Cellular networks adapt to IoT applications

Mobile operators are adapting their networks with new technologies in readiness for the predicted increase in IoT traffic, writes Sally Ward-Foxton.

The number of connected devices in the Internet of Things (IoT) has been steadily increasing. The latest figures from Gartner predict that compared to 2016, in 2017 there will be 31% more connected devices, and that figure will continue to rise (8.4 billion in 2017 rising to 20.4 billion by 2020). These billions of connected devices are all part of the IoT, in applications as varied as utility metering, factory optimisation and consumer smartphones. All of these devices require secure, low power connectivity at the right price.

The electronics and telecoms industries have come up with a number of ways of making these cheap, secure, low power connections happen in a scalable, practical way. There are many technology options available, from SigFox to LoRa to the plethora of sub-GHz proprietary protocols on the market. While these work well in particular niches, the default technology for all IoT applications will likely be based on the cellular networks – existing global availability is a big plus, as well as the ability of licensed spectrum to provide reliability and security advantages.

Global mobile operators are therefore working on the next generation of technologies that will cater for the massive influx of connected devices onto cellular networks in the coming years. The first step is new protocols, designed for modern, efficient M2M communication. The industry consensus is that the various flavours of LTE will be used for most, if not all, IoT applications.

LTE Cat-1

LTE category 1 is already available today, having been defined along with categories 2-4 back in 2008, though it’s been neglected somewhat while IoT was in its infancy, as operators and device manufacturers focused on category 3 and 4 applications such as smartphones. Of the LTE IoT options, this one is for the most data-rich applications that require voice or internet browsing. While its performance is still below what 3G can do, it’s one of the technologies being touted as a 3G replacement when the time comes.

LTE Cat-M1

LTE category M1 (also called Cat-M and eMTC), a successor to what was originally called category 0, was designed specifically for M2M communication in 2016’s Release 13. Compared to Cat-1, it’s much lower power as connection to the network every second isn’t required, plus there’s a sleep mode. Cat-M1 is set to replace current 2G and 2.5G services as these are slowly switched off, as it has similar functionality and cost profiles, competing directly with low power wide area networks (LPWANs) such as LoRA. Applications include health and fitness wearables, vending machines, and many more.

NB-IoT

LTE category NB1, or narrow band IoT (NB-IoT), confusingly also sometimes called LTE Cat-M2, is the technology that everyone is talking about with respect to ultra-low power wide area networks for M2M. This was approved as part of Release 13 (along with Cat-M1) back in summer 2016. It offers long range communication combined with ultra-low power consumption and low complexity (and therefore, cheaper components).

This is for low data throughput (tens of kbps), and its features include 2-way communications (allowing things like over the air device firmware upgrades), LTE level security and ultra-low power consumption. The lower frequencies it uses make for excellent propagation coverage, covering many kilometres and penetrating easily into buildings. This standard is ideal for the lowest data throughput applications, including smart city applications such as utility meters, connected street lighting, parking space availability trackers, etc.

Trials already well underway include a well-publicised project from u-blox, Vodafone and Huawei to install NB-IoT connected water meters in Valencia, Spain. According to u-blox, NB-IoT was perfect for this application because the signals can penetrate walls, earth and metal conduits – many Valencian water meters are in homeowners’ basements – and the radio modules are cost effective and simple. Ultra-low power operation means the meter’s batteries should last over ten years.

EC-GSM

Extended coverage GSM, also called EC-EGPRS as it’s based on what was the eGPRS standard, is a high capacity, long range, ultra-low power standard for M2M. This is a new technology which can be run on existing cellular networks after a software upgrade, offering functionality somewhere between current 2G and 3G services. The ‘extended coverage’ part refers to a comparison between this standard and ordinary GSM - in trials last year, Ericsson and Orange showed its EC-GSM network increased coverage by 20dB, enough to compete with the various unlicensed spectrum LPWANs out there. Some countries are showing interest in this technology, with commercial launches apparently planned for 2017.

Embedded SIM

One of the key hardware changes that the GSMA has made to encourage IoT applications is the introduction of the embedded SIM (subscriber identity module), also called the eUICC (embedded Universal Integrated Circuit Card). Unlike existing smartphone and tablet SIM cards, which the user can remove manually in order to change network provider, an embedded SIM is simply the SIM chip embedded into the wireless module inside the connected device. The idea behind this is that if the user wants to change operator (or perhaps more likely, change utility provider to one with a deal with a different operator for their utility metering connectivity), a remote update can be applied to the embedded SIM to allow it to join another network. No site visit to the utility meter is required. This feature is called remote SIM provisioning for M2M.

The format of the network’s profile data on the SIM chip has recently been standardised, making it easier for wireless module and device manufacturers to second-source their SIM chips as required.

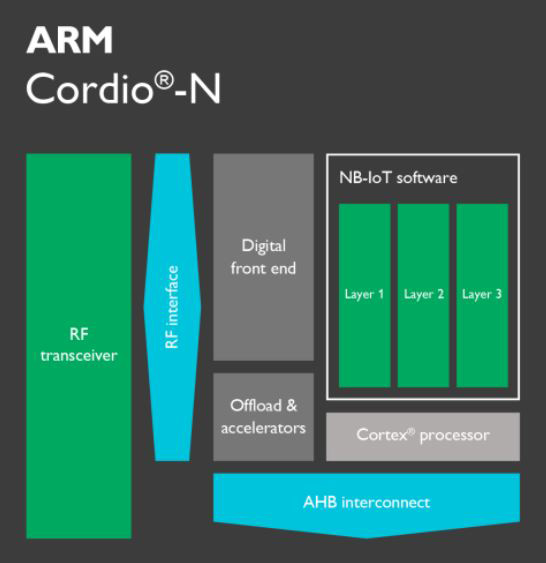

Above: A block diagram of ARM’s Cordio-N IP for NB-IoT SoCs

Above: A block diagram of ARM’s Cordio-N IP for NB-IoT SoCs

Components coming up

The semiconductor industry is of course responding to these developments in mobile communications technology for M2M and IoT applications.

Intellectual property powerhouse ARM has developed a piece of IP for NB-IoT SoCs called Cordio-N. It’s a complete IP reference for NB-IoT for integration into SoCs, based on an ARM Cortex-M33 processor, plus baseband and software for layer 1-3 protocols through to RF. Cordio-N is already validated with several cellular carriers, ARM says, reducing time to market for chip makers. ARM has also recently acquired two companies, Mistbase and NextG-Com, specialising in NB-IoT physical layer (layer 1) solutions and layer 2 and 3 software stacks, respectively.

One of the first companies to announce an NB-IoT wireless module was u-blox, in the form of SARA-N2. This module, in a 16x26mm form factor, is intended for utility metering, white goods, asset tracking and similar applications. It can operate for 10 to 20 years from a single-cell primary battery and supports three RF bands, making it well suited to most geographic regions.

Some chip makers, such as Nordic Semiconductor, have unveiled product roadmaps for NB-IoT technology. Nordic’s nRF91 series will include integrated chipsets and software for LTE Cat-M and NB-IoT technologies, and is expected to start sampling during the second half of 2017.

As the Internet of Things becomes more and more pervasive, mobile operators are starting to take M2M traffic seriously and are rolling out Cat-M1 and NB-IoT networks in regions around the world. Complementary technologies, such as embedded SIM, will support these network deployments, while semiconductor manufacturers, module makers and the whole chain of hardware suppliers work on innovative new products for the next generation of communications technology.