Jim Anderson, President and CEO, said: "We grew revenue 28% for the full year 2022, with continued strong growth in our strategic segments of industrial and automotive, and communications and computing. We delivered 86% annual growth in net income on a GAAP basis and 64% on a non-GAAP basis. In December, we launched the Lattice Avant platform, which doubles our addressable market and creates new greenfield growth opportunities. As we begin 2023, while we’re certainly not immune to any macro-economic challenges impacting the industry, the company is well positioned in secular growth markets, with an expanding product portfolio, accelerating customer momentum and strong financial execution."

Sherri Luther, CFO, said: "In Q4 2022, revenue increased 24%, marking the eleventh consecutive quarter of sequential growth. We achieved record operating profit of 30.7% on a GAAP basis and 40.2% on a non-GAAP basis, while driving gross margin expansion of 520 basis points on a GAAP basis and 490 basis points on a non-GAAP basis compared to Q4 2021. We generated a record level of cash flow from operations, with a 42% increase compared to the prior year. In addition, since beginning our share repurchase programme nine quarters ago, we have repurchased approximately 3.6 million shares, with 290,000 shares repurchased in Q4 2022."

Fourth quarter and full year 2022 highlights:

- Revenue growth: Q4 2022 revenue increased 24% year-over-year, marking the eleventh consecutive quarter of sequential growth. Revenue for the full year 2022 increased 28% compared to 2021.

- Margin expansion: Gross margin expanded 520 basis points on a GAAP basis and 490 basis points on a non-GAAP basis compared to Q4 2021. For the full year 2022, gross margin expanded 610 basis points on a GAAP basis and 590 basis points on a non-GAAP basis compared to 2021.

- Successful Lattice Avant Launch: Lattice launched its newest power-efficient FPGA platform, Lattice Avant, significantly expanding its product portfolio, doubling the addressable market and creating new greenfield revenue growth opportunities.

- Lattice receives multiple industry awards: For the third year in a row, Lattice received the Global Semiconductor Alliance (GSA) Most Respected Public Semiconductor Company Award. Lattice won the 2022 SEAL Sustainability Award and was a 2023 BIG Innovation Awards winner for the Lattice Avant FPGA platform.

- 2023 analyst and investor day: Lattice Semiconductor expects to hold its 2023 Analyst and Investor Day on 15 May 2023 at Nasdaq's MarketSite in Times Square, New York City.

Business outlook – first quarter of 2023:

- Revenue for the first quarter of 2023 is expected to be between $175 million and $185 million.

- Gross margin percentage for the first quarter of 2023 is expected to be 70% plus or minus 1% on a non-GAAP basis.

- Total operating expenses for the first quarter of 2023 are expected to be between $53 million and $55 million on a non-GAAP basis.

Non-GAAP financial measures: In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this earnings release makes reference to non-GAAP financial measures. With respect to the outlook for the first quarter of 2023, certain items that affect GAAP measurement of financial measures for gross margin percentage and total operating expenses is not accessible on a forward-looking basis because such items cannot be reasonably predicted without unreasonable efforts due to the unpredictability of the amounts and timing of events affecting the items we exclude from non-GAAP measures. Consequently, the Company is unable to provide a reasonable estimate of GAAP measurement for non-GAAP gross margin percentage or non-GAAP total operating expenses for first quarter guidance or a corresponding reconciliation to GAAP for the quarter. Additional information regarding the reasons the Company uses non-GAAP measures, a reconciliation of these measures to the most directly comparable GAAP measures, and other information relating to these measures are included below, following the GAAP financial information.