US robot sensor market poised for maximum revenues

According to a recent study from market research firm Graphical Research, the North America robot sensor market size is poised to expand at substantial CAGR during the forecast period. Rising trend for the autonomous robotic technology will fuel North America robot sensor market share. Lack of staff, for instance - surgeons - may further propel the demand for robots. Specifically, the Association of American Medical College has forecast that the US may grapple with scarcity of surgeons of around 54,100 to 139,000 physicians by 2033-end.

As businesses and consumers seek concrete ways to boost accuracy and precision in surgeries, the medical industry is slated to exhibit traction for robots. Medical robots, including non-invasive radiosurgery robots, rehabilitation robots and surgical medical robots will remain in the mix.

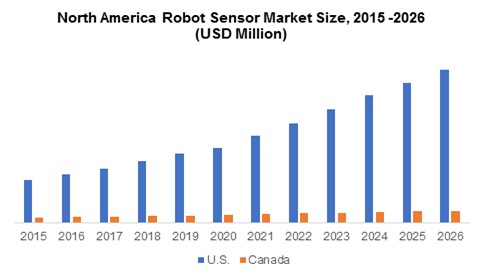

The International Federation of Robotics stated in its press release that medical service robot sales witnessed a surge by 28% in 2019, with a double digit growth. Moreover, approximately 90% of the medical robot suppliers are from North America and Europe. According to an estimate, North America robot sensor market size is forecast to surpass $1.5bn by 2026.

Both well-established and emerging companies are touted to augment robot sensors’ production emphasising the defense industry. To put this in perspective, demand for assisted technology devices for controlling and monitoring applications will bolster the market uptake.

Governments, for instance, are injecting funds in robots to keep abreast with the trend. More so, the US Air Force reportedly tested the likelihood of robot dogs on the battlefield in September 2020. The market share from the defense application segment in North America robot sensor market is likely to expand at a strong CAGR of seven percent through 2026.

Collaborative robots (Cobots) will be the cornerstone towards a bullish industry outlook across the US and Canada. Manufacturing facilities will be the major market for cobots to bolster safety features, such as force feedback and collision detection.

Cobots are highly desirable in facilities for quality inspection, pick and place, palletizing and packaging. Lately, domestic and agricultural applications such as helping restaurants with employee shortages and handling seedling and herbs have set the trend in the landscape.

Robot manufacturers have upped their focus on new product innovations. Specifically, Omron rolled out a new Cobot in January 2019 which can allegedly automate repetitive tasks, along with improving human-machine interaction. The market share from the collaborative segment stood at ten percent in 2019 and will expand at a strong CAGR of more than 15% through 2026.

Up-and-coming companies are likely to show liking for ultrasonic sensors in automated guided vehicles (AGVs), robotic grippers and automated assembly lines. Robust demand for ultrasonic sensors is mainly attributed to upsides such as near-field navigation and precision distance measurement that assist both service and industrial robots in collision avoidance and obstacle detection. Based on share, the ultrasonic sensor segment logged more than 10% in 2019 and is forecast to grow at a healthy CAGR of more than 9.5% through 2026.

Leading companies are injecting funds to introduce technologically advanced ultrasonic sensors. For instance, Maxbotix, rolled-out a new ultrasonic sensor that provides short to long-distance detection with feature such as side object rejection.

The US will potentially reign supreme following investment galore from governments and NGOs. To further dwell on the spending, the US President and the US Congress earmarked $740.5bn on national security - allocating $704.5bn for the Department of Defense (DoD) in the proposed FY2021 budget. North America robot sensor market outlook will count on governments’ spending, R&D activities, microelectronics and automation.

Some of the industry participants in the ecosystem are Honeywell International, Keyence Corporation, Rockwell Automation, Cognex Corporation, Fanuc and ATI Industrial Automation, among several others. Business strategies are likely to hover around collaborations, mergers & acquisitions and product launches. To Illustrate, Fanuc rolled-out a vision sensor in April 2020 for e-commerce, logistics and warehousing applications.